8-K: Current report

Published on August 5, 2025

Apollo Global Management, Inc. Second Quarter 2025 Earnings

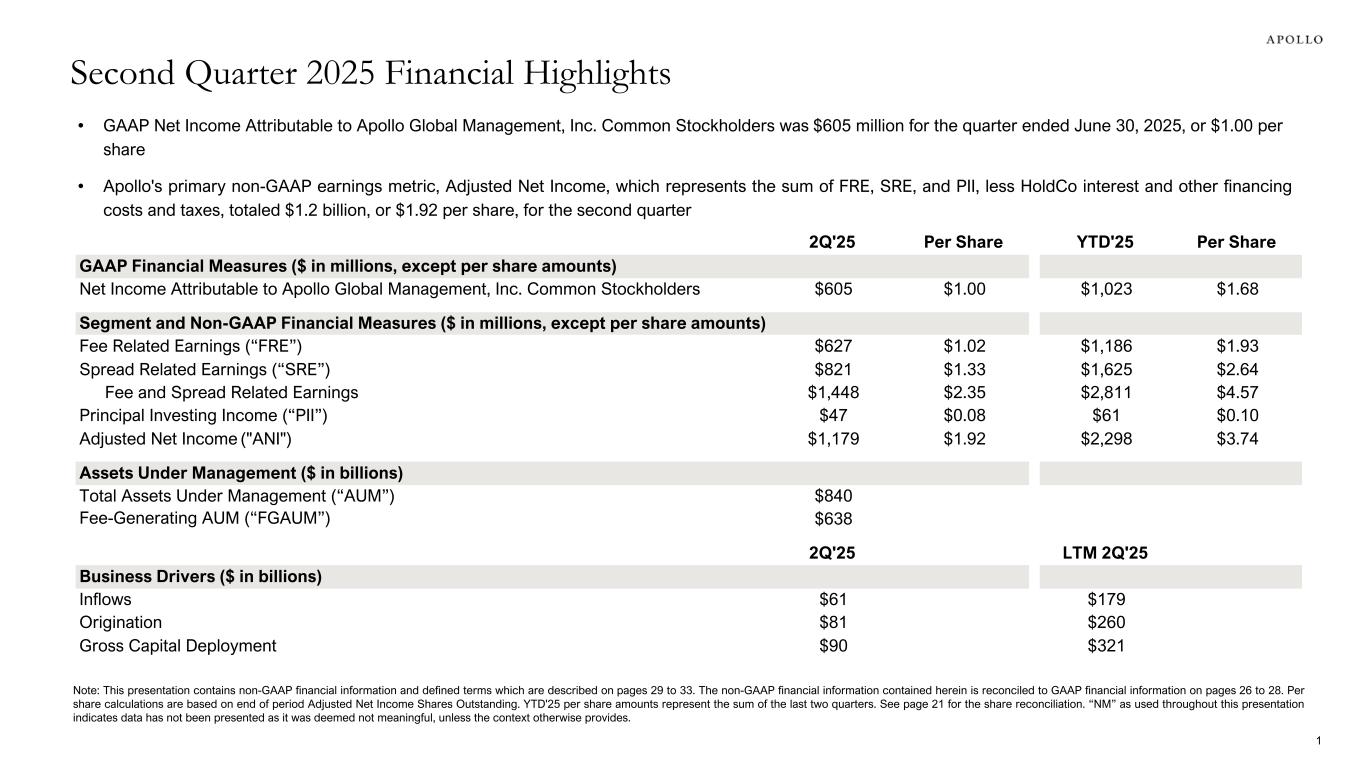

2Q'25 Per Share YTD'25 Per Share GAAP Financial Measures ($ in millions, except per share amounts) Net Income Attributable to Apollo Global Management, Inc. Common Stockholders $605 $1.00 $1,023 $1.68 Segment and Non-GAAP Financial Measures ($ in millions, except per share amounts) Fee Related Earnings (“FRE”) $627 $1.02 $1,186 $1.93 Spread Related Earnings (“SRE”) $821 $1.33 $1,625 $2.64 Fee and Spread Related Earnings $1,448 $2.35 $2,811 $4.57 Principal Investing Income (“PII”) $47 $0.08 $61 $0.10 Adjusted Net Income ("ANI") $1,179 $1.92 $2,298 $3.74 Assets Under Management ($ in billions) Total Assets Under Management (“AUM”) $840 Fee-Generating AUM (“FGAUM”) $638 2Q'25 LTM 2Q'25 Business Drivers ($ in billions) Inflows $61 $179 Origination $81 $260 Gross Capital Deployment $90 $321 Second Quarter 2025 Financial Highlights • GAAP Net Income Attributable to Apollo Global Management, Inc. Common Stockholders was $605 million for the quarter ended June 30, 2025, or $1.00 per share • Apollo's primary non-GAAP earnings metric, Adjusted Net Income, which represents the sum of FRE, SRE, and PII, less HoldCo interest and other financing costs and taxes, totaled $1.2 billion, or $1.92 per share, for the second quarter Note: This presentation contains non-GAAP financial information and defined terms which are described on pages 29 to 33. The non-GAAP financial information contained herein is reconciled to GAAP financial information on pages 26 to 28. Per share calculations are based on end of period Adjusted Net Income Shares Outstanding. YTD'25 per share amounts represent the sum of the last two quarters. See page 21 for the share reconciliation. “NM” as used throughout this presentation indicates data has not been presented as it was deemed not meaningful, unless the context otherwise provides. 1

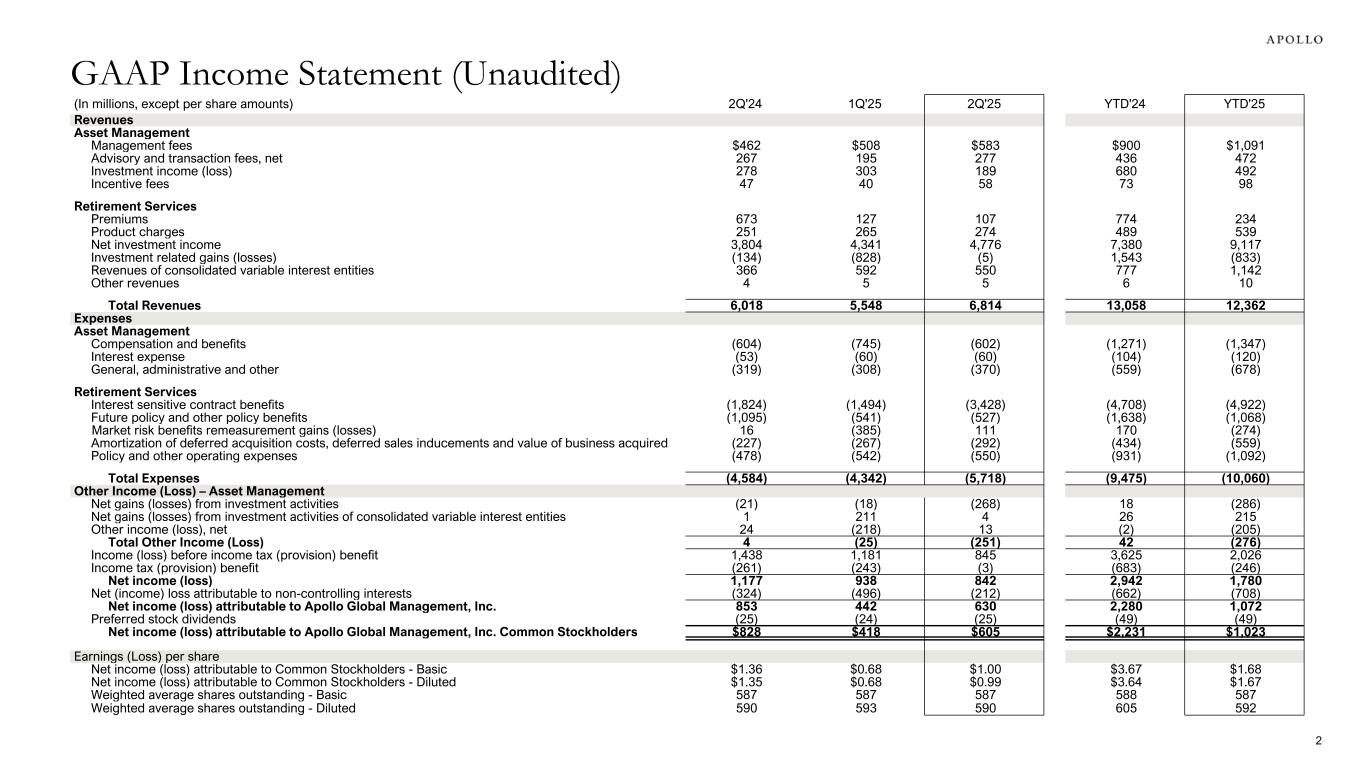

(In millions, except per share amounts) 2Q'24 1Q'25 2Q'25 YTD'24 YTD'25 Revenues Asset Management Management fees $462 $508 $583 $900 $1,091 Advisory and transaction fees, net 267 195 277 436 472 Investment income (loss) 278 303 189 680 492 Incentive fees 47 40 58 73 98 Retirement Services Premiums 673 127 107 774 234 Product charges 251 265 274 489 539 Net investment income 3,804 4,341 4,776 7,380 9,117 Investment related gains (losses) (134) (828) (5) 1,543 (833) Revenues of consolidated variable interest entities 366 592 550 777 1,142 Other revenues 4 5 5 6 10 Total Revenues 6,018 5,548 6,814 13,058 12,362 Expenses Asset Management Compensation and benefits (604) (745) (602) (1,271) (1,347) Interest expense (53) (60) (60) (104) (120) General, administrative and other (319) (308) (370) (559) (678) Retirement Services Interest sensitive contract benefits (1,824) (1,494) (3,428) (4,708) (4,922) Future policy and other policy benefits (1,095) (541) (527) (1,638) (1,068) Market risk benefits remeasurement gains (losses) 16 (385) 111 170 (274) Amortization of deferred acquisition costs, deferred sales inducements and value of business acquired (227) (267) (292) (434) (559) Policy and other operating expenses (478) (542) (550) (931) (1,092) Total Expenses (4,584) (4,342) (5,718) (9,475) (10,060) Other Income (Loss) – Asset Management Net gains (losses) from investment activities (21) (18) (268) 18 (286) Net gains (losses) from investment activities of consolidated variable interest entities 1 211 4 26 215 Other income (loss), net 24 (218) 13 (2) (205) Total Other Income (Loss) 4 (25) (251) 42 (276) Income (loss) before income tax (provision) benefit 1,438 1,181 845 3,625 2,026 Income tax (provision) benefit (261) (243) (3) (683) (246) Net income (loss) 1,177 938 842 2,942 1,780 Net (income) loss attributable to non-controlling interests (324) (496) (212) (662) (708) Net income (loss) attributable to Apollo Global Management, Inc. 853 442 630 2,280 1,072 Preferred stock dividends (25) (24) (25) (49) (49) Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $828 $418 $605 $2,231 $1,023 Earnings (Loss) per share Net income (loss) attributable to Common Stockholders - Basic $1.36 $0.68 $1.00 $3.67 $1.68 Net income (loss) attributable to Common Stockholders - Diluted $1.35 $0.68 $0.99 $3.64 $1.67 Weighted average shares outstanding - Basic 587 587 587 588 587 Weighted average shares outstanding - Diluted 590 593 590 605 592 GAAP Income Statement (Unaudited) 2

Second Quarter 2025 Business Highlights ✓ ✓ 3 Second quarter results across Asset Management and Retirement Services • Record quarterly FRE of $627 million driven by strong management fee growth and record capital solutions fees • SRE of $821 million supported by continued strong organic growth • Together, record FRE and SRE totaled $1.4 billion in the second quarter, showcasing the strength of the combined earnings streams • Total AUM of $840 billion benefited from inflows of $61 billion in the second quarter and $179 billion over the last twelve months, driving a 21% increase year-over-year Continued execution on three strategic growth pillars • Origination: Record quarterly origination activity of $81 billion driven by significant contributions from debt origination platforms and core credit • Global Wealth: Strong quarterly inflows of $4 billion driven by continued expansion in signature semi-liquid products and continued education and momentum surrounding fixed income replacement-focused products • Capital Solutions: Record quarterly fee revenue of $216 million demonstrating Apollo's differentiated capabilities to provide flexible capital solutions through dynamic market environments Strategically allocating capital to drive stockholder value • Investments: Allocated $170 million of strategic capital to fund various investments supporting future growth over the last twelve months as well as committed to the pending acquisition of Bridge Investment Group expected to close in the third quarter • Share Repurchases: Repurchased more than $1.3 billion of common stock over the last twelve months, including $557 million of opportunistic share repurchases • Dividends: Distributed more than $1 billion of common stock dividends over the last twelve months

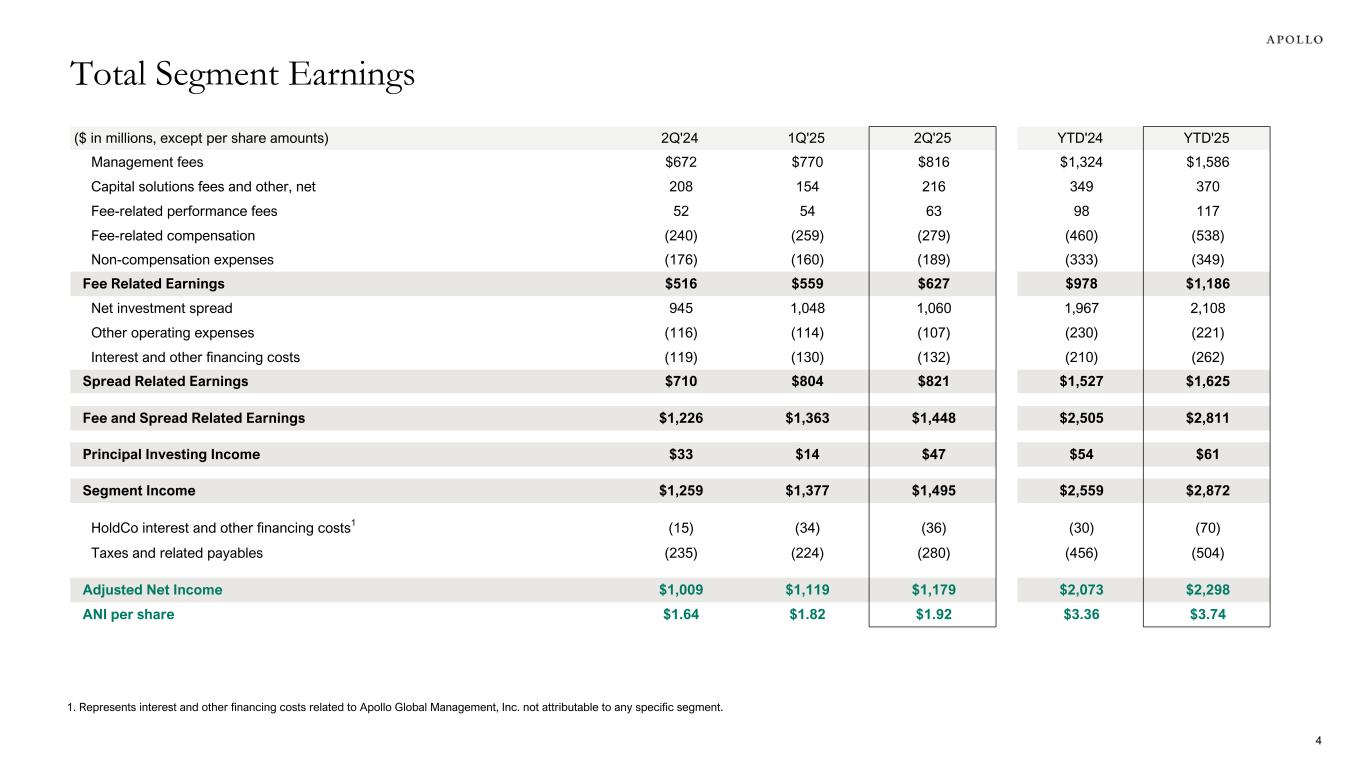

($ in millions, except per share amounts) 2Q'24 1Q'25 2Q'25 YTD'24 YTD'25 Management fees $672 $770 $816 $1,324 $1,586 Capital solutions fees and other, net 208 154 216 349 370 Fee-related performance fees 52 54 63 98 117 Fee-related compensation (240) (259) (279) (460) (538) Non-compensation expenses (176) (160) (189) (333) (349) Fee Related Earnings $516 $559 $627 $978 $1,186 Net investment spread 945 1,048 1,060 1,967 2,108 Other operating expenses (116) (114) (107) (230) (221) Interest and other financing costs (119) (130) (132) (210) (262) Spread Related Earnings $710 $804 $821 $1,527 $1,625 Fee and Spread Related Earnings $1,226 $1,363 $1,448 $2,505 $2,811 Principal Investing Income $33 $14 $47 $54 $61 Segment Income $1,259 $1,377 $1,495 $2,559 $2,872 HoldCo interest and other financing costs1 (15) (34) (36) (30) (70) Taxes and related payables (235) (224) (280) (456) (504) Adjusted Net Income $1,009 $1,119 $1,179 $2,073 $2,298 ANI per share $1.64 $1.82 $1.92 $3.36 $3.74 1. Represents interest and other financing costs related to Apollo Global Management, Inc. not attributable to any specific segment. Total Segment Earnings 4

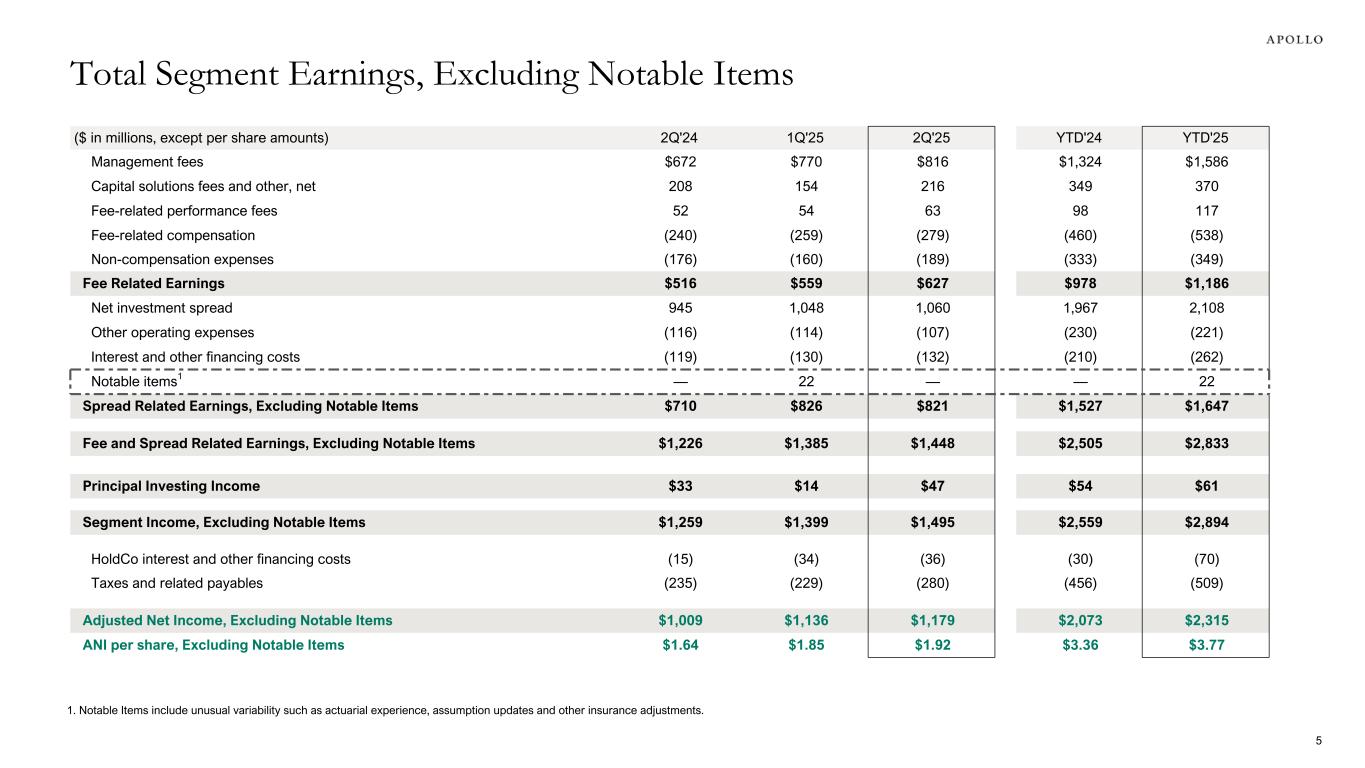

($ in millions, except per share amounts) 2Q'24 1Q'25 2Q'25 YTD'24 YTD'25 Management fees $672 $770 $816 $1,324 $1,586 Capital solutions fees and other, net 208 154 216 349 370 Fee-related performance fees 52 54 63 98 117 Fee-related compensation (240) (259) (279) (460) (538) Non-compensation expenses (176) (160) (189) (333) (349) Fee Related Earnings $516 $559 $627 $978 $1,186 Net investment spread 945 1,048 1,060 1,967 2,108 Other operating expenses (116) (114) (107) (230) (221) Interest and other financing costs (119) (130) (132) (210) (262) Notable items1 — 22 — — 22 Spread Related Earnings, Excluding Notable Items $710 $826 $821 $1,527 $1,647 Fee and Spread Related Earnings, Excluding Notable Items $1,226 $1,385 $1,448 $2,505 $2,833 Principal Investing Income $33 $14 $47 $54 $61 Segment Income, Excluding Notable Items $1,259 $1,399 $1,495 $2,559 $2,894 HoldCo interest and other financing costs (15) (34) (36) (30) (70) Taxes and related payables (235) (229) (280) (456) (509) Adjusted Net Income, Excluding Notable Items $1,009 $1,136 $1,179 $2,073 $2,315 ANI per share, Excluding Notable Items $1.64 $1.85 $1.92 $3.36 $3.77 Total Segment Earnings, Excluding Notable Items 5 1. Notable Items include unusual variability such as actuarial experience, assumption updates and other insurance adjustments.

Segment Details

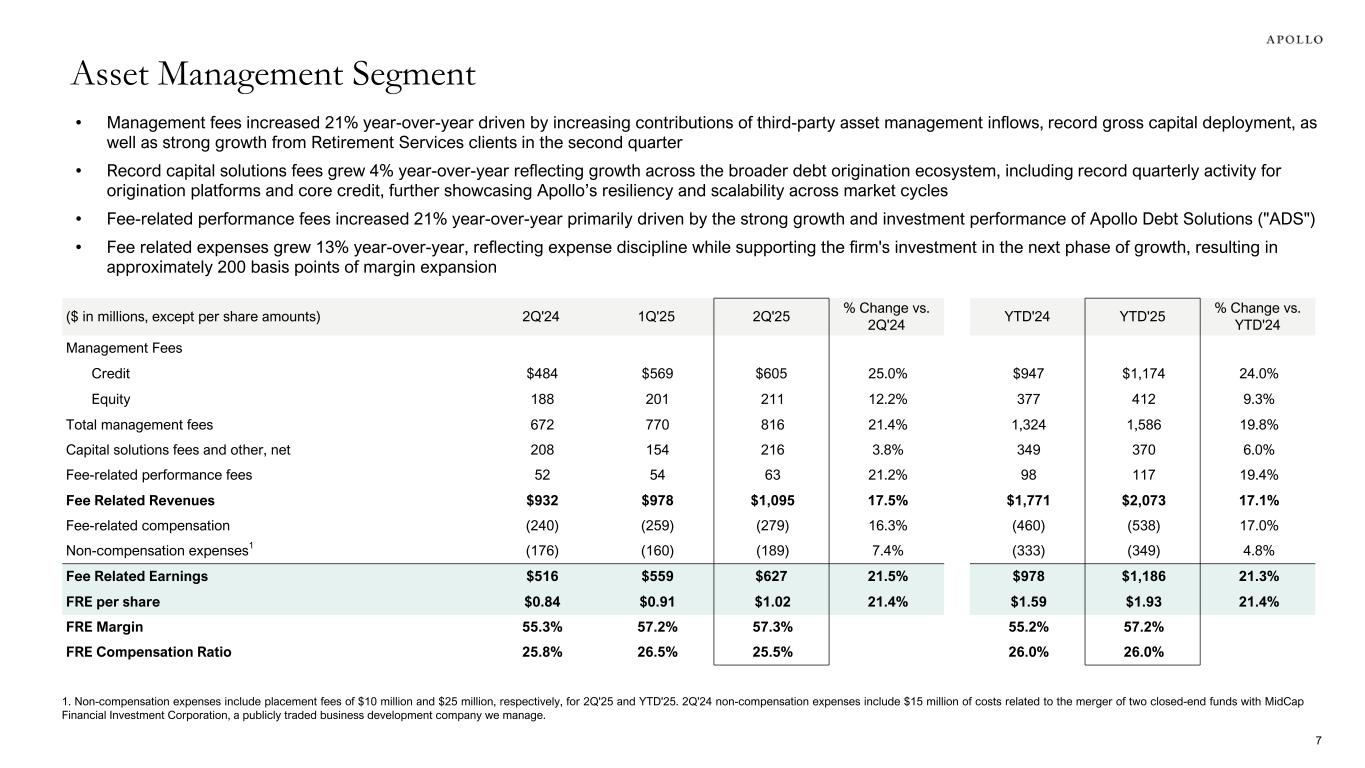

• Management fees increased 21% year-over-year driven by increasing contributions of third-party asset management inflows, record gross capital deployment, as well as strong growth from Retirement Services clients in the second quarter • Record capital solutions fees grew 4% year-over-year reflecting growth across the broader debt origination ecosystem, including record quarterly activity for origination platforms and core credit, further showcasing Apollo’s resiliency and scalability across market cycles • Fee-related performance fees increased 21% year-over-year primarily driven by the strong growth and investment performance of Apollo Debt Solutions ("ADS") • Fee related expenses grew 13% year-over-year, reflecting expense discipline while supporting the firm's investment in the next phase of growth, resulting in approximately 200 basis points of margin expansion ($ in millions, except per share amounts) 2Q'24 1Q'25 2Q'25 % Change vs. 2Q'24 YTD'24 YTD'25 % Change vs. YTD'24 Management Fees Credit $484 $569 $605 25.0% $947 $1,174 24.0% Equity 188 201 211 12.2% 377 412 9.3% Total management fees 672 770 816 21.4% 1,324 1,586 19.8% Capital solutions fees and other, net 208 154 216 3.8% 349 370 6.0% Fee-related performance fees 52 54 63 21.2% 98 117 19.4% Fee Related Revenues $932 $978 $1,095 17.5% $1,771 $2,073 17.1% Fee-related compensation (240) (259) (279) 16.3% (460) (538) 17.0% Non-compensation expenses1 (176) (160) (189) 7.4% (333) (349) 4.8% Fee Related Earnings $516 $559 $627 21.5% $978 $1,186 21.3% FRE per share $0.84 $0.91 $1.02 21.4% $1.59 $1.93 21.4% FRE Margin 55.3% 57.2% 57.3% 55.2% 57.2% FRE Compensation Ratio 25.8% 26.5% 25.5% 26.0% 26.0% Asset Management Segment 1. Non-compensation expenses include placement fees of $10 million and $25 million, respectively, for 2Q'25 and YTD'25. 2Q'24 non-compensation expenses include $15 million of costs related to the merger of two closed-end funds with MidCap Financial Investment Corporation, a publicly traded business development company we manage. 7

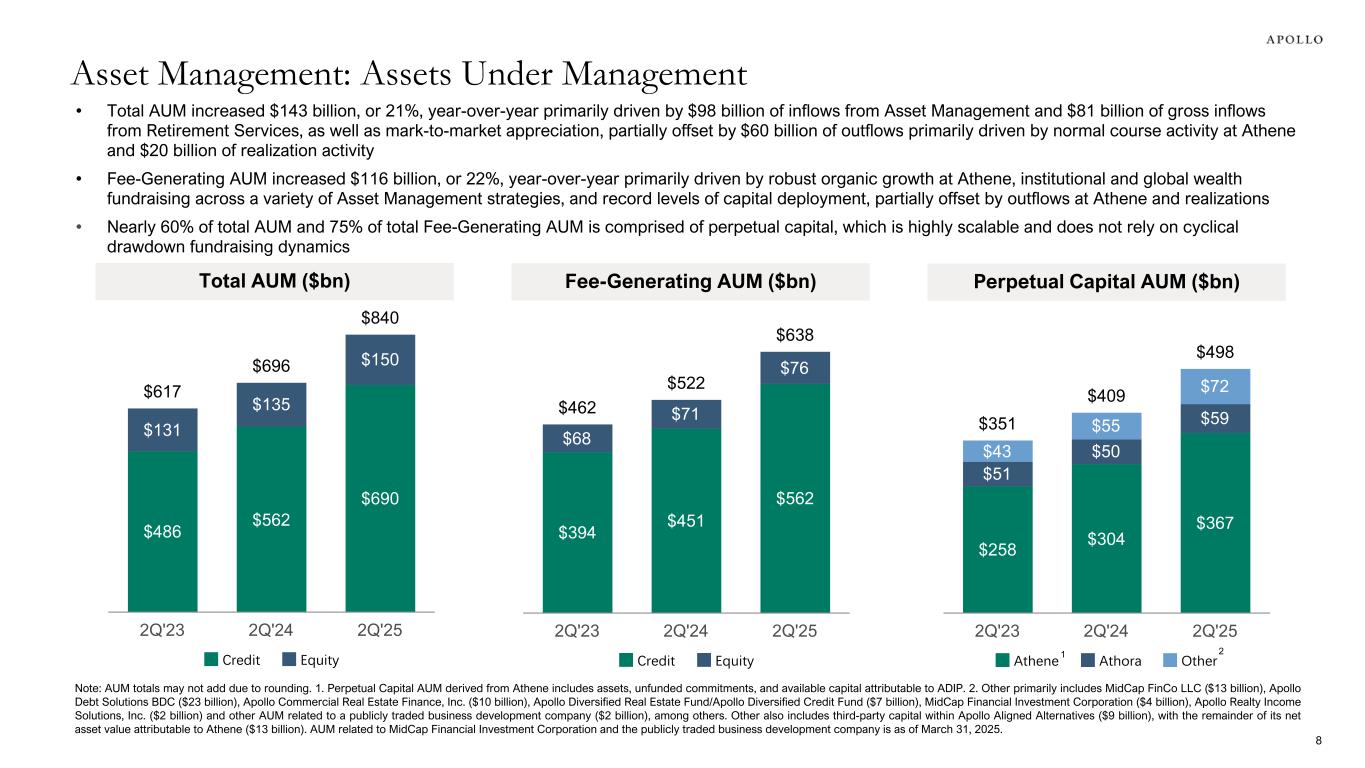

• Total AUM increased $143 billion, or 21%, year-over-year primarily driven by $98 billion of inflows from Asset Management and $81 billion of gross inflows from Retirement Services, as well as mark-to-market appreciation, partially offset by $60 billion of outflows primarily driven by normal course activity at Athene and $20 billion of realization activity • Fee-Generating AUM increased $116 billion, or 22%, year-over-year primarily driven by robust organic growth at Athene, institutional and global wealth fundraising across a variety of Asset Management strategies, and record levels of capital deployment, partially offset by outflows at Athene and realizations • Nearly 60% of total AUM and 75% of total Fee-Generating AUM is comprised of perpetual capital, which is highly scalable and does not rely on cyclical drawdown fundraising dynamics Total AUM ($bn) Fee-Generating AUM ($bn) $617 $696 $840 $486 $562 $690 $131 $135 $150 Credit Equity 2Q'23 2Q'24 2Q'25 $462 $522 $638 $394 $451 $562 $68 $71 $76 Credit Equity 2Q'23 2Q'24 2Q'25 Perpetual Capital AUM ($bn) $351 $409 $498 $258 $304 $367 $51 $50 $59 $43 $55 $72 Athene Athora Other 2Q'23 2Q'24 2Q'25 8 Asset Management: Assets Under Management Note: AUM totals may not add due to rounding. 1. Perpetual Capital AUM derived from Athene includes assets, unfunded commitments, and available capital attributable to ADIP. 2. Other primarily includes MidCap FinCo LLC ($13 billion), Apollo Debt Solutions BDC ($23 billion), Apollo Commercial Real Estate Finance, Inc. ($10 billion), Apollo Diversified Real Estate Fund/Apollo Diversified Credit Fund ($7 billion), MidCap Financial Investment Corporation ($4 billion), Apollo Realty Income Solutions, Inc. ($2 billion) and other AUM related to a publicly traded business development company ($2 billion), among others. Other also includes third-party capital within Apollo Aligned Alternatives ($9 billion), with the remainder of its net asset value attributable to Athene ($13 billion). AUM related to MidCap Financial Investment Corporation and the publicly traded business development company is as of March 31, 2025. 21

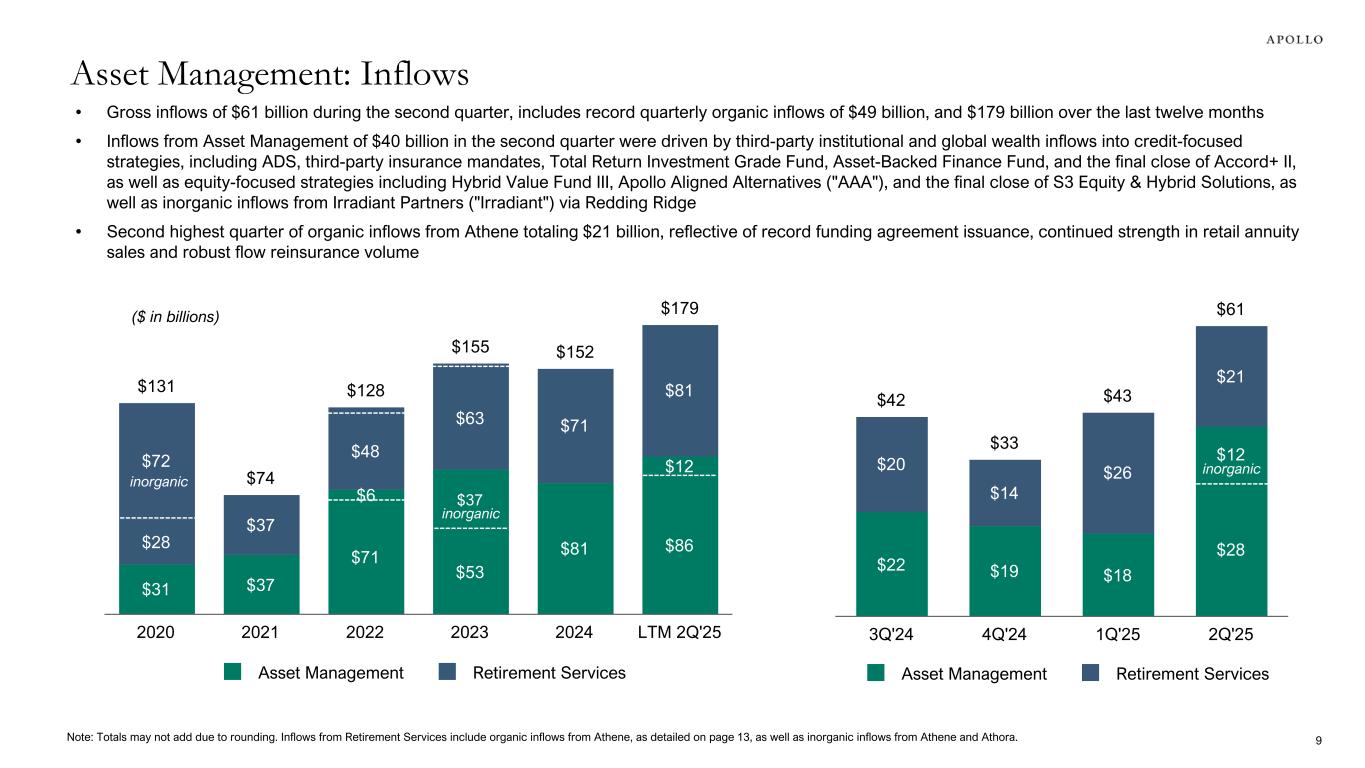

$42 $33 $43 $61 $22 $19 $18 $28 $12$20 $14 $26 $21 Asset Management Retirement Services 3Q'24 4Q'24 1Q'25 2Q'25 $131 $74 $128 $155 $152 $179 $31 $37 $71 $53 $81 $86 $6 $37 $12 $28 $37 $48 $63 $71 $81 $72 Asset Management Retirement Services 2020 2021 2022 2023 2024 LTM 2Q'25 • Gross inflows of $61 billion during the second quarter, includes record quarterly organic inflows of $49 billion, and $179 billion over the last twelve months • Inflows from Asset Management of $40 billion in the second quarter were driven by third-party institutional and global wealth inflows into credit-focused strategies, including ADS, third-party insurance mandates, Total Return Investment Grade Fund, Asset-Backed Finance Fund, and the final close of Accord+ II, as well as equity-focused strategies including Hybrid Value Fund III, Apollo Aligned Alternatives ("AAA"), and the final close of S3 Equity & Hybrid Solutions, as well as inorganic inflows from Irradiant Partners ("Irradiant") via Redding Ridge • Second highest quarter of organic inflows from Athene totaling $21 billion, reflective of record funding agreement issuance, continued strength in retail annuity sales and robust flow reinsurance volume ($ in billions) Asset Management: Inflows inorganic inorganic Note: Totals may not add due to rounding. Inflows from Retirement Services include organic inflows from Athene, as detailed on page 13, as well as inorganic inflows from Athene and Athora. 9 inorganic

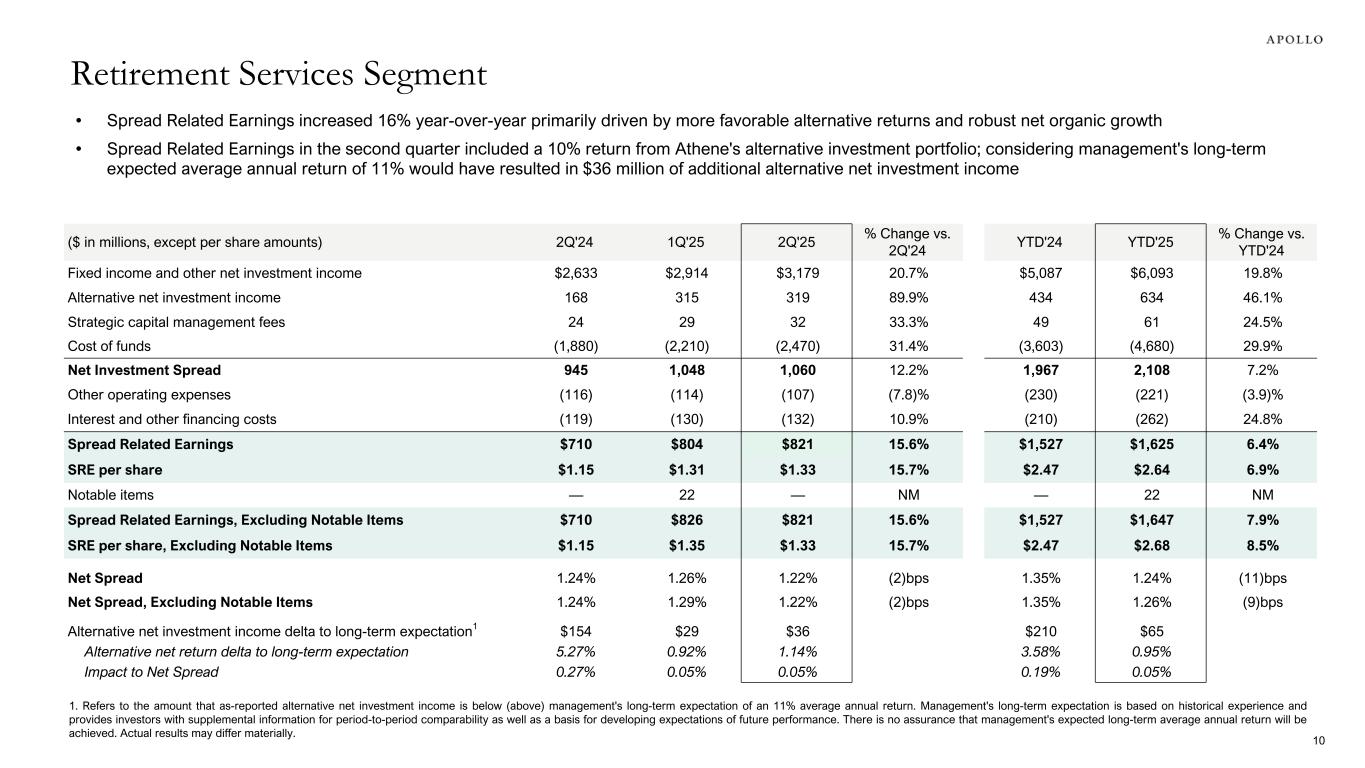

• Spread Related Earnings increased 16% year-over-year primarily driven by more favorable alternative returns and robust net organic growth • Spread Related Earnings in the second quarter included a 10% return from Athene's alternative investment portfolio; considering management's long-term expected average annual return of 11% would have resulted in $36 million of additional alternative net investment income 1. Refers to the amount that as-reported alternative net investment income is below (above) management's long-term expectation of an 11% average annual return. Management's long-term expectation is based on historical experience and provides investors with supplemental information for period-to-period comparability as well as a basis for developing expectations of future performance. There is no assurance that management's expected long-term average annual return will be achieved. Actual results may differ materially. ($ in millions, except per share amounts) 2Q'24 1Q'25 2Q'25 % Change vs. 2Q'24 YTD'24 YTD'25 % Change vs. YTD'24 Fixed income and other net investment income $2,633 $2,914 $3,179 20.7% $5,087 $6,093 19.8% Alternative net investment income 168 315 319 89.9% 434 634 46.1% Strategic capital management fees 24 29 32 33.3% 49 61 24.5% Cost of funds (1,880) (2,210) (2,470) 31.4% (3,603) (4,680) 29.9% Net Investment Spread 945 1,048 1,060 12.2% 1,967 2,108 7.2% Other operating expenses (116) (114) (107) (7.8)% (230) (221) (3.9)% Interest and other financing costs (119) (130) (132) 10.9% (210) (262) 24.8% Spread Related Earnings $710 $804 $821 15.6% $1,527 $1,625 6.4% SRE per share $1.15 $1.31 $1.33 15.7% $2.47 $2.64 6.9% Notable items — 22 — NM — 22 NM Spread Related Earnings, Excluding Notable Items $710 $826 $821 15.6% $1,527 $1,647 7.9% SRE per share, Excluding Notable Items $1.15 $1.35 $1.33 15.7% $2.47 $2.68 8.5% Net Spread 1.24% 1.26% 1.22% (2)bps 1.35% 1.24% (11)bps Net Spread, Excluding Notable Items 1.24% 1.29% 1.22% (2)bps 1.35% 1.26% (9)bps Alternative net investment income delta to long-term expectation1 $154 $29 $36 $210 $65 Alternative net return delta to long-term expectation 5.27% 0.92% 1.14% 3.58% 0.95% Impact to Net Spread 0.27% 0.05% 0.05% 0.19% 0.05% Retirement Services Segment 10

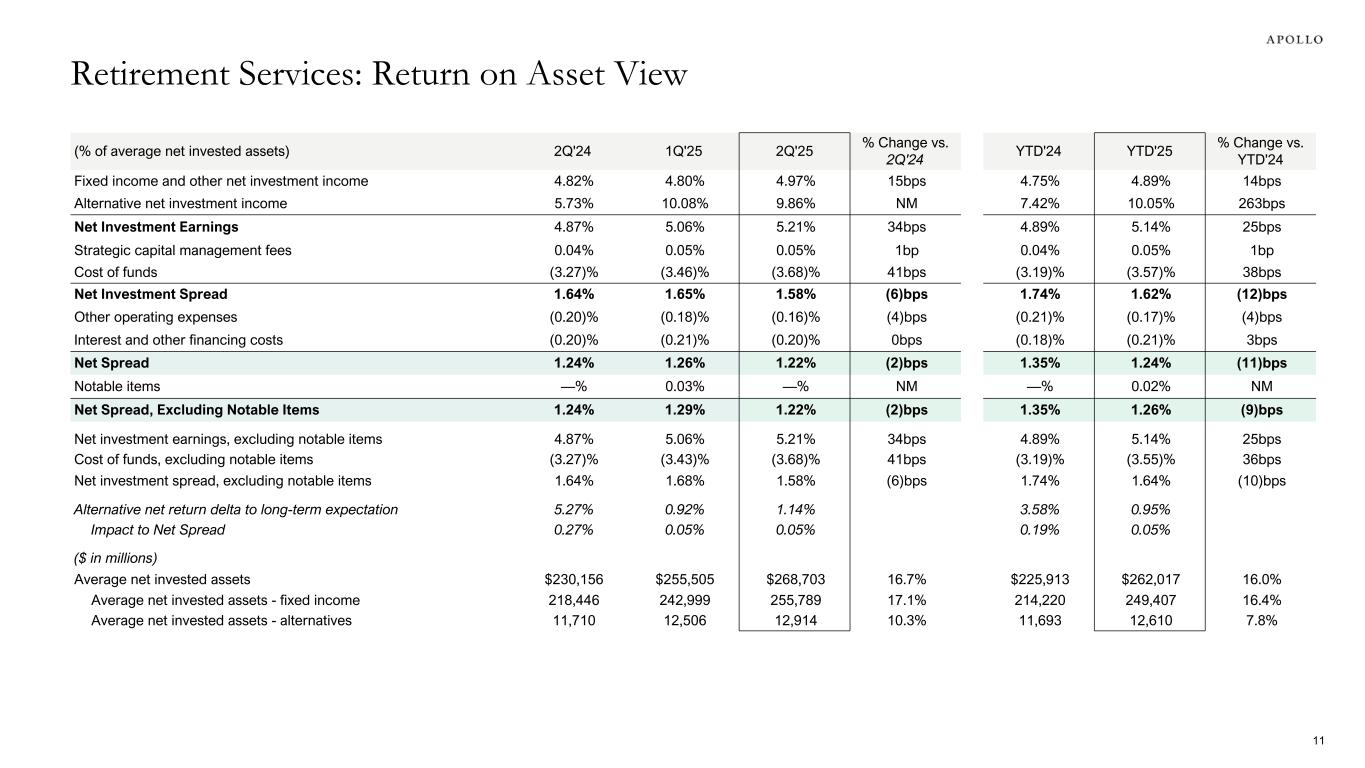

(% of average net invested assets) 2Q'24 1Q'25 2Q'25 % Change vs. 2Q'24 YTD'24 YTD'25 % Change vs. YTD'24 Fixed income and other net investment income 4.82% 4.80% 4.97% 15bps 4.75% 4.89% 14bps Alternative net investment income 5.73% 10.08% 9.86% NM 7.42% 10.05% 263bps Net Investment Earnings 4.87% 5.06% 5.21% 34bps 4.89% 5.14% 25bps Strategic capital management fees 0.04% 0.05% 0.05% 1bp 0.04% 0.05% 1bp Cost of funds (3.27)% (3.46)% (3.68)% 41bps (3.19)% (3.57)% 38bps Net Investment Spread 1.64% 1.65% 1.58% (6)bps 1.74% 1.62% (12)bps Other operating expenses (0.20)% (0.18)% (0.16)% (4)bps (0.21)% (0.17)% (4)bps Interest and other financing costs (0.20)% (0.21)% (0.20)% 0bps (0.18)% (0.21)% 3bps Net Spread 1.24% 1.26% 1.22% (2)bps 1.35% 1.24% (11)bps Notable items —% 0.03% —% NM —% 0.02% NM Net Spread, Excluding Notable Items 1.24% 1.29% 1.22% (2)bps 1.35% 1.26% (9)bps Net investment earnings, excluding notable items 4.87% 5.06% 5.21% 34bps 4.89% 5.14% 25bps Cost of funds, excluding notable items (3.27)% (3.43)% (3.68)% 41bps (3.19)% (3.55)% 36bps Net investment spread, excluding notable items 1.64% 1.68% 1.58% (6)bps 1.74% 1.64% (10)bps Alternative net return delta to long-term expectation 5.27% 0.92% 1.14% 3.58% 0.95% Impact to Net Spread 0.27% 0.05% 0.05% 0.19% 0.05% ($ in millions) Average net invested assets $230,156 $255,505 $268,703 16.7% $225,913 $262,017 16.0% Average net invested assets - fixed income 218,446 242,999 255,789 17.1% 214,220 249,407 16.4% Average net invested assets - alternatives 11,710 12,506 12,914 10.3% 11,693 12,610 7.8% Retirement Services: Return on Asset View 11

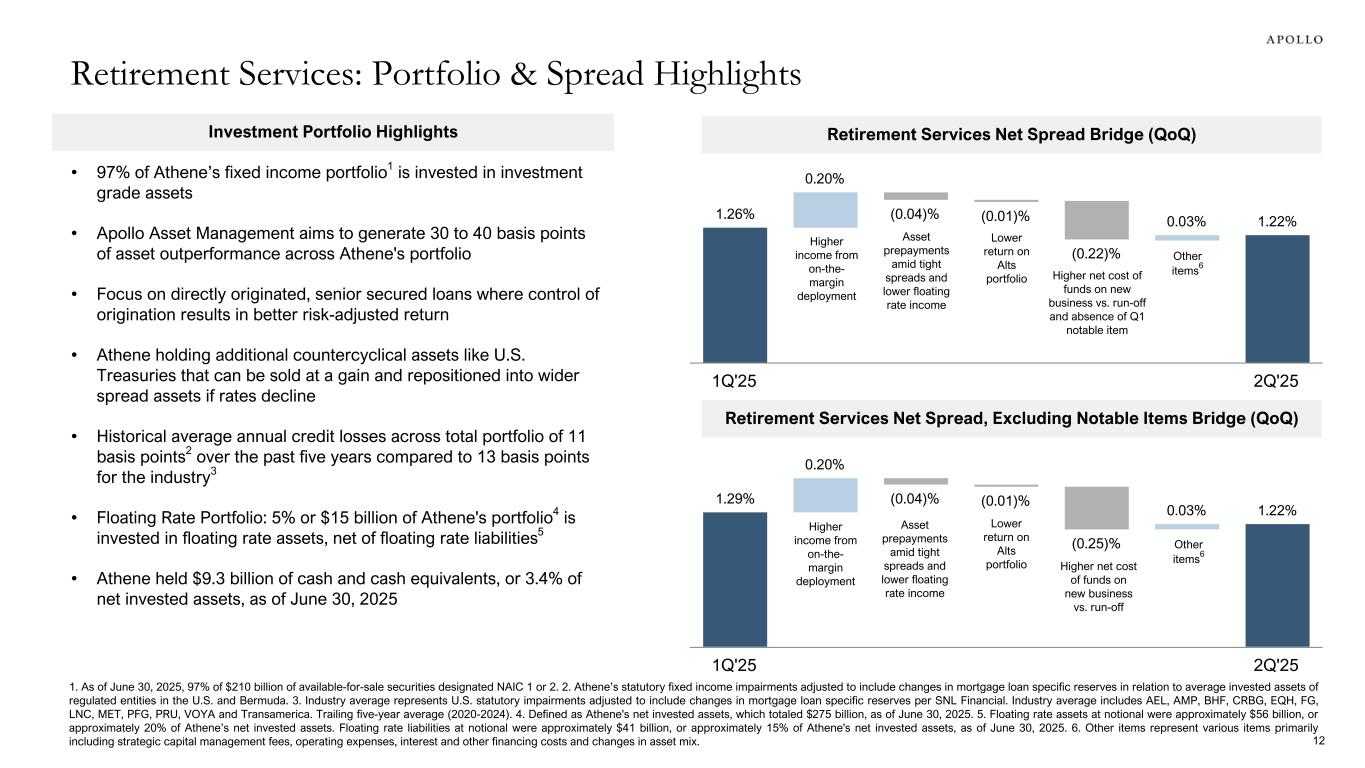

1.26% 0.20% (0.04)% (0.01)% (0.22)% 0.03% 1.22% 1Q'25 2Q'25 Lower return on Alts portfolio Higher net cost of funds on new business vs. run-off and absence of Q1 notable item Investment Portfolio Highlights Retirement Services: Portfolio & Spread Highlights 12 Retirement Services Net Spread Bridge (QoQ) 1. As of June 30, 2025, 97% of $210 billion of available-for-sale securities designated NAIC 1 or 2. 2. Athene’s statutory fixed income impairments adjusted to include changes in mortgage loan specific reserves in relation to average invested assets of regulated entities in the U.S. and Bermuda. 3. Industry average represents U.S. statutory impairments adjusted to include changes in mortgage loan specific reserves per SNL Financial. Industry average includes AEL, AMP, BHF, CRBG, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. Trailing five-year average (2020-2024). 4. Defined as Athene's net invested assets, which totaled $275 billion, as of June 30, 2025. 5. Floating rate assets at notional were approximately $56 billion, or approximately 20% of Athene’s net invested assets. Floating rate liabilities at notional were approximately $41 billion, or approximately 15% of Athene's net invested assets, as of June 30, 2025. 6. Other items represent various items primarily including strategic capital management fees, operating expenses, interest and other financing costs and changes in asset mix. • 97% of Athene’s fixed income portfolio1 is invested in investment grade assets • Apollo Asset Management aims to generate 30 to 40 basis points of asset outperformance across Athene's portfolio • Focus on directly originated, senior secured loans where control of origination results in better risk-adjusted return • Athene holding additional countercyclical assets like U.S. Treasuries that can be sold at a gain and repositioned into wider spread assets if rates decline • Historical average annual credit losses across total portfolio of 11 basis points2 over the past five years compared to 13 basis points for the industry3 • Floating Rate Portfolio: 5% or $15 billion of Athene's portfolio4 is invested in floating rate assets, net of floating rate liabilities5 • Athene held $9.3 billion of cash and cash equivalents, or 3.4% of net invested assets, as of June 30, 2025 1.29% 0.20% (0.04)% (0.01)% (0.25)% 0.03% 1.22% 1Q'25 2Q'25 Retirement Services Net Spread, Excluding Notable Items Bridge (QoQ) Asset prepayments amid tight spreads and lower floating rate income Other items6 Higher income from on-the- margin deployment Higher income from on-the- margin deployment Lower return on Alts portfolio Higher net cost of funds on new business vs. run-off Other items6 Asset prepayments amid tight spreads and lower floating rate income

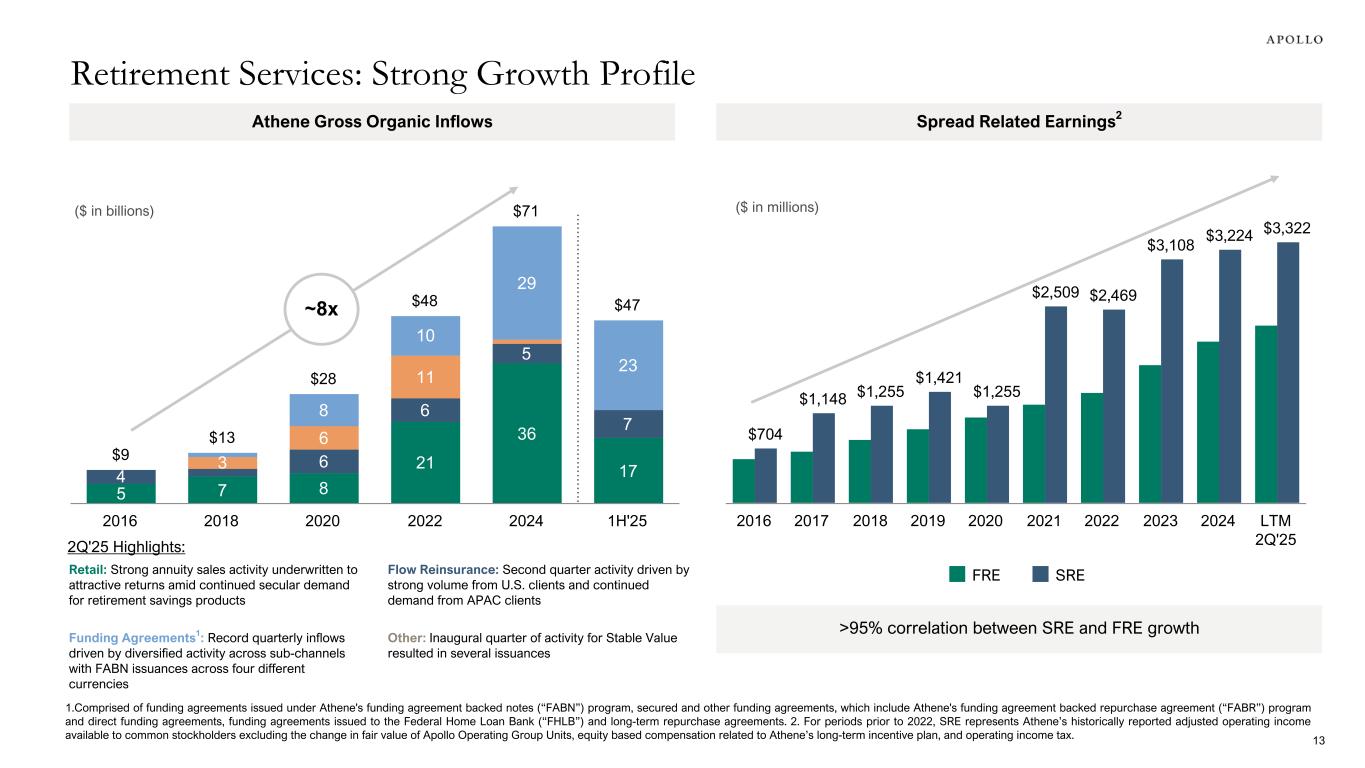

Retail: Strong annuity sales activity underwritten to attractive returns amid continued secular demand for retirement savings products Flow Reinsurance: Second quarter activity driven by strong volume from U.S. clients and continued demand from APAC clients Funding Agreements1: Record quarterly inflows driven by diversified activity across sub-channels with FABN issuances across four different currencies Other: Inaugural quarter of activity for Stable Value resulted in several issuances $704 $1,148 $1,255 $1,421 $1,255 $2,509 $2,469 $3,108 $3,224 $3,322 FRE SRE 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM 2Q'25 $9 $13 $28 $48 $71 $47 5 7 8 21 36 174 6 6 5 7 3 6 11 8 10 29 23 2016 2018 2020 2022 2024 1H'25 1.Comprised of funding agreements issued under Athene's funding agreement backed notes (“FABN”) program, secured and other funding agreements, which include Athene's funding agreement backed repurchase agreement (“FABR”) program and direct funding agreements, funding agreements issued to the Federal Home Loan Bank (“FHLB”) and long-term repurchase agreements. 2. For periods prior to 2022, SRE represents Athene’s historically reported adjusted operating income available to common stockholders excluding the change in fair value of Apollo Operating Group Units, equity based compensation related to Athene’s long-term incentive plan, and operating income tax. Retirement Services: Strong Growth Profile Athene Gross Organic Inflows Spread Related Earnings2 ~8x ($ in billions) >95% correlation between SRE and FRE growth 13 ($ in millions) 2Q'25 Highlights:

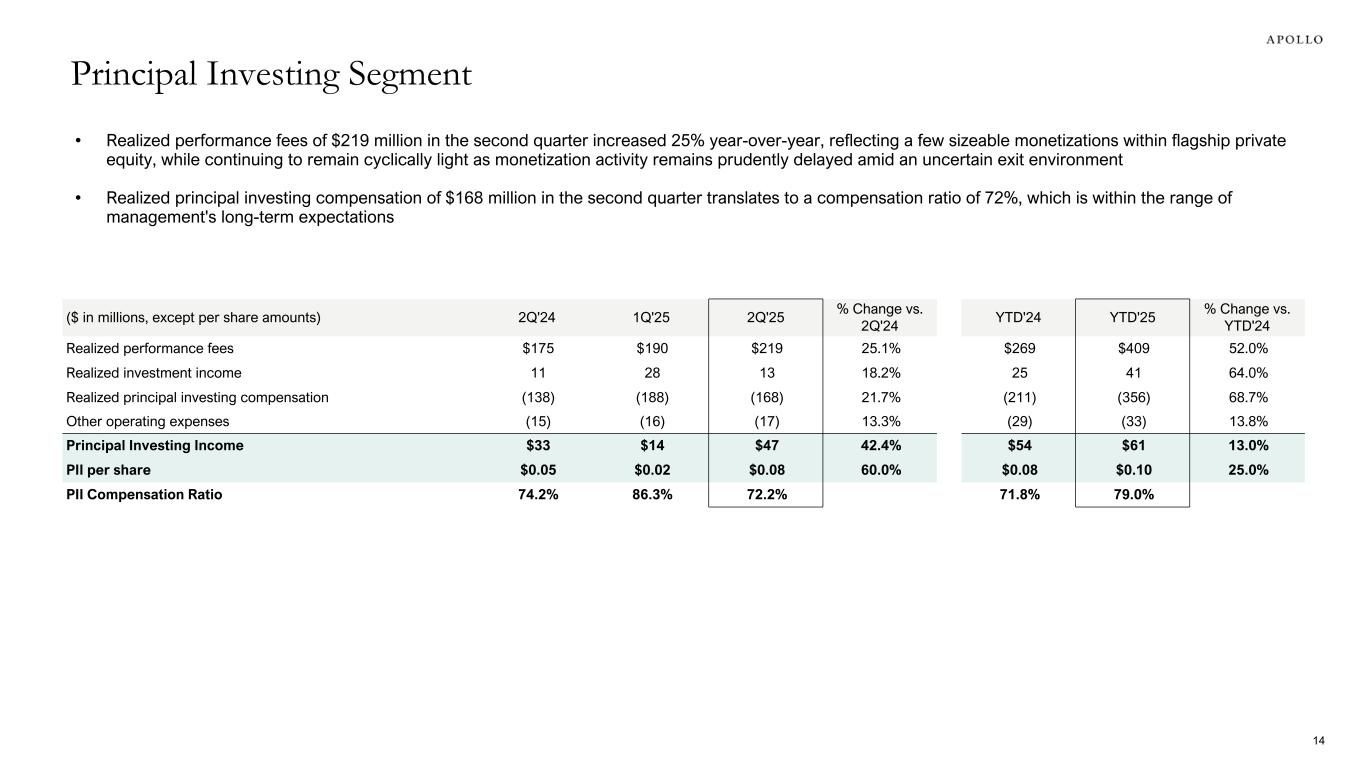

($ in millions, except per share amounts) 2Q'24 1Q'25 2Q'25 % Change vs. 2Q'24 YTD'24 YTD'25 % Change vs. YTD'24 Realized performance fees $175 $190 $219 25.1% $269 $409 52.0% Realized investment income 11 28 13 18.2% 25 41 64.0% Realized principal investing compensation (138) (188) (168) 21.7% (211) (356) 68.7% Other operating expenses (15) (16) (17) 13.3% (29) (33) 13.8% Principal Investing Income $33 $14 $47 42.4% $54 $61 13.0% PII per share $0.05 $0.02 $0.08 60.0% $0.08 $0.10 25.0% PII Compensation Ratio 74.2% 86.3% 72.2% 71.8% 79.0% Principal Investing Segment 14 • Realized performance fees of $219 million in the second quarter increased 25% year-over-year, reflecting a few sizeable monetizations within flagship private equity, while continuing to remain cyclically light as monetization activity remains prudently delayed amid an uncertain exit environment • Realized principal investing compensation of $168 million in the second quarter translates to a compensation ratio of 72%, which is within the range of management's long-term expectations

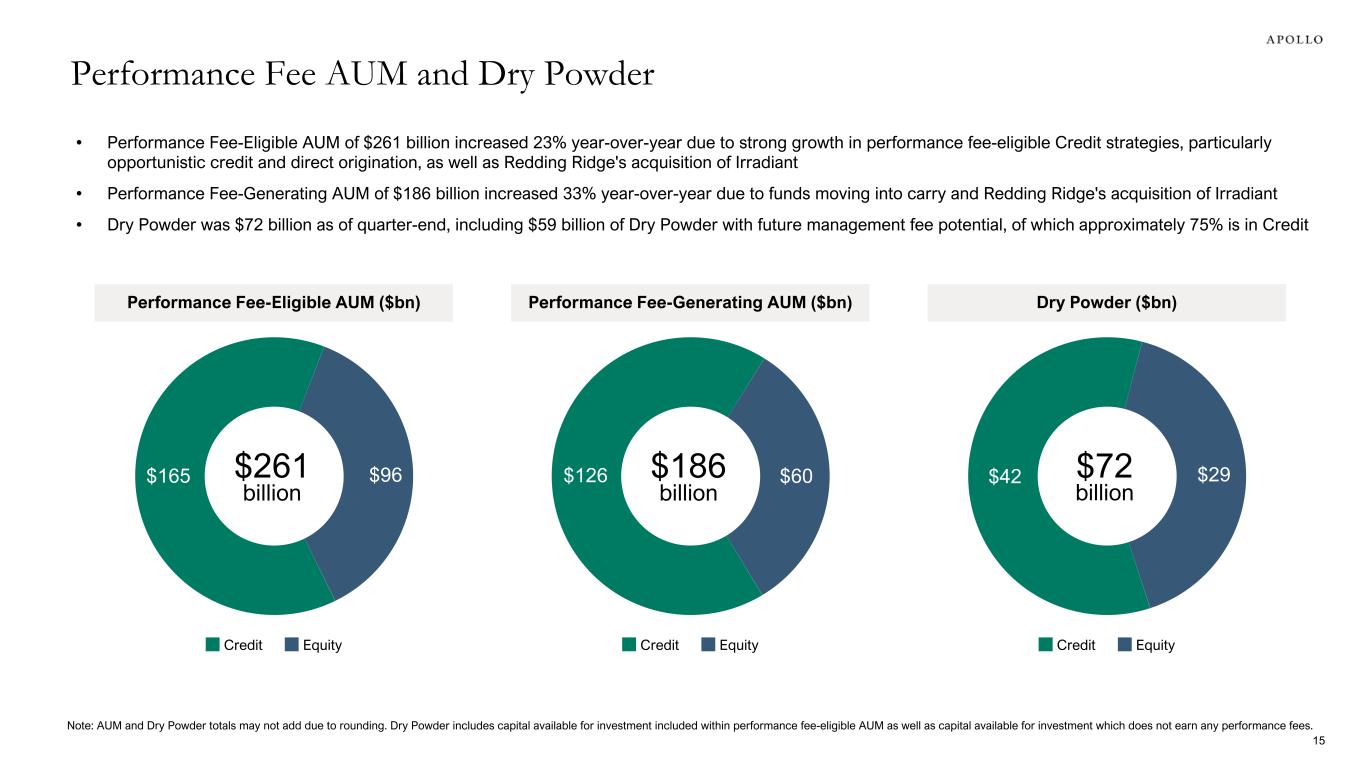

• Performance Fee-Eligible AUM of $261 billion increased 23% year-over-year due to strong growth in performance fee-eligible Credit strategies, particularly opportunistic credit and direct origination, as well as Redding Ridge's acquisition of Irradiant • Performance Fee-Generating AUM of $186 billion increased 33% year-over-year due to funds moving into carry and Redding Ridge's acquisition of Irradiant • Dry Powder was $72 billion as of quarter-end, including $59 billion of Dry Powder with future management fee potential, of which approximately 75% is in Credit Performance Fee-Eligible AUM ($bn) Performance Fee-Generating AUM ($bn) Dry Powder ($bn) Note: AUM and Dry Powder totals may not add due to rounding. Dry Powder includes capital available for investment included within performance fee-eligible AUM as well as capital available for investment which does not earn any performance fees. Performance Fee AUM and Dry Powder 15 $165 $96 Credit Equity $126 $60 Credit Equity $42 $29 Credit Equity $261 billion $186 billion $72 billion

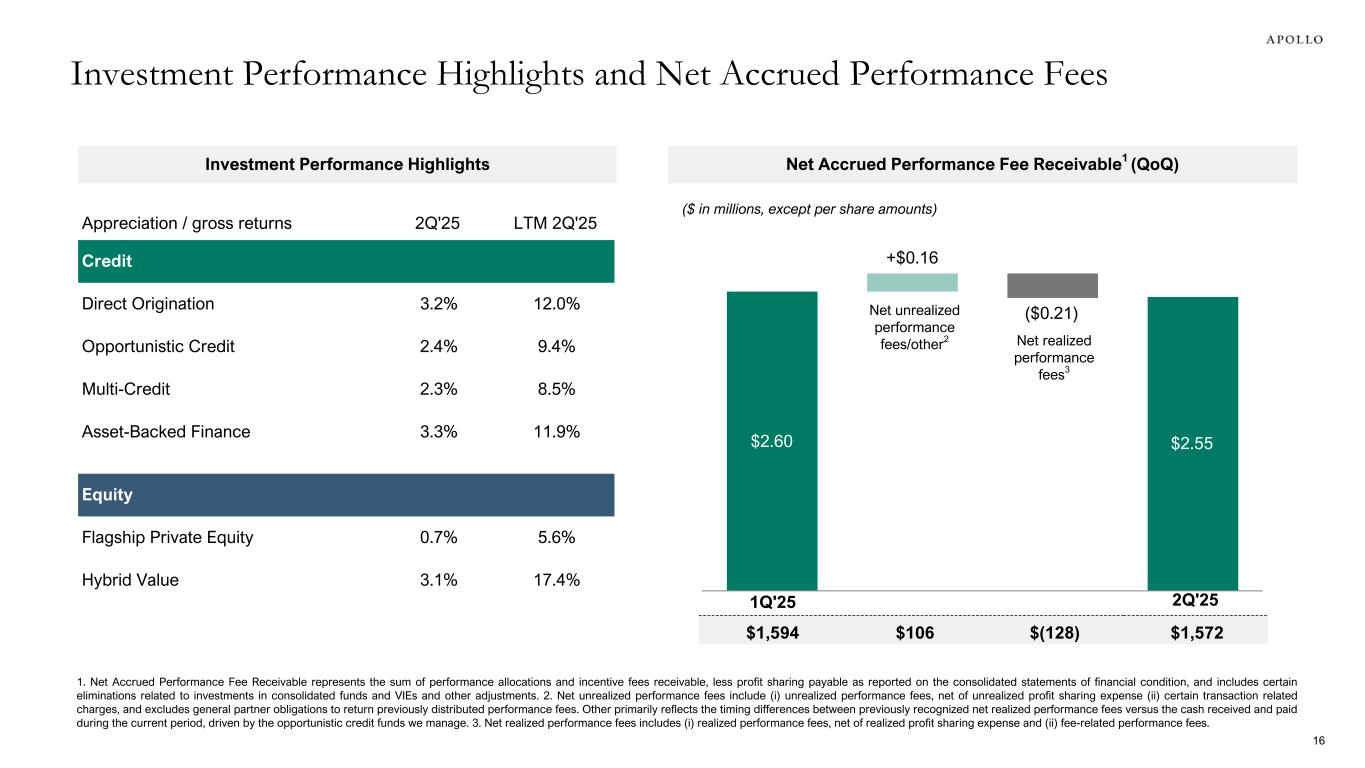

Investment Performance Highlights Net Accrued Performance Fee Receivable1 (QoQ) Appreciation / gross returns 2Q'25 LTM 2Q'25 Credit Direct Origination 3.2% 12.0% Opportunistic Credit 2.4% 9.4% Multi-Credit 2.3% 8.5% Asset-Backed Finance 3.3% 11.9% Equity Flagship Private Equity 0.7% 5.6% Hybrid Value 3.1% 17.4% $2.60 +$0.16 ($0.21) $2.55 Net unrealized performance fees/other2 1Q'25 Net realized performance fees3 1. Net Accrued Performance Fee Receivable represents the sum of performance allocations and incentive fees receivable, less profit sharing payable as reported on the consolidated statements of financial condition, and includes certain eliminations related to investments in consolidated funds and VIEs and other adjustments. 2. Net unrealized performance fees include (i) unrealized performance fees, net of unrealized profit sharing expense (ii) certain transaction related charges, and excludes general partner obligations to return previously distributed performance fees. Other primarily reflects the timing differences between previously recognized net realized performance fees versus the cash received and paid during the current period, driven by the opportunistic credit funds we manage. 3. Net realized performance fees includes (i) realized performance fees, net of realized profit sharing expense and (ii) fee-related performance fees. 2Q'25 $1,594 $106 $(128) $1,572 ($ in millions, except per share amounts) Investment Performance Highlights and Net Accrued Performance Fees 16

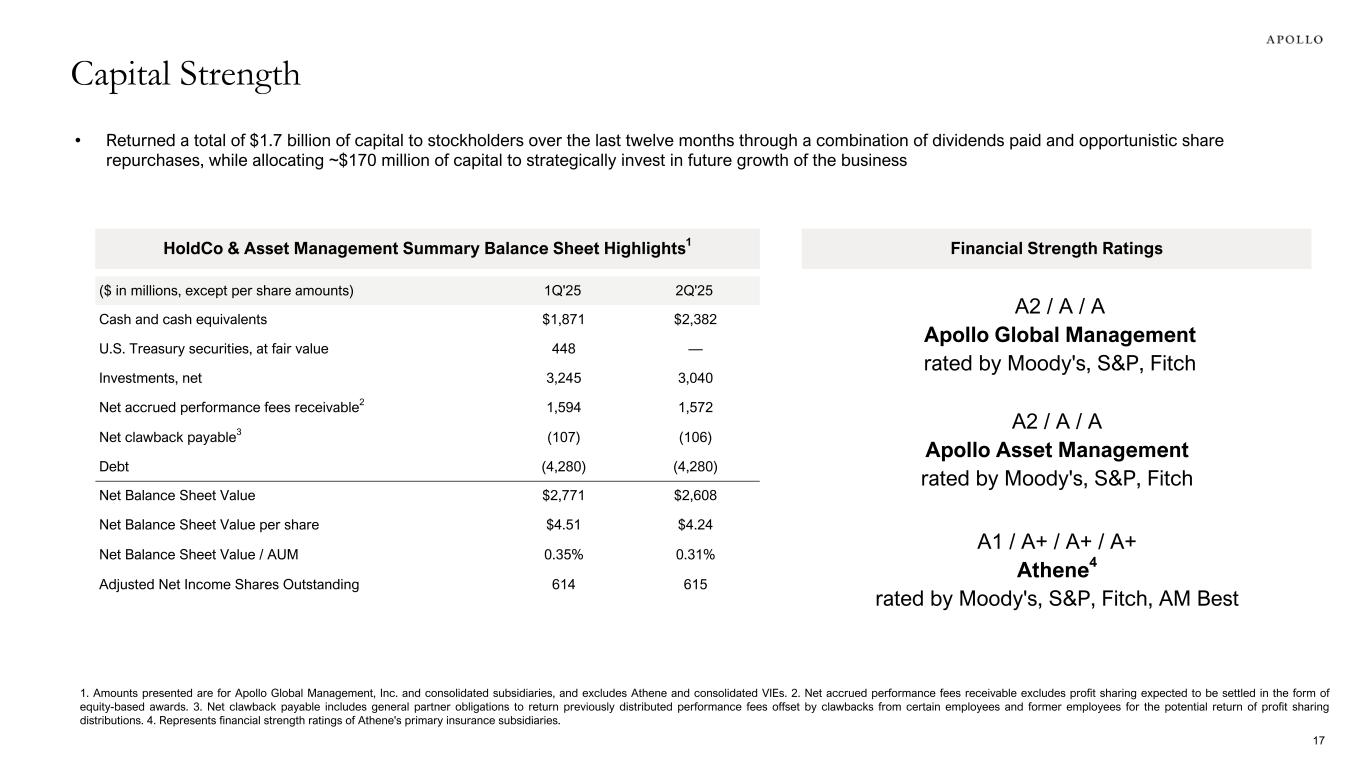

HoldCo & Asset Management Summary Balance Sheet Highlights1 Financial Strength Ratings ($ in millions, except per share amounts) 1Q'25 2Q'25 Cash and cash equivalents $1,871 $2,382 U.S. Treasury securities, at fair value 448 — Investments, net 3,245 3,040 Net accrued performance fees receivable2 1,594 1,572 Net clawback payable3 (107) (106) Debt (4,280) (4,280) Net Balance Sheet Value $2,771 $2,608 Net Balance Sheet Value per share $4.51 $4.24 Net Balance Sheet Value / AUM 0.35% 0.31% Adjusted Net Income Shares Outstanding 614 615 A2 / A / A Apollo Asset Management rated by Moody's, S&P, Fitch A1 / A+ / A+ / A+ Athene4 rated by Moody's, S&P, Fitch, AM Best 1. Amounts presented are for Apollo Global Management, Inc. and consolidated subsidiaries, and excludes Athene and consolidated VIEs. 2. Net accrued performance fees receivable excludes profit sharing expected to be settled in the form of equity-based awards. 3. Net clawback payable includes general partner obligations to return previously distributed performance fees offset by clawbacks from certain employees and former employees for the potential return of profit sharing distributions. 4. Represents financial strength ratings of Athene's primary insurance subsidiaries. Capital Strength 17 A2 / A / A Apollo Global Management rated by Moody's, S&P, Fitch • Returned a total of $1.7 billion of capital to stockholders over the last twelve months through a combination of dividends paid and opportunistic share repurchases, while allocating ~$170 million of capital to strategically invest in future growth of the business

Supplemental Details

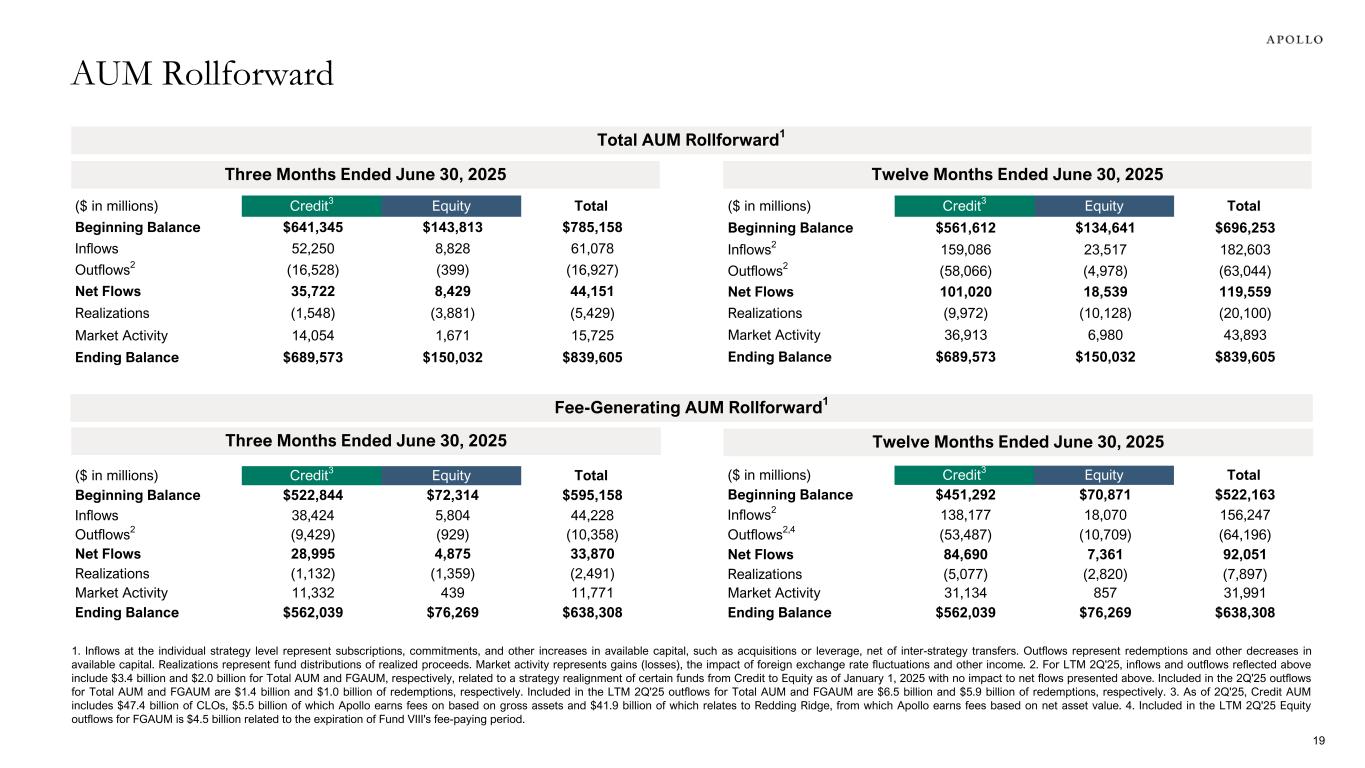

($ in millions) Credit3 Equity Total Beginning Balance $641,345 $143,813 $785,158 Inflows 52,250 8,828 61,078 Outflows2 (16,528) (399) (16,927) Net Flows 35,722 8,429 44,151 Realizations (1,548) (3,881) (5,429) Market Activity 14,054 1,671 15,725 Ending Balance $689,573 $150,032 $839,605 Three Months Ended June 30, 2025 ($ in millions) Credit3 Equity Total Beginning Balance $561,612 $134,641 $696,253 Inflows2 159,086 23,517 182,603 Outflows2 (58,066) (4,978) (63,044) Net Flows 101,020 18,539 119,559 Realizations (9,972) (10,128) (20,100) Market Activity 36,913 6,980 43,893 Ending Balance $689,573 $150,032 $839,605 Twelve Months Ended June 30, 2025 ($ in millions) Credit3 Equity Total Beginning Balance $522,844 $72,314 $595,158 Inflows 38,424 5,804 44,228 Outflows2 (9,429) (929) (10,358) Net Flows 28,995 4,875 33,870 Realizations (1,132) (1,359) (2,491) Market Activity 11,332 439 11,771 Ending Balance $562,039 $76,269 $638,308 Three Months Ended June 30, 2025 ($ in millions) Credit3 Equity Total Beginning Balance $451,292 $70,871 $522,163 Inflows2 138,177 18,070 156,247 Outflows2,4 (53,487) (10,709) (64,196) Net Flows 84,690 7,361 92,051 Realizations (5,077) (2,820) (7,897) Market Activity 31,134 857 31,991 Ending Balance $562,039 $76,269 $638,308 Twelve Months Ended June 30, 2025 Fee-Generating AUM Rollforward1 Total AUM Rollforward1 1. Inflows at the individual strategy level represent subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers. Outflows represent redemptions and other decreases in available capital. Realizations represent fund distributions of realized proceeds. Market activity represents gains (losses), the impact of foreign exchange rate fluctuations and other income. 2. For LTM 2Q'25, inflows and outflows reflected above include $3.4 billion and $2.0 billion for Total AUM and FGAUM, respectively, related to a strategy realignment of certain funds from Credit to Equity as of January 1, 2025 with no impact to net flows presented above. Included in the 2Q'25 outflows for Total AUM and FGAUM are $1.4 billion and $1.0 billion of redemptions, respectively. Included in the LTM 2Q'25 outflows for Total AUM and FGAUM are $6.5 billion and $5.9 billion of redemptions, respectively. 3. As of 2Q'25, Credit AUM includes $47.4 billion of CLOs, $5.5 billion of which Apollo earns fees on based on gross assets and $41.9 billion of which relates to Redding Ridge, from which Apollo earns fees based on net asset value. 4. Included in the LTM 2Q'25 Equity outflows for FGAUM is $4.5 billion related to the expiration of Fund VIII's fee-paying period. AUM Rollforward 19

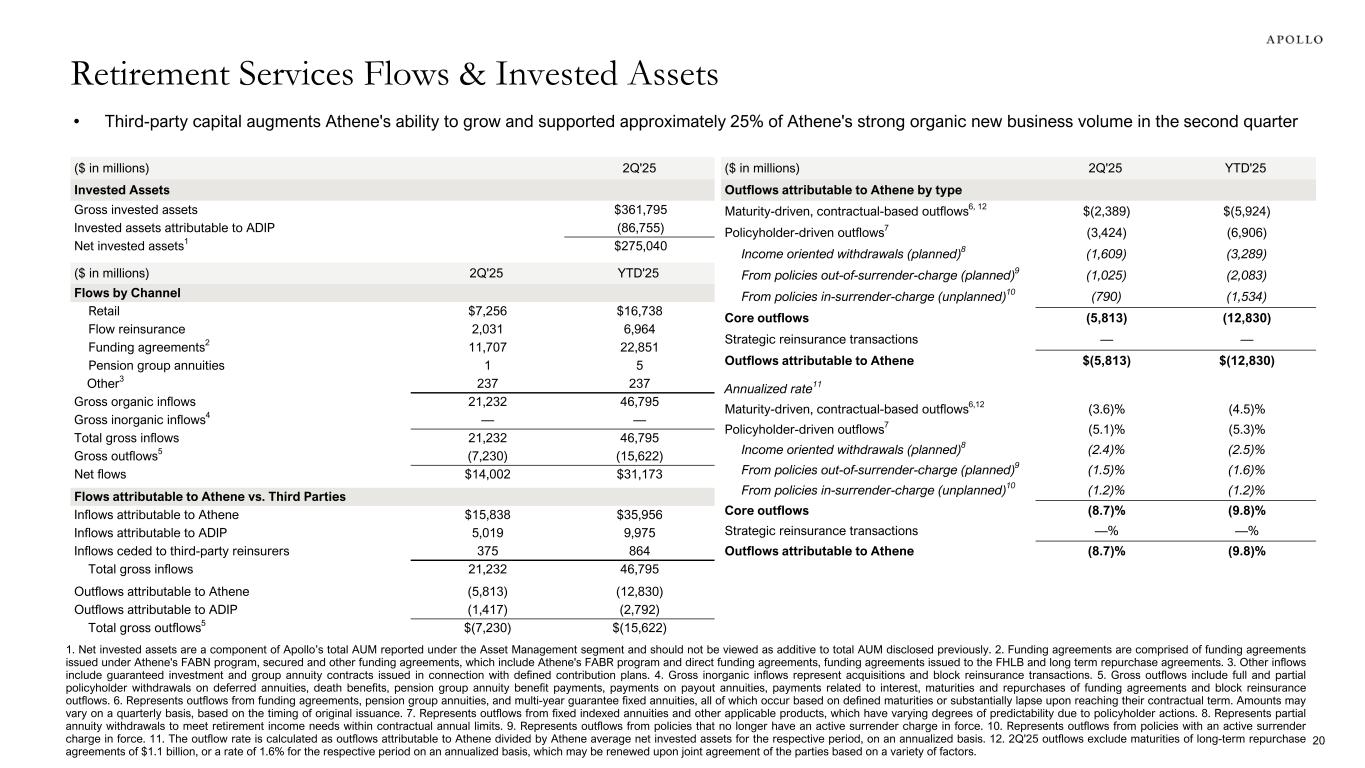

• Third-party capital augments Athene's ability to grow and supported approximately 25% of Athene's strong organic new business volume in the second quarter 20 1. Net invested assets are a component of Apollo’s total AUM reported under the Asset Management segment and should not be viewed as additive to total AUM disclosed previously. 2. Funding agreements are comprised of funding agreements issued under Athene's FABN program, secured and other funding agreements, which include Athene's FABR program and direct funding agreements, funding agreements issued to the FHLB and long term repurchase agreements. 3. Other inflows include guaranteed investment and group annuity contracts issued in connection with defined contribution plans. 4. Gross inorganic inflows represent acquisitions and block reinsurance transactions. 5. Gross outflows include full and partial policyholder withdrawals on deferred annuities, death benefits, pension group annuity benefit payments, payments on payout annuities, payments related to interest, maturities and repurchases of funding agreements and block reinsurance outflows. 6. Represents outflows from funding agreements, pension group annuities, and multi-year guarantee fixed annuities, all of which occur based on defined maturities or substantially lapse upon reaching their contractual term. Amounts may vary on a quarterly basis, based on the timing of original issuance. 7. Represents outflows from fixed indexed annuities and other applicable products, which have varying degrees of predictability due to policyholder actions. 8. Represents partial annuity withdrawals to meet retirement income needs within contractual annual limits. 9. Represents outflows from policies that no longer have an active surrender charge in force. 10. Represents outflows from policies with an active surrender charge in force. 11. The outflow rate is calculated as outflows attributable to Athene divided by Athene average net invested assets for the respective period, on an annualized basis. 12. 2Q'25 outflows exclude maturities of long-term repurchase agreements of $1.1 billion, or a rate of 1.6% for the respective period on an annualized basis, which may be renewed upon joint agreement of the parties based on a variety of factors. Retirement Services Flows & Invested Assets ($ in millions) 2Q'25 YTD'25 Flows by Channel Retail $7,256 $16,738 Flow reinsurance 2,031 6,964 Funding agreements2 11,707 22,851 Pension group annuities 1 5 Other3 237 237 Gross organic inflows 21,232 46,795 Gross inorganic inflows4 — — Total gross inflows 21,232 46,795 Gross outflows5 (7,230) (15,622) Net flows $14,002 $31,173 Flows attributable to Athene vs. Third Parties Inflows attributable to Athene $15,838 $35,956 Inflows attributable to ADIP 5,019 9,975 Inflows ceded to third-party reinsurers 375 864 Total gross inflows 21,232 46,795 Outflows attributable to Athene (5,813) (12,830) Outflows attributable to ADIP (1,417) (2,792) Total gross outflows5 $(7,230) $(15,622) ($ in millions) 2Q'25 Invested Assets Gross invested assets $361,795 Invested assets attributable to ADIP (86,755) Net invested assets1 $275,040 ($ in millions) 2Q'25 YTD'25 Outflows attributable to Athene by type Maturity-driven, contractual-based outflows6, 12 $(2,389) $(5,924) Policyholder-driven outflows7 (3,424) (6,906) Income oriented withdrawals (planned)8 (1,609) (3,289) From policies out-of-surrender-charge (planned)9 (1,025) (2,083) From policies in-surrender-charge (unplanned)10 (790) (1,534) Core outflows (5,813) (12,830) Strategic reinsurance transactions — — Outflows attributable to Athene $(5,813) $(12,830) Annualized rate11 Maturity-driven, contractual-based outflows6,12 (3.6)% (4.5)% Policyholder-driven outflows7 (5.1)% (5.3)% Income oriented withdrawals (planned)8 (2.4)% (2.5)% From policies out-of-surrender-charge (planned)9 (1.5)% (1.6)% From policies in-surrender-charge (unplanned)10 (1.2)% (1.2)% Core outflows (8.7)% (9.8)% Strategic reinsurance transactions —% —% Outflows attributable to Athene (8.7)% (9.8)%

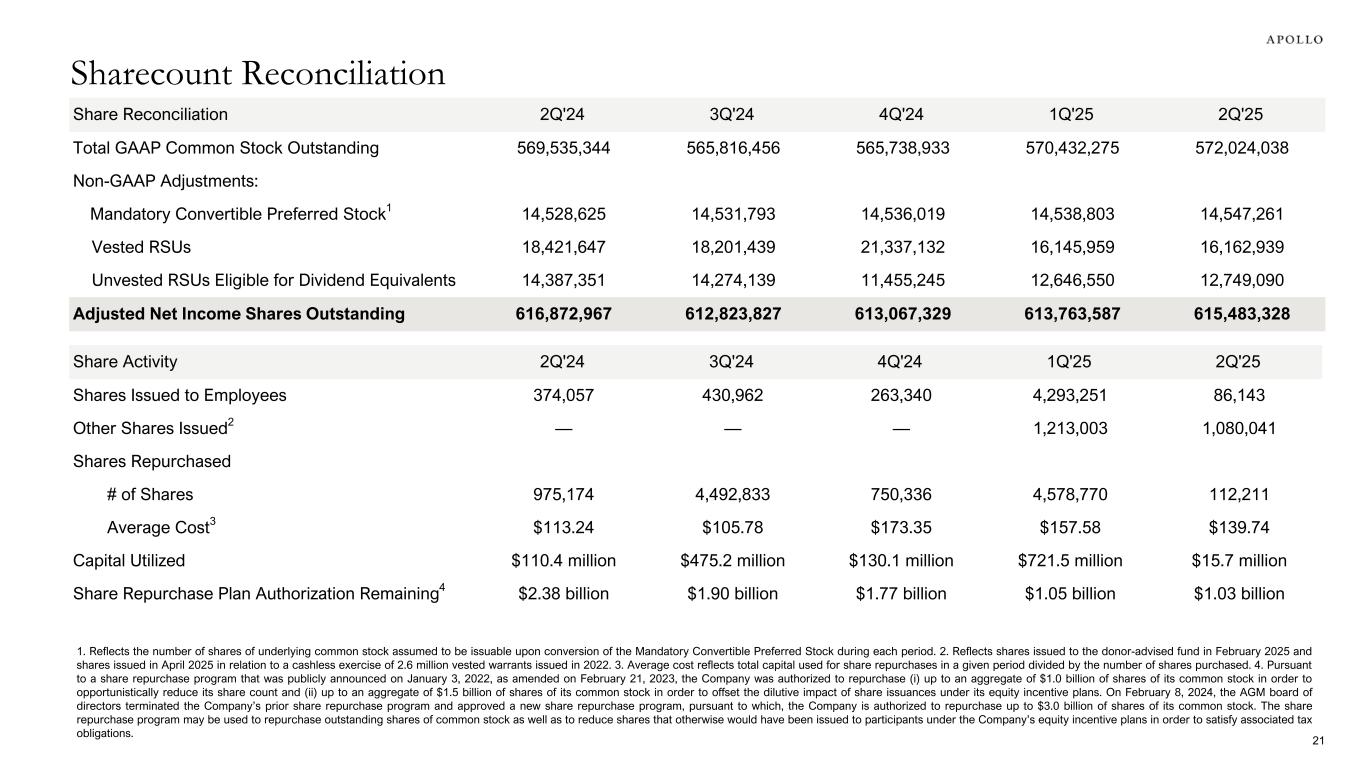

Share Reconciliation 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Total GAAP Common Stock Outstanding 569,535,344 565,816,456 565,738,933 570,432,275 572,024,038 Non-GAAP Adjustments: Mandatory Convertible Preferred Stock1 14,528,625 14,531,793 14,536,019 14,538,803 14,547,261 Vested RSUs 18,421,647 18,201,439 21,337,132 16,145,959 16,162,939 Unvested RSUs Eligible for Dividend Equivalents 14,387,351 14,274,139 11,455,245 12,646,550 12,749,090 Adjusted Net Income Shares Outstanding 616,872,967 612,823,827 613,067,329 613,763,587 615,483,328 1. Reflects the number of shares of underlying common stock assumed to be issuable upon conversion of the Mandatory Convertible Preferred Stock during each period. 2. Reflects shares issued to the donor-advised fund in February 2025 and shares issued in April 2025 in relation to a cashless exercise of 2.6 million vested warrants issued in 2022. 3. Average cost reflects total capital used for share repurchases in a given period divided by the number of shares purchased. 4. Pursuant to a share repurchase program that was publicly announced on January 3, 2022, as amended on February 21, 2023, the Company was authorized to repurchase (i) up to an aggregate of $1.0 billion of shares of its common stock in order to opportunistically reduce its share count and (ii) up to an aggregate of $1.5 billion of shares of its common stock in order to offset the dilutive impact of share issuances under its equity incentive plans. On February 8, 2024, the AGM board of directors terminated the Company’s prior share repurchase program and approved a new share repurchase program, pursuant to which, the Company is authorized to repurchase up to $3.0 billion of shares of its common stock. The share repurchase program may be used to repurchase outstanding shares of common stock as well as to reduce shares that otherwise would have been issued to participants under the Company’s equity incentive plans in order to satisfy associated tax obligations. Share Activity 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Shares Issued to Employees 374,057 430,962 263,340 4,293,251 86,143 Other Shares Issued2 — — — 1,213,003 1,080,041 Shares Repurchased # of Shares 975,174 4,492,833 750,336 4,578,770 112,211 Average Cost3 $113.24 $105.78 $173.35 $157.58 $139.74 Capital Utilized $110.4 million $475.2 million $130.1 million $721.5 million $15.7 million Share Repurchase Plan Authorization Remaining4 $2.38 billion $1.90 billion $1.77 billion $1.05 billion $1.03 billion Sharecount Reconciliation 21

Reconciliations and Disclosures

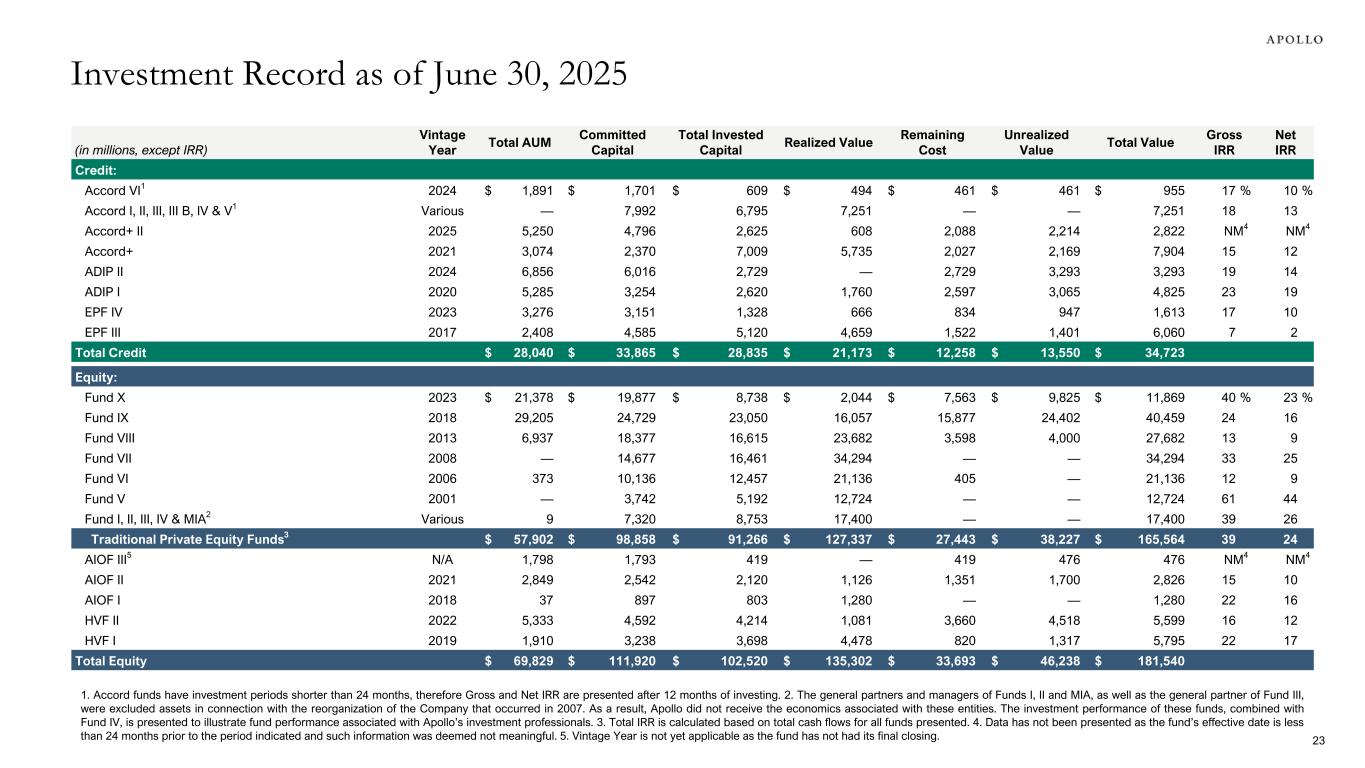

(in millions, except IRR) Vintage Year Total AUM Committed Capital Total Invested Capital Realized Value Remaining Cost Unrealized Value Total Value Gross IRR Net IRR Credit: Accord VI1 2024 $ 1,891 $ 1,701 $ 609 $ 494 $ 461 $ 461 $ 955 17 % 10 % Accord I, II, III, III B, IV & V1 Various — 7,992 6,795 7,251 — — 7,251 18 13 Accord+ II 2025 5,250 4,796 2,625 608 2,088 2,214 2,822 NM4 NM4 Accord+ 2021 3,074 2,370 7,009 5,735 2,027 2,169 7,904 15 12 ADIP II 2024 6,856 6,016 2,729 — 2,729 3,293 3,293 19 14 ADIP I 2020 5,285 3,254 2,620 1,760 2,597 3,065 4,825 23 19 EPF IV 2023 3,276 3,151 1,328 666 834 947 1,613 17 10 EPF III 2017 2,408 4,585 5,120 4,659 1,522 1,401 6,060 7 2 Total Credit $ 28,040 $ 33,865 $ 28,835 $ 21,173 $ 12,258 $ 13,550 $ 34,723 Equity: Fund X 2023 $ 21,378 $ 19,877 $ 8,738 $ 2,044 $ 7,563 $ 9,825 $ 11,869 40 % 23 % Fund IX 2018 29,205 24,729 23,050 16,057 15,877 24,402 40,459 24 16 Fund VIII 2013 6,937 18,377 16,615 23,682 3,598 4,000 27,682 13 9 Fund VII 2008 — 14,677 16,461 34,294 — — 34,294 33 25 Fund VI 2006 373 10,136 12,457 21,136 405 — 21,136 12 9 Fund V 2001 — 3,742 5,192 12,724 — — 12,724 61 44 Fund I, II, III, IV & MIA2 Various 9 7,320 8,753 17,400 — — 17,400 39 26 Traditional Private Equity Funds3 $ 57,902 $ 98,858 $ 91,266 $ 127,337 $ 27,443 $ 38,227 $ 165,564 39 24 AIOF III5 N/A 1,798 1,793 419 — 419 476 476 NM4 NM4 AIOF II 2021 2,849 2,542 2,120 1,126 1,351 1,700 2,826 15 10 AIOF I 2018 37 897 803 1,280 — — 1,280 22 16 HVF II 2022 5,333 4,592 4,214 1,081 3,660 4,518 5,599 16 12 HVF I 2019 1,910 3,238 3,698 4,478 820 1,317 5,795 22 17 Total Equity $ 69,829 $ 111,920 $ 102,520 $ 135,302 $ 33,693 $ 46,238 $ 181,540 Investment Record as of June 30, 2025 23 1. Accord funds have investment periods shorter than 24 months, therefore Gross and Net IRR are presented after 12 months of investing. 2. The general partners and managers of Funds I, II and MIA, as well as the general partner of Fund III, were excluded assets in connection with the reorganization of the Company that occurred in 2007. As a result, Apollo did not receive the economics associated with these entities. The investment performance of these funds, combined with Fund IV, is presented to illustrate fund performance associated with Apollo’s investment professionals. 3. Total IRR is calculated based on total cash flows for all funds presented. 4. Data has not been presented as the fund’s effective date is less than 24 months prior to the period indicated and such information was deemed not meaningful. 5. Vintage Year is not yet applicable as the fund has not had its final closing.

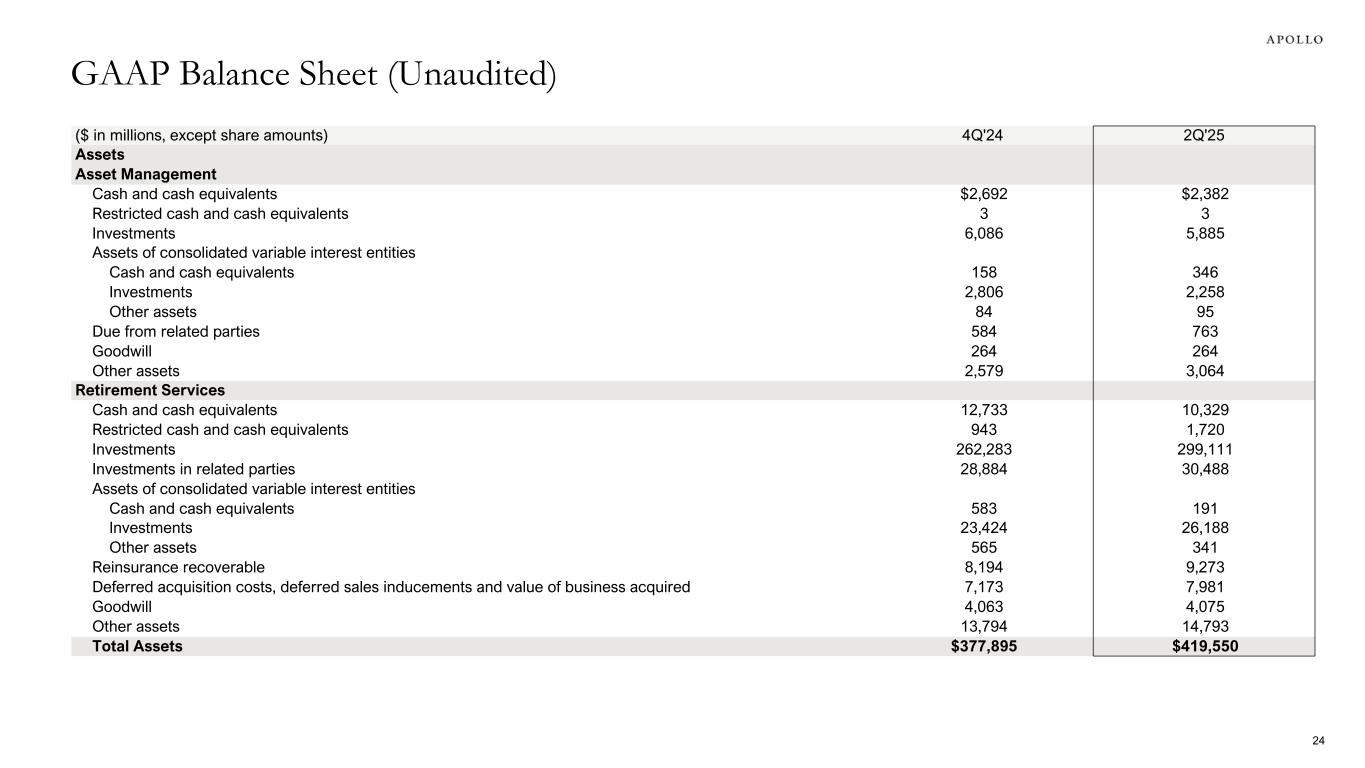

($ in millions, except share amounts) 4Q'24 2Q'25 Assets Asset Management Cash and cash equivalents $2,692 $2,382 Restricted cash and cash equivalents 3 3 Investments 6,086 5,885 Assets of consolidated variable interest entities Cash and cash equivalents 158 346 Investments 2,806 2,258 Other assets 84 95 Due from related parties 584 763 Goodwill 264 264 Other assets 2,579 3,064 Retirement Services Cash and cash equivalents 12,733 10,329 Restricted cash and cash equivalents 943 1,720 Investments 262,283 299,111 Investments in related parties 28,884 30,488 Assets of consolidated variable interest entities Cash and cash equivalents 583 191 Investments 23,424 26,188 Other assets 565 341 Reinsurance recoverable 8,194 9,273 Deferred acquisition costs, deferred sales inducements and value of business acquired 7,173 7,981 Goodwill 4,063 4,075 Other assets 13,794 14,793 Total Assets $377,895 $419,550 GAAP Balance Sheet (Unaudited) 24

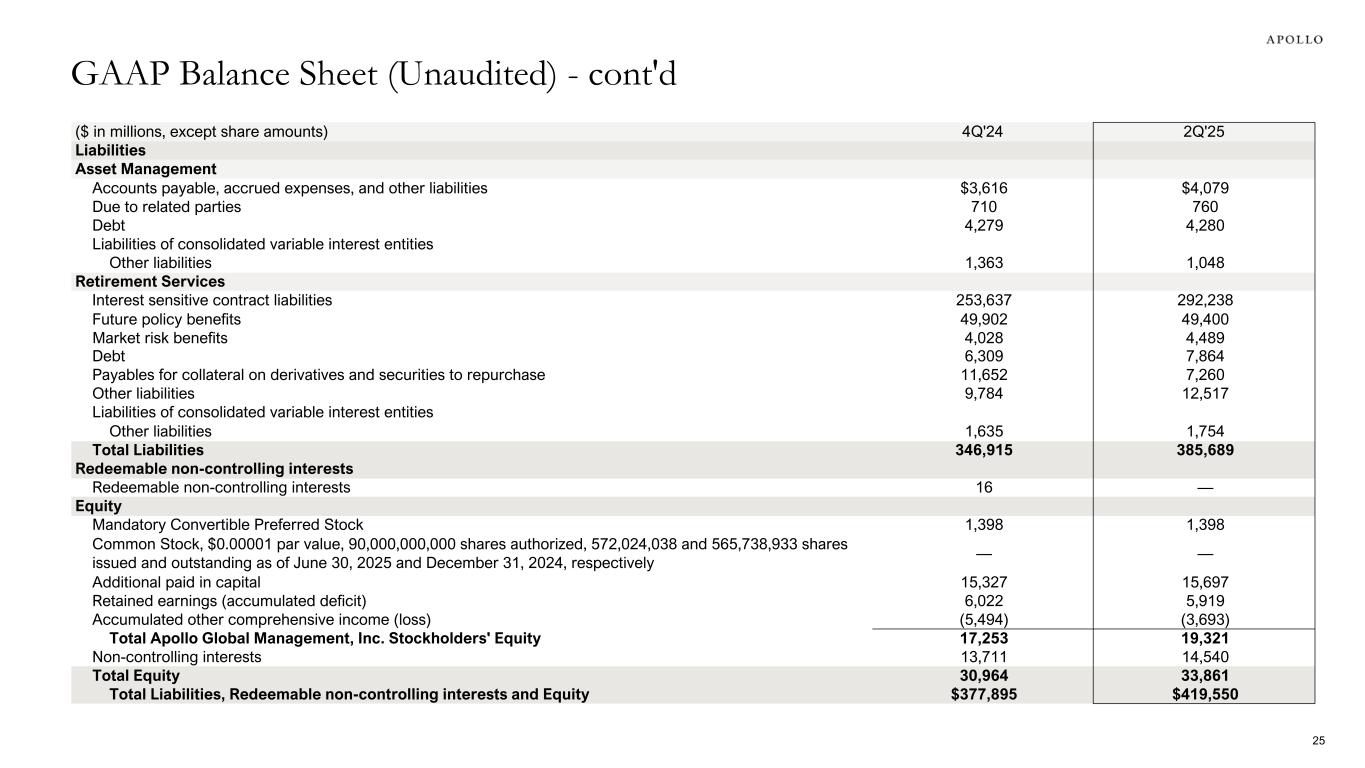

($ in millions, except share amounts) 4Q'24 2Q'25 Liabilities Asset Management Accounts payable, accrued expenses, and other liabilities $3,616 $4,079 Due to related parties 710 760 Debt 4,279 4,280 Liabilities of consolidated variable interest entities Other liabilities 1,363 1,048 Retirement Services Interest sensitive contract liabilities 253,637 292,238 Future policy benefits 49,902 49,400 Market risk benefits 4,028 4,489 Debt 6,309 7,864 Payables for collateral on derivatives and securities to repurchase 11,652 7,260 Other liabilities 9,784 12,517 Liabilities of consolidated variable interest entities Other liabilities 1,635 1,754 Total Liabilities 346,915 385,689 Redeemable non-controlling interests Redeemable non-controlling interests 16 — Equity Mandatory Convertible Preferred Stock 1,398 1,398 Common Stock, $0.00001 par value, 90,000,000,000 shares authorized, 572,024,038 and 565,738,933 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively — — Additional paid in capital 15,327 15,697 Retained earnings (accumulated deficit) 6,022 5,919 Accumulated other comprehensive income (loss) (5,494) (3,693) Total Apollo Global Management, Inc. Stockholders' Equity 17,253 19,321 Non-controlling interests 13,711 14,540 Total Equity 30,964 33,861 Total Liabilities, Redeemable non-controlling interests and Equity $377,895 $419,550 GAAP Balance Sheet (Unaudited) - cont'd 25

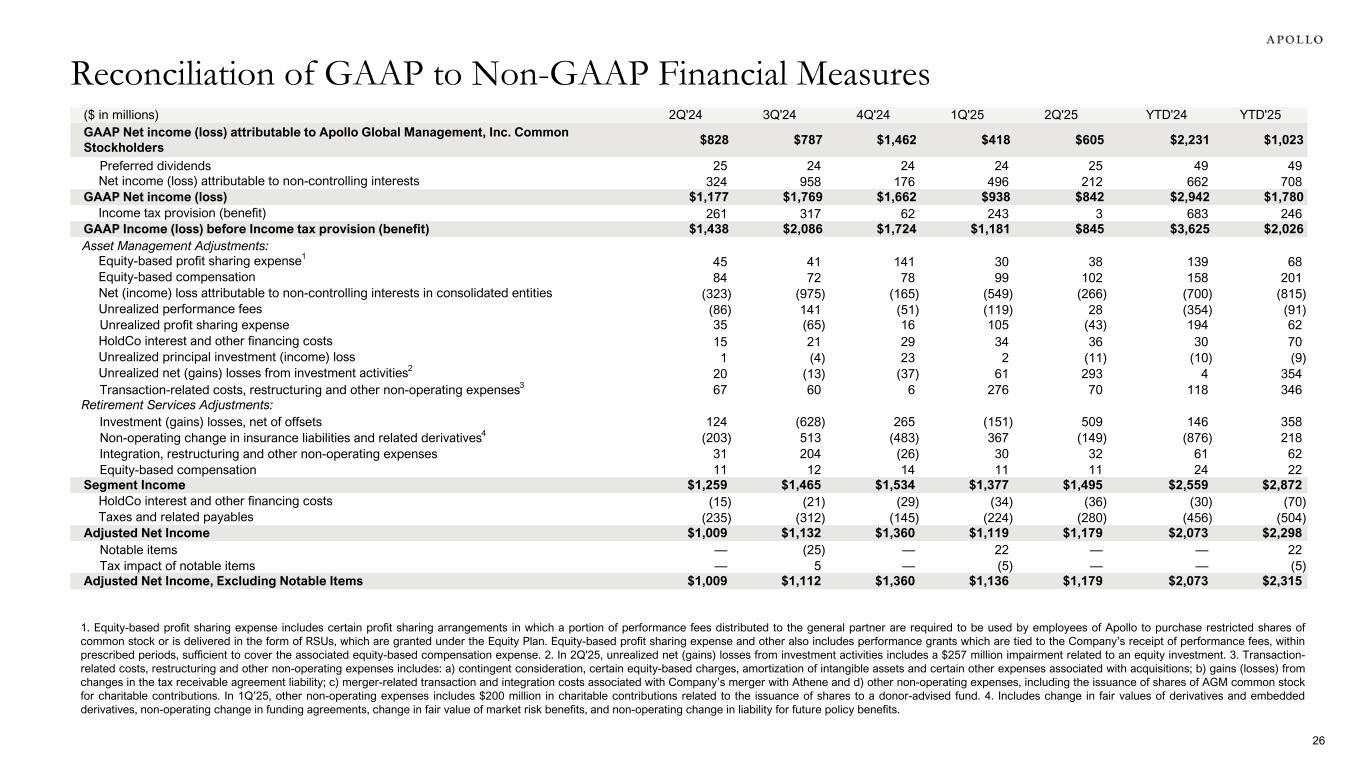

($ in millions) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 YTD'24 YTD'25 GAAP Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $828 $787 $1,462 $418 $605 $2,231 $1,023 Preferred dividends 25 24 24 24 25 49 49 Net income (loss) attributable to non-controlling interests 324 958 176 496 212 662 708 GAAP Net income (loss) $1,177 $1,769 $1,662 $938 $842 $2,942 $1,780 Income tax provision (benefit) 261 317 62 243 3 683 246 GAAP Income (loss) before Income tax provision (benefit) $1,438 $2,086 $1,724 $1,181 $845 $3,625 $2,026 Asset Management Adjustments: Equity-based profit sharing expense1 45 41 141 30 38 139 68 Equity-based compensation 84 72 78 99 102 158 201 Net (income) loss attributable to non-controlling interests in consolidated entities (323) (975) (165) (549) (266) (700) (815) Unrealized performance fees (86) 141 (51) (119) 28 (354) (91) Unrealized profit sharing expense 35 (65) 16 105 (43) 194 62 HoldCo interest and other financing costs 15 21 29 34 36 30 70 Unrealized principal investment (income) loss 1 (4) 23 2 (11) (10) (9) Unrealized net (gains) losses from investment activities2 20 (13) (37) 61 293 4 354 Transaction-related costs, restructuring and other non-operating expenses3 67 60 6 276 70 118 346 Retirement Services Adjustments: Investment (gains) losses, net of offsets 124 (628) 265 (151) 509 146 358 Non-operating change in insurance liabilities and related derivatives4 (203) 513 (483) 367 (149) (876) 218 Integration, restructuring and other non-operating expenses 31 204 (26) 30 32 61 62 Equity-based compensation 11 12 14 11 11 24 22 Segment Income $1,259 $1,465 $1,534 $1,377 $1,495 $2,559 $2,872 HoldCo interest and other financing costs (15) (21) (29) (34) (36) (30) (70) Taxes and related payables (235) (312) (145) (224) (280) (456) (504) Adjusted Net Income $1,009 $1,132 $1,360 $1,119 $1,179 $2,073 $2,298 Notable items — (25) — 22 — — 22 Tax impact of notable items — 5 — (5) — — (5) Adjusted Net Income, Excluding Notable Items $1,009 $1,112 $1,360 $1,136 $1,179 $2,073 $2,315 1. Equity-based profit sharing expense includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are required to be used by employees of Apollo to purchase restricted shares of common stock or is delivered in the form of RSUs, which are granted under the Equity Plan. Equity-based profit sharing expense and other also includes performance grants which are tied to the Company’s receipt of performance fees, within prescribed periods, sufficient to cover the associated equity-based compensation expense. 2. In 2Q'25, unrealized net (gains) losses from investment activities includes a $257 million impairment related to an equity investment. 3. Transaction- related costs, restructuring and other non-operating expenses includes: a) contingent consideration, certain equity-based charges, amortization of intangible assets and certain other expenses associated with acquisitions; b) gains (losses) from changes in the tax receivable agreement liability; c) merger-related transaction and integration costs associated with Company’s merger with Athene and d) other non-operating expenses, including the issuance of shares of AGM common stock for charitable contributions. In 1Q’25, other non-operating expenses includes $200 million in charitable contributions related to the issuance of shares to a donor-advised fund. 4. Includes change in fair values of derivatives and embedded derivatives, non-operating change in funding agreements, change in fair value of market risk benefits, and non-operating change in liability for future policy benefits. Reconciliation of GAAP to Non-GAAP Financial Measures 26

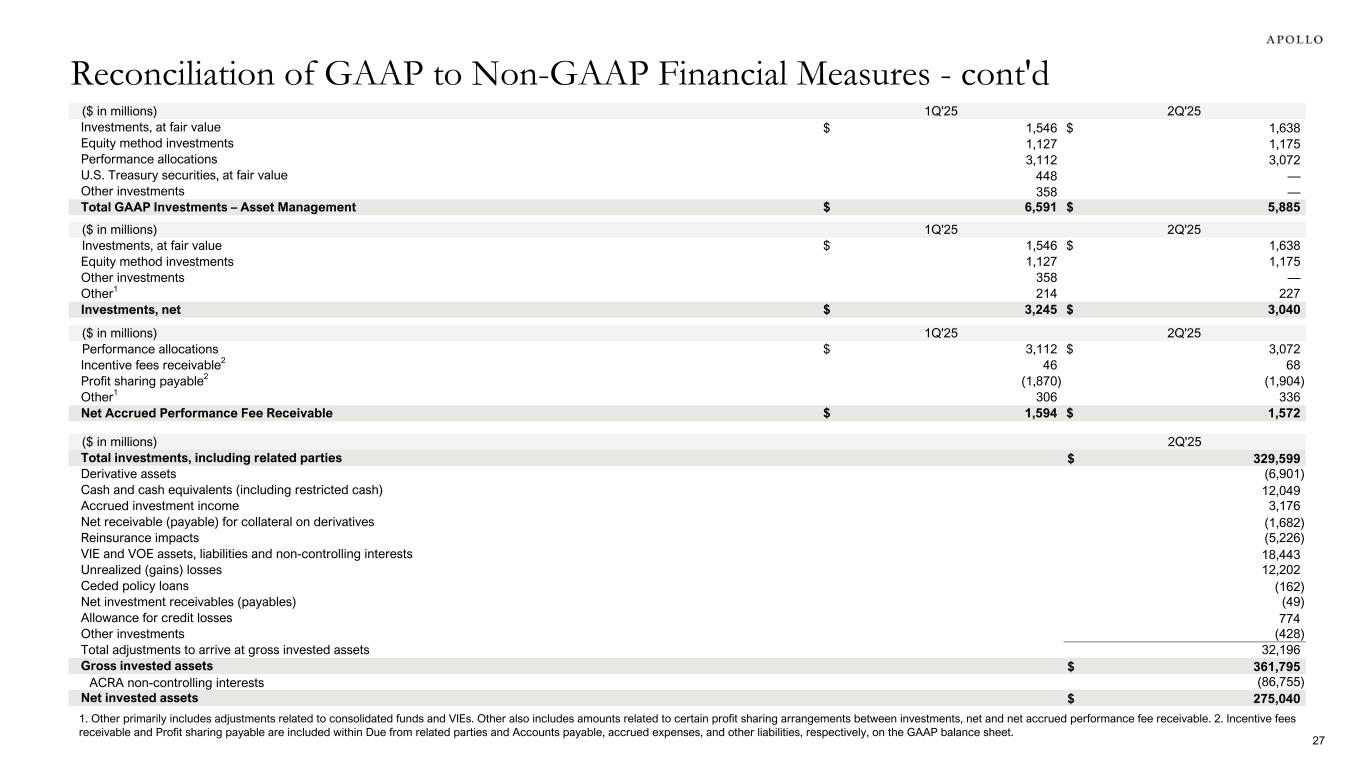

Reconciliation of GAAP to Non-GAAP Financial Measures - cont'd 27 ($ in millions) 1Q'25 2Q'25 Investments, at fair value $ 1,546 $ 1,638 Equity method investments 1,127 1,175 Other investments 358 — Other1 214 227 Investments, net $ 3,245 $ 3,040 ($ in millions) 1Q'25 2Q'25 Performance allocations $ 3,112 $ 3,072 Incentive fees receivable2 46 68 Profit sharing payable2 (1,870) (1,904) Other1 306 336 Net Accrued Performance Fee Receivable $ 1,594 $ 1,572 ($ in millions) 1Q'25 2Q'25 Investments, at fair value $ 1,546 $ 1,638 Equity method investments 1,127 1,175 Performance allocations 3,112 3,072 U.S. Treasury securities, at fair value 448 — Other investments 358 — Total GAAP Investments – Asset Management $ 6,591 $ 5,885 1. Other primarily includes adjustments related to consolidated funds and VIEs. Other also includes amounts related to certain profit sharing arrangements between investments, net and net accrued performance fee receivable. 2. Incentive fees receivable and Profit sharing payable are included within Due from related parties and Accounts payable, accrued expenses, and other liabilities, respectively, on the GAAP balance sheet. ($ in millions) 2Q'25 Total investments, including related parties $ 329,599 Derivative assets (6,901) Cash and cash equivalents (including restricted cash) 12,049 Accrued investment income 3,176 Net receivable (payable) for collateral on derivatives (1,682) Reinsurance impacts (5,226) VIE and VOE assets, liabilities and non-controlling interests 18,443 Unrealized (gains) losses 12,202 Ceded policy loans (162) Net investment receivables (payables) (49) Allowance for credit losses 774 Other investments (428) Total adjustments to arrive at gross invested assets 32,196 Gross invested assets $ 361,795 ACRA non-controlling interests (86,755) Net invested assets $ 275,040

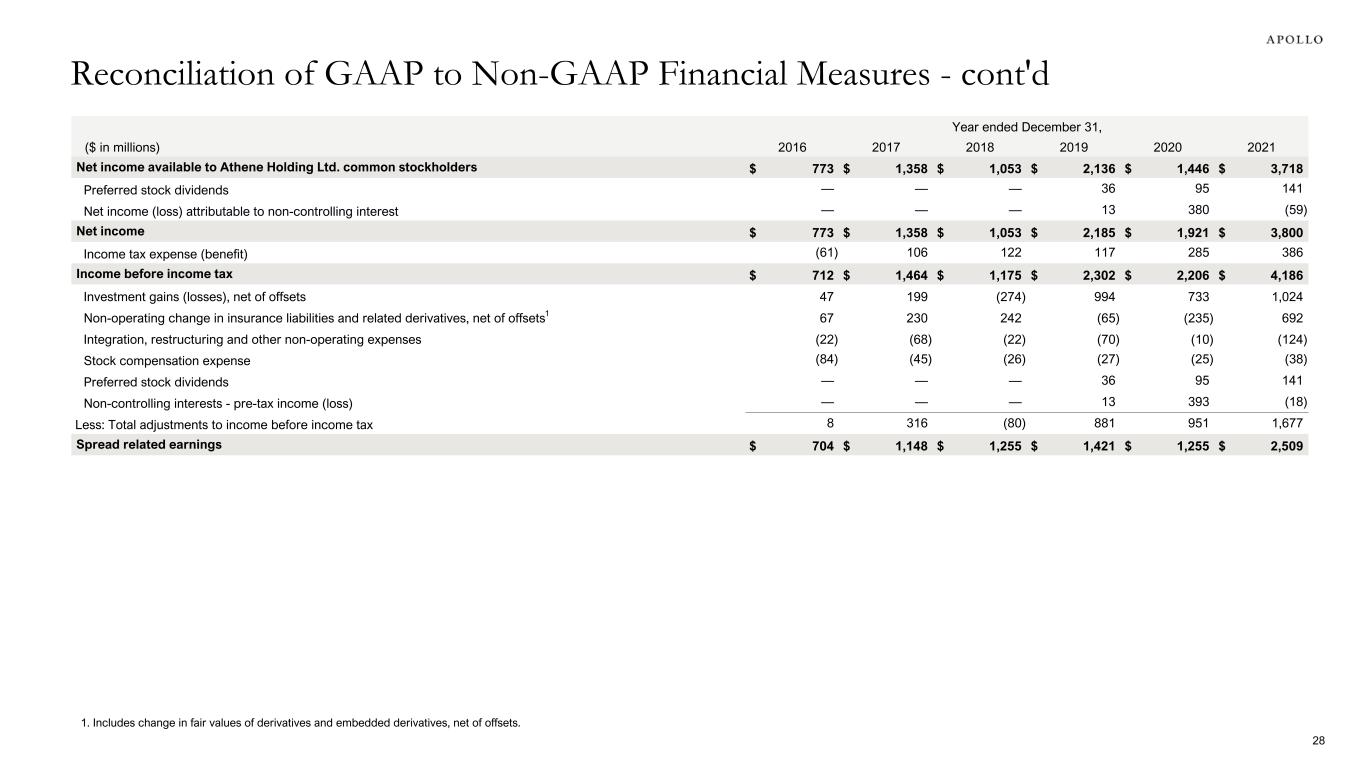

Year ended December 31, ($ in millions) 2016 2017 2018 2019 2020 2021 Net income available to Athene Holding Ltd. common stockholders $ 773 $ 1,358 $ 1,053 $ 2,136 $ 1,446 $ 3,718 Preferred stock dividends — — — 36 95 141 Net income (loss) attributable to non-controlling interest — — — 13 380 (59) Net income $ 773 $ 1,358 $ 1,053 $ 2,185 $ 1,921 $ 3,800 Income tax expense (benefit) (61) 106 122 117 285 386 Income before income tax $ 712 $ 1,464 $ 1,175 $ 2,302 $ 2,206 $ 4,186 Investment gains (losses), net of offsets 47 199 (274) 994 733 1,024 Non-operating change in insurance liabilities and related derivatives, net of offsets1 67 230 242 (65) (235) 692 Integration, restructuring and other non-operating expenses (22) (68) (22) (70) (10) (124) Stock compensation expense (84) (45) (26) (27) (25) (38) Preferred stock dividends — — — 36 95 141 Non-controlling interests - pre-tax income (loss) — — — 13 393 (18) Less: Total adjustments to income before income tax 8 316 (80) 881 951 1,677 Spread related earnings $ 704 $ 1,148 $ 1,255 $ 1,421 $ 1,255 $ 2,509 Reconciliation of GAAP to Non-GAAP Financial Measures - cont'd 28 1. Includes change in fair values of derivatives and embedded derivatives, net of offsets.

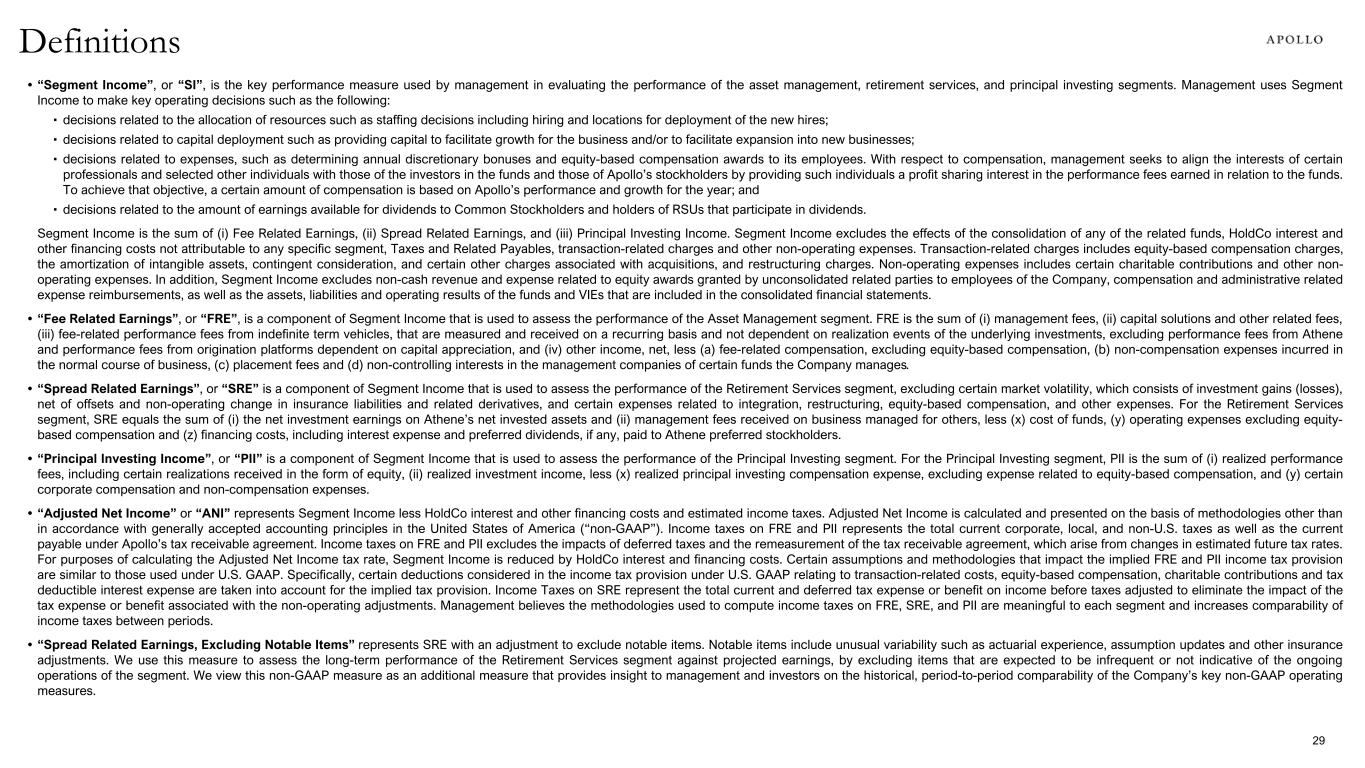

• “Segment Income”, or “SI”, is the key performance measure used by management in evaluating the performance of the asset management, retirement services, and principal investing segments. Management uses Segment Income to make key operating decisions such as the following: ▪ decisions related to the allocation of resources such as staffing decisions including hiring and locations for deployment of the new hires; ▪ decisions related to capital deployment such as providing capital to facilitate growth for the business and/or to facilitate expansion into new businesses; ▪ decisions related to expenses, such as determining annual discretionary bonuses and equity-based compensation awards to its employees. With respect to compensation, management seeks to align the interests of certain professionals and selected other individuals with those of the investors in the funds and those of Apollo’s stockholders by providing such individuals a profit sharing interest in the performance fees earned in relation to the funds. To achieve that objective, a certain amount of compensation is based on Apollo’s performance and growth for the year; and ▪ decisions related to the amount of earnings available for dividends to Common Stockholders and holders of RSUs that participate in dividends. Segment Income is the sum of (i) Fee Related Earnings, (ii) Spread Related Earnings, and (iii) Principal Investing Income. Segment Income excludes the effects of the consolidation of any of the related funds, HoldCo interest and other financing costs not attributable to any specific segment, Taxes and Related Payables, transaction-related charges and other non-operating expenses. Transaction-related charges includes equity-based compensation charges, the amortization of intangible assets, contingent consideration, and certain other charges associated with acquisitions, and restructuring charges. Non-operating expenses includes certain charitable contributions and other non- operating expenses. In addition, Segment Income excludes non-cash revenue and expense related to equity awards granted by unconsolidated related parties to employees of the Company, compensation and administrative related expense reimbursements, as well as the assets, liabilities and operating results of the funds and VIEs that are included in the consolidated financial statements. • “Fee Related Earnings”, or “FRE”, is a component of Segment Income that is used to assess the performance of the Asset Management segment. FRE is the sum of (i) management fees, (ii) capital solutions and other related fees, (iii) fee-related performance fees from indefinite term vehicles, that are measured and received on a recurring basis and not dependent on realization events of the underlying investments, excluding performance fees from Athene and performance fees from origination platforms dependent on capital appreciation, and (iv) other income, net, less (a) fee-related compensation, excluding equity-based compensation, (b) non-compensation expenses incurred in the normal course of business, (c) placement fees and (d) non-controlling interests in the management companies of certain funds the Company manages. • “Spread Related Earnings”, or “SRE” is a component of Segment Income that is used to assess the performance of the Retirement Services segment, excluding certain market volatility, which consists of investment gains (losses), net of offsets and non-operating change in insurance liabilities and related derivatives, and certain expenses related to integration, restructuring, equity-based compensation, and other expenses. For the Retirement Services segment, SRE equals the sum of (i) the net investment earnings on Athene’s net invested assets and (ii) management fees received on business managed for others, less (x) cost of funds, (y) operating expenses excluding equity- based compensation and (z) financing costs, including interest expense and preferred dividends, if any, paid to Athene preferred stockholders. • “Principal Investing Income”, or “PII” is a component of Segment Income that is used to assess the performance of the Principal Investing segment. For the Principal Investing segment, PII is the sum of (i) realized performance fees, including certain realizations received in the form of equity, (ii) realized investment income, less (x) realized principal investing compensation expense, excluding expense related to equity-based compensation, and (y) certain corporate compensation and non-compensation expenses. • “Adjusted Net Income” or “ANI” represents Segment Income less HoldCo interest and other financing costs and estimated income taxes. Adjusted Net Income is calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“non-GAAP”). Income taxes on FRE and PII represents the total current corporate, local, and non-U.S. taxes as well as the current payable under Apollo’s tax receivable agreement. Income taxes on FRE and PII excludes the impacts of deferred taxes and the remeasurement of the tax receivable agreement, which arise from changes in estimated future tax rates. For purposes of calculating the Adjusted Net Income tax rate, Segment Income is reduced by HoldCo interest and financing costs. Certain assumptions and methodologies that impact the implied FRE and PII income tax provision are similar to those used under U.S. GAAP. Specifically, certain deductions considered in the income tax provision under U.S. GAAP relating to transaction-related costs, equity-based compensation, charitable contributions and tax deductible interest expense are taken into account for the implied tax provision. Income Taxes on SRE represent the total current and deferred tax expense or benefit on income before taxes adjusted to eliminate the impact of the tax expense or benefit associated with the non-operating adjustments. Management believes the methodologies used to compute income taxes on FRE, SRE, and PII are meaningful to each segment and increases comparability of income taxes between periods. • “Spread Related Earnings, Excluding Notable Items” represents SRE with an adjustment to exclude notable items. Notable items include unusual variability such as actuarial experience, assumption updates and other insurance adjustments. We use this measure to assess the long-term performance of the Retirement Services segment against projected earnings, by excluding items that are expected to be infrequent or not indicative of the ongoing operations of the segment. We view this non-GAAP measure as an additional measure that provides insight to management and investors on the historical, period-to-period comparability of the Company’s key non-GAAP operating measures. Definitions 29

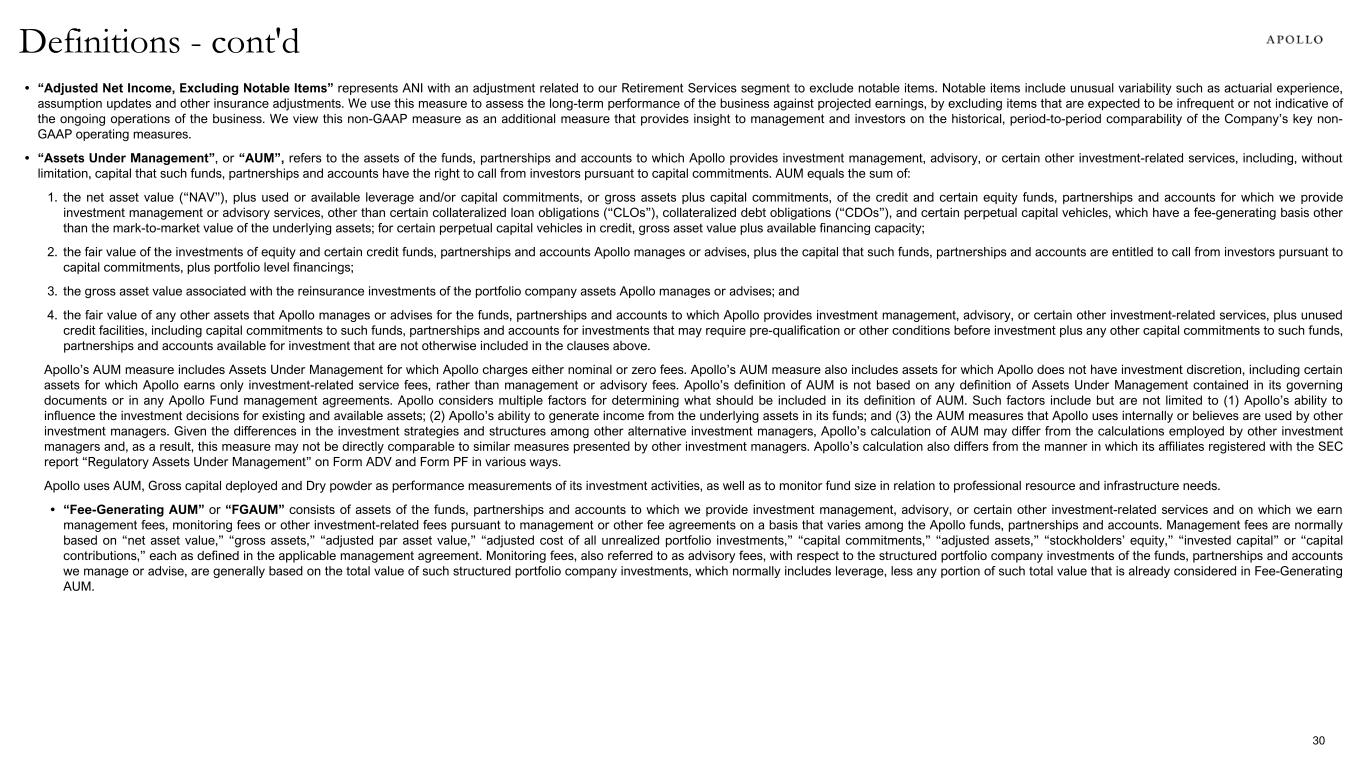

• “Adjusted Net Income, Excluding Notable Items” represents ANI with an adjustment related to our Retirement Services segment to exclude notable items. Notable items include unusual variability such as actuarial experience, assumption updates and other insurance adjustments. We use this measure to assess the long-term performance of the business against projected earnings, by excluding items that are expected to be infrequent or not indicative of the ongoing operations of the business. We view this non-GAAP measure as an additional measure that provides insight to management and investors on the historical, period-to-period comparability of the Company’s key non- GAAP operating measures. • “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. AUM equals the sum of: 1. the net asset value (“NAV”), plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the credit and certain equity funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in credit, gross asset value plus available financing capacity; 2. the fair value of the investments of equity and certain credit funds, partnerships and accounts Apollo manages or advises, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any Apollo Fund management agreements. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in its funds; and (3) the AUM measures that Apollo uses internally or believes are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM, Gross capital deployed and Dry powder as performance measurements of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. • “Fee-Generating AUM” or “FGAUM” consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM. Definitions - cont'd 30

• “Performance Fee-Eligible AUM” or “PFEAUM” refers to the AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following: • “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements; • “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is currently below its hurdle rate or preferred return; and • “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner. • “ACRA” refers to Athene Co-Invest Reinsurance Affiliate Holding Ltd, together with its subsidiaries (“ACRA 1”), and Athene Co-Invest Reinsurance Affiliate Holding 2 Ltd, together with its subsidiaries (“ACRA 2”). • “ADIP” refers to Apollo/Athene Dedicated Investment Program (“ADIP I”) and Apollo/Athene Dedicated Investment Program II (“ADIP II”), funds managed by Apollo including third-party capital that, through ACRA, invest alongside Athene in certain investments. • “Adjusted Net Income Shares Outstanding” or “ANI Shares Outstanding” consists of total shares of Common Stock outstanding, RSUs that participate in dividends, and shares of Common Stock assumed to be issuable upon the conversion of the shares of Mandatory Convertible Preferred Stock. • “Appreciation (depreciation)” of flagship private equity and hybrid value funds refers to gain (loss) and income for the periods presented on a total return basis before giving effect to fees and expenses. The performance percentage is determined by dividing (a) the change in the fair value of investments over the period presented, minus the change in invested capital over the period presented, plus the realized value for the period presented, by (b) the beginning unrealized value for the period presented plus the change in invested capital for the period presented. Returns over multiple periods are calculated by geometrically linking each period’s return over time. • “Athene” refers to Athene Holding Ltd. (together with its subsidiaries, “Athene”), a subsidiary of the Company and a leading retirement services company that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs, and to which Apollo, through its consolidated subsidiary Apollo Insurance Solutions Group LP (“ISG”), provides asset management and advisory services. • “Athora” refers to a strategic platform that acquires or reinsures blocks of insurance business in the German and broader European life insurance market (collectively, the “Athora Accounts”). • “Capital solutions fees and other, net” primarily includes transaction fees earned by Apollo Capital Solutions (“ACS”) related to underwriting, structuring, arrangement and placement of debt and equity securities, and syndication for funds managed by Apollo, portfolio companies of funds managed by Apollo, and third parties. Capital solutions fees and other, net also includes advisory fees for the ongoing monitoring of portfolio operations and directors' fees. These fees also include certain offsetting amounts including reductions in management fees related to a percentage of these fees recognized (“management fee offset”) and other additional revenue sharing arrangements. • “Cost of Funds” includes liability costs related to cost of crediting on both deferred annuities and institutional products as well as other liability costs, but does not include the proportionate share of the ACRA cost of funds associated with the non-controlling interests. While we believe cost of funds is a meaningful financial metric and enhances the understanding of the underlying profitability drivers of our retirement services business, it should not be used as a substitute for total benefits and expenses presented under U.S. GAAP. • “Dry Powder” represents the amount of capital available for investment or reinvestment subject to the provisions of the applicable limited partnership agreements or other governing agreements of the funds, partnerships and accounts we manage. Dry powder excludes uncalled commitments which can only be called for fund fees and expenses and commitments from perpetual capital vehicles. • “FRE Compensation Ratio” is calculated as fee-related compensation divided by fee-related revenues (which includes management fees, capital solutions fees and other, net, and fee-related performance fees). • “FRE Margin” is calculated as Fee Related Earnings divided by fee-related revenues (which includes management fees, capital solutions fees and other, net, and fee-related performance fees). • “Gross Capital Deployment” represents the gross capital that has been invested by the funds and accounts we manage during the relevant period, but excludes certain investment activities primarily related to hedging and cash management functions at the firm. Gross Capital Deployment is not reduced or netted down by sales or refinancings, and takes into account leverage used by the funds and accounts we manage in gaining exposure to the various investments that they have made. 31 Definitions - cont'd

• “Gross IRR” of accord series, ADIP funds and the European principal finance funds represents the annualized return of a fund based on the actual timing of all cumulative fund cash flows before management fees, performance fees allocated to the general partner and certain other expenses. Calculations may include certain investors that do not pay fees. The terminal value is the net asset value as of the reporting date. Non-U.S. dollar denominated (“USD”) fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. • “Gross IRR” of a traditional private equity or hybrid value fund represents the cumulative investment-related cash flows (i) for a given investment for the fund or funds which made such investment, and (ii) for a given fund, in the relevant fund itself (and not any one investor in the fund), in each case, on the basis of the actual timing of investment inflows and outflows (for unrealized investments assuming disposition on June 30, 2025 or other date specified) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, performance fees and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. • “Gross IRR” of infrastructure funds represents the cumulative investment-related cash flows in the fund itself (and not any one investor in the fund), on the basis of the actual timing of cash inflows and outflows (for unrealized investments assuming disposition on June 30, 2025 or other date specified) starting on the date that each investment closes, and the return is annualized and compounded before management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. Non- USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. • “Gross Return” for credit funds is the monthly or quarterly time-weighted return that is equal to the percentage change in the value of a fund’s portfolio, adjusted for all contributions and withdrawals, before the effects of management fees, incentive fees allocated to the general partner, and other fees and expenses. Returns for these categories are calculated for all funds and accounts in the respective strategies excluding assets managed for Athene, Athora, and certain other entities where Apollo manages or may manage a significant portion of the total company assets, or where Apollo only provides certain other investment-related services. Certain funds and accounts that have elected not to use fair-value accounting standards are also excluded due to the lack of returns. Returns for the Asset-Backed Finance strategy excludes CRE Debt and ACTC funds. Returns of CLOs represent the gross returns on assets. Returns over multiple periods are calculated by geometrically linking each period’s return over time. • “HoldCo” refers to Apollo Global Management, Inc. • “Inflows” within the Asset Management segment represents (i) at the individual strategy level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers, and (ii) on an aggregate basis, the sum of inflows across the credit and equity strategies. • “Mandatory Convertible Preferred Stock” refers to the 6.75% Series A Mandatory Convertible Preferred Stock of AGM. • “Net Invested Assets” represent the investments that directly back Athene's net reserve liabilities as well as surplus assets. Net invested assets is used in the computation of net investment earned rate, which is used to analyze the profitability of Athene’s investment portfolio. Net invested assets include (a) total investments on the statements of financial condition, with AFS securities, trading securities and mortgage loans at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE and VOE assets, liabilities and non-controlling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an adjustment for the allowance for credit losses. Net invested assets exclude the derivative collateral offsetting the related cash positions. Athene includes the underlying investments supporting its assumed funds withheld and modco agreements and excludes the underlying investments related to ceded reinsurance transactions in its net invested assets calculation in order to match the assets with the income received. Athene believes the adjustments for reinsurance provide a view of the assets for which it has economic exposure. Net invested assets include Athene’s proportionate share of ACRA investments, based on its economic ownership, but do not include the proportionate share of investments associated with the non-controlling interests. Net invested assets are averaged over the number of quarters in the relevant period to compute a net investment earned rate for such period. While Athene believes net invested assets is a meaningful financial metric and enhances the understanding of the underlying drivers of its investment portfolio, it should not be used as a substitute for total investments, including related parties, presented under U.S. GAAP. • “Net Investment Earned Rate” is computed as the income from Athene's net invested assets divided by the average net invested assets for the relevant period, presented on an annualized basis for interim periods. • “Net Investment Spread” measures Athene's investment performance plus its strategic capital management fees, less its total cost of funds. Net investment earned rate is a key measure of Athene's investment performance while cost of funds is a key measure of the cost of its policyholder benefits and liabilities. • “Net IRR” of accord series, ADIP funds and the European principal finance funds represents the annualized return of a fund after management fees, performance fees allocated to the general partner and certain other expenses, calculated on investors that pay such fees. The terminal value is the net asset value as of the reporting date. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. 32 Definitions - cont'd