10-Q: Quarterly report [Sections 13 or 15(d)]

Published on May 7, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2025 OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-41197

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) (Zip Code)

(212 ) 515-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | Emerging growth company | ||||||||||||||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of May 5, 2025, there were 571,494,234 shares of the registrant’s common stock outstanding.

| TABLE OF CONTENTS | ||||||||

| PART I | ||||||||

| ITEM 1. | ||||||||

| ITEM 1A. | ||||||||

| ITEM 2. | ||||||||

| ITEM 3. | ||||||||

| ITEM 4. | ||||||||

| PART II | ||||||||

| ITEM 1. | ||||||||

| ITEM 1A. | ||||||||

| ITEM 2. | ||||||||

| ITEM 3. | ||||||||

| ITEM 4. | ||||||||

| ITEM 5. | ||||||||

| ITEM 6. | ||||||||

2

Forward-Looking Statements

This report may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this report, the words “believe,” “anticipate,” “estimate,” “expect,” “intend,” “target” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to inflation, interest rate fluctuations and market conditions generally, international trade barriers, domestic or international political developments and other geopolitical events, including geopolitical tensions and hostilities, the impact of energy market dislocation, our ability to manage our growth, our ability to operate in highly competitive environments, the performance of the funds we manage, our ability to raise new funds, the variability of our revenues, earnings and cash flow, the accuracy of management’s assumptions and estimates, our dependence on certain key personnel, our use of leverage to finance our businesses and investments by the funds we manage, Athene’s ability to maintain or improve financial strength ratings, the impact of Athene’s reinsurers failing to meet their assumed obligations, Athene’s ability to manage its business in a highly regulated industry, changes in our regulatory environment and tax status, and litigation risks, among others. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in the Company’s annual report on Form 10-K filed with the United States Securities and Exchange Commission (“SEC”) on February 24, 2025 (the “2024 Annual Report”), as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other filings with the SEC. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Terms Used in This Report

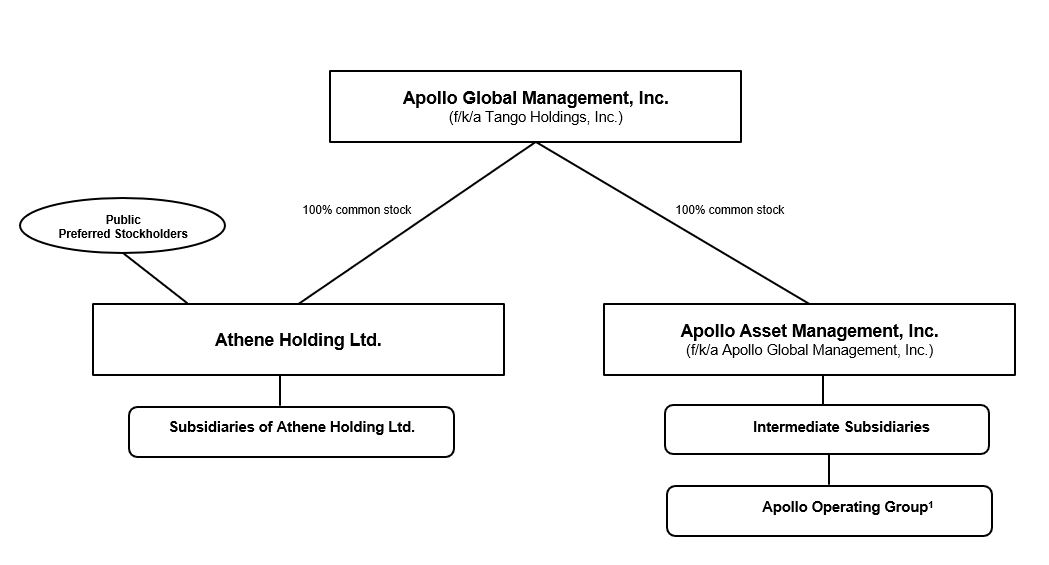

In this report, references to “Apollo,” “we,” “us,” “our,” and the “Company” refer to Apollo Global Management, Inc. (“AGM”) and its subsidiaries unless the context requires otherwise. References to “AGM common stock” or “common stock” of the Company refer to shares of common stock, par value $0.00001 per share, of AGM and “Mandatory Convertible Preferred Stock” refers to the 6.75% Series A Mandatory Convertible Preferred Stock of AGM.

The use of any defined term in this report to mean more than one entity, person, security or other item collectively is solely for convenience of reference and in no way implies that such entities, persons, securities or other items are one indistinguishable group. For example, notwithstanding the use of the defined terms “Apollo,” “we,” “us,” “our,” and the “Company” in this report to refer to AGM and its subsidiaries, each subsidiary of AGM is a standalone legal entity that is separate and distinct from AGM and any of its other subsidiaries. Any AGM entity (including any Athene entity) referenced herein is responsible for its own financial, contractual and legal obligations.

| Term or Acronym | Definition | ||||

| AAA | Apollo Aligned Alternatives Aggregator, LP | ||||

| AAIA | Athene Annuity and Life Company | ||||

| AAM | Apollo Asset Management, Inc. (f/k/a Apollo Global Management, Inc. prior to the Mergers.) | ||||

| AARe | Athene Annuity Re Ltd., a Bermuda reinsurance subsidiary | ||||

| ABS | Asset-backed securities | ||||

| Accord+ | Apollo Accord+ Fund, L.P., together with its parallel funds and alternative investment vehicles | ||||

| Accord+ II | Apollo Accord+ II Fund, L.P., together with its parallel funds and alternative investment vehicles | ||||

| Accord I | Apollo Accord Master Fund, L.P., together with its feeder funds | ||||

| Accord II | Apollo Accord Master Fund II, L.P., together with its feeder funds | ||||

| Accord III | Apollo Accord Master Fund III, L.P., together with its feeder funds | ||||

| Accord III B | Apollo Accord Master Fund III B, L.P., together with its feeder funds | ||||

| Accord IV | Apollo Accord Fund IV, L.P., together with its parallel funds and alternative investment vehicles | ||||

| Accord V | Apollo Accord Fund V, L.P., together with its parallel funds and alternative investment vehicles | ||||

3

| Accord VI | Apollo Accord Fund VI, L.P., together with its parallel funds and alternative investment vehicles | ||||

| Accord Funds | Accord I, Accord II, Accord III, Accord III B, Accord IV, Accord V and Accord VI | ||||

| Accord+ Funds | Accord+ and Accord+ II | ||||

| ACRA | ACRA 1 and ACRA 2 | ||||

| ACRA 1 | Athene Co-Invest Reinsurance Affiliate Holding Ltd., together with its subsidiaries | ||||

| ACRA 2 | Athene Co-Invest Reinsurance Affiliate Holding 2 Ltd., together with its subsidiaries | ||||

| ADCF | Apollo Diversified Credit Fund | ||||

| ADIP | ADIP I and ADIP II | ||||

| ADIP I | Apollo/Athene Dedicated Investment Program (A), L.P., together with its parallel funds, a series of funds managed by Apollo including third-party capital that, through ACRA 1, invests alongside Athene in certain investments | ||||

| ADIP II | Apollo/Athene Dedicated Investment Program II, L.P., a fund managed by Apollo including third-party capital that, through ACRA 2, invests alongside Athene in certain investments | ||||

| Adjusted Net Income Shares Outstanding, or ANI Shares Outstanding | Consists of total shares of common stock outstanding, RSUs that participate in dividends, and shares of common stock assumed to be issuable upon the conversion of the shares of Mandatory Convertible Preferred Stock | ||||

| ADREF | Apollo Diversified Real Estate Fund | ||||

| ADS | Apollo Debt Solutions BDC | ||||

| AFS | Available-for-sale | ||||

| AIOF I | Apollo Infra Equity US Fund, L.P. and Apollo Infra Equity International Fund, L.P., including their feeder funds and alternative investment vehicles | ||||

| AIOF II | Apollo Infrastructure Opportunities Fund II, L.P., together with its parallel funds and alternative investment vehicles | ||||

| AIOF III | Apollo Infrastructure Opportunities Fund III, L.P., together with its parallel funds and alternative investment vehicles | ||||

| ALRe | Athene Life Re Ltd., a Bermuda reinsurance subsidiary | ||||

| Alternative investments | Alternative investments, including investment funds and VIEs, adjusted for reinsurance impacts and to include Athene's proportionate share of ACRA alternative investments based on its economic ownership | ||||

| AMH | Apollo Management Holdings, L.P., a Delaware limited partnership, that is an indirect subsidiary of AGM | ||||

| ANRP I | Apollo Natural Resources Partners, L.P., together with its alternative investment vehicles | ||||

| ANRP II | Apollo Natural Resources Partners II, L.P., together with its alternative investment vehicles | ||||

| ANRP III | Apollo Natural Resources Partners III, L.P., together with its parallel funds and alternative investment vehicles | ||||

| AOCI | Accumulated other comprehensive income (loss) | ||||

| AOG Unit Payment | On December 31, 2021, holders of units of the Apollo Operating Group (“AOG Units”) (other than Athene and the Company) sold and transferred a portion of such AOG Units to APO Corp., a wholly-owned consolidated subsidiary of the Company, in exchange for an amount equal to $3.66 multiplied by the total number of AOG Units held by such holders immediately prior to such transaction. | ||||

| Apollo DAF | The donor-advised fund established by Apollo | ||||

| Apollo funds, our funds and references to the funds we manage | The funds (including the parallel funds and alternative investment vehicles of such funds), partnerships, accounts, including strategic investment accounts or “SIAs,” alternative asset companies and other entities for which subsidiaries of Apollo provide investment management or advisory services. | ||||

| Apollo Operating Group | (i) The entities through which we currently operate our asset management business and (ii) one or more entities formed for the purpose of, among other activities, holding certain of our gains or losses on our principal investments in the funds, which we refer to as our “principal investments.” | ||||

| ARI | Apollo Commercial Real Estate Finance, Inc. | ||||

| ARIS | Apollo Realty Income Solutions, Inc. | ||||

4

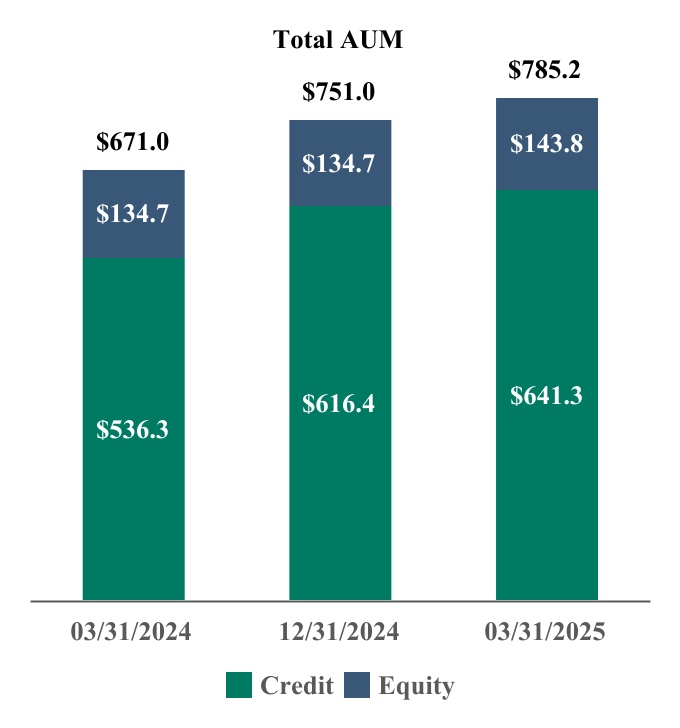

| Assets Under Management, or AUM | The assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of: 1. the NAV, plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the credit and certain equity funds, partnerships and accounts for which we provide investment management or advisory services, other than certain CLOs, CDOs, and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in credit, gross asset value plus available financing capacity; 2. the fair value of the investments of the equity and certain credit funds, partnerships and accounts Apollo manages or advises, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any management agreements of the funds Apollo manages. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in the funds it manages; and (3) the AUM measures that Apollo uses internally or believes are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM, Gross capital deployment and Dry powder as performance measurements of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. |

||||

| Athene | Athene Holding Ltd. (“Athene Holding” or “AHL”, together with its subsidiaries, “Athene”), a leading financial services company specializing in retirement services that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs, and to which Apollo, through its consolidated subsidiary ISG, provides asset management and advisory services. | ||||

| Athora | Athora Holding, Ltd. (“Athora Holding”, together with its subsidiaries, “Athora”), a strategic liabilities platform that acquires or reinsures blocks of insurance business in the German and broader European life insurance market (collectively, the “Athora Accounts”). Apollo, through ISGI, provides investment advisory services to Athora. Athora Non-Sub-Advised Assets includes the Athora assets which are managed by Apollo but not sub-advised by Apollo nor invested in Apollo funds or investment vehicles. Athora Sub-Advised includes assets which the Company explicitly sub-advises as well as those assets in the Athora Accounts which are invested directly in funds and investment vehicles Apollo manages. | ||||

| Atlas | An equity investment of AAA and refers to certain subsidiaries of Atlas Securitized Products Holdings LP | ||||

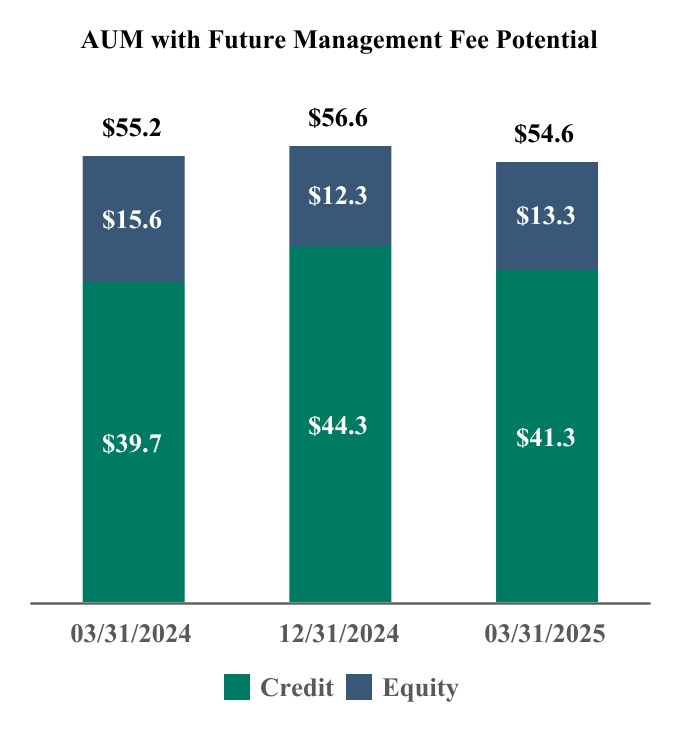

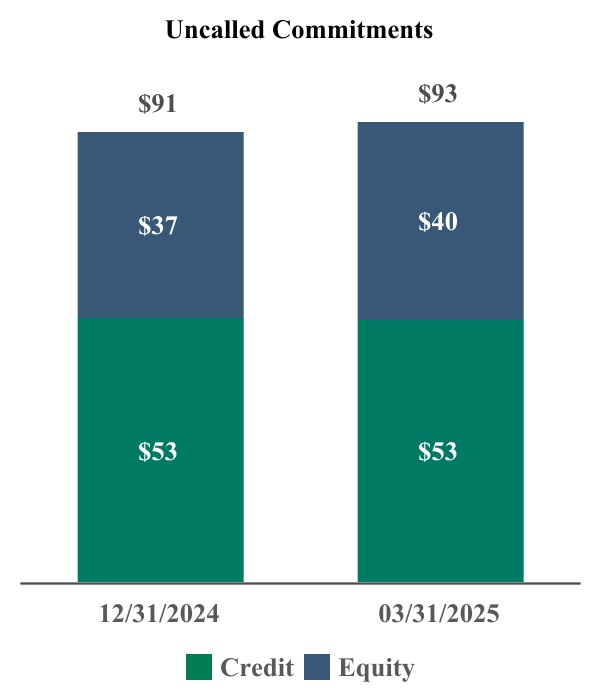

| AUM with Future Management Fee Potential | The committed uninvested capital portion of total AUM not currently earning management fees. The amount depends on the specific terms and conditions of each fund. | ||||

| AUSA | Athene USA Corporation | ||||

| Bermuda capital | The capital of Athene's non-U.S. reinsurance subsidiaries as reported in the Bermuda statutory financial statements and applying U.S. statutory accounting principles for policyholder reserve liabilities which are subjected to U.S. cash flow testing requirements, excluding certain items that do not exist under Athene's applicable Bermuda requirements, such as interest maintenance reserves. There are certain Bermuda statutory accounting differences, primarily (1) marking to market of inception date investment gains or losses relating to reinsurance transactions and (2) admission of certain deferred tax assets, that may from time to time result in material differences from the calculation of statutory capital under U.S. statutory accounting principles. | ||||

| Bermuda RBC | The risk-based capital ratio of Athene’s non-U.S. reinsurance subsidiaries calculated using Bermuda capital and applying NAIC risk-based capital factors on an aggregate basis, excluding U.S. subsidiaries which are included within Athene’s U.S. RBC Ratio. | ||||

| BMA | Bermuda Monetary Authority | ||||

5

| Capital solutions fees and other, net | Primarily includes transaction fees earned by our capital solutions business which we refer to as Apollo Capital Solutions (“ACS”) related to underwriting, structuring, arrangement and placement of debt and equity securities, and syndication for funds managed by Apollo, portfolio companies of funds managed by Apollo, and third parties. Capital solutions fees and other, net also includes advisory fees for the ongoing monitoring of portfolio operations and directors’ fees. These fees also include certain offsetting amounts, including reductions in management fees related to a percentage of these fees recognized (“management fee offset”) and other additional revenue sharing arrangements. |

||||

| CDO | Collateralized debt obligation | ||||

| Class A shares | Class A common stock, $0.00001 par value per share, of AAM prior to the Mergers. | ||||

| CLO | Collateralized loan obligation | ||||

| CMBS | Commercial mortgage-backed securities | ||||

| CML | Commercial mortgage loan | ||||

| Contributing Partners | Partners and their related parties (other than Messrs. Leon Black, Joshua Harris and Marc Rowan, our co-founders) who indirectly beneficially owned AOG units. | ||||

| Consolidated RBC | The consolidated risk-based capital ratio of Athene’s non-U.S. reinsurance and U.S. insurance subsidiaries calculated by aggregating U.S. RBC and Bermuda RBC. | ||||

| Cost of funds | Cost of funds includes liability costs related to cost of crediting on both deferred annuities, including, with respect to Athene's fixed indexed annuities, option costs, and institutional costs related to institutional products, as well as other liability costs, but does not include the proportionate share of the ACRA cost of funds associated with the non-controlling interests. Other liability costs include DAC, DSI and VOBA amortization, certain market risk benefit costs, the cost of liabilities on products other than deferred annuities and institutional products, premiums and certain product charges and other revenues. Athene includes the costs related to business added through assumed reinsurance transactions but excludes the costs on business related to ceded reinsurance transactions. Cost of funds is computed as the total liability costs divided by the average net invested assets for the relevant period, presented on an annualized basis for interim periods. | ||||

| Credit Strategies | Apollo Credit Strategies Master Fund Ltd., together with its feeder funds | ||||

| CS | Credit Suisse AG | ||||

| DAC | Deferred acquisition costs | ||||

| Deferred annuities | Fixed indexed annuities, annual reset annuities, multi-year guaranteed annuities and registered index-linked annuities | ||||

| Dry Powder | The amount of capital available for investment or reinvestment subject to the provisions of the applicable limited partnership agreements or other governing agreements of the funds, partnerships and accounts we manage. Dry powder excludes uncalled commitments which can only be called for fund fees and expenses and commitments from perpetual capital vehicles. | ||||

| DSI | Deferred sales inducement | ||||

| EPF Funds | Apollo European Principal Finance Fund, L.P., Apollo European Principal Finance Fund II (Dollar A), L.P., EPF III, and EPF IV, together with their parallel funds and alternative investment vehicles | ||||

| EPF III | Apollo European Principal Finance Fund III (Dollar A), L.P., together with its parallel funds and alternative investment vehicles | ||||

| EPF IV | Apollo European Principal Finance Fund IV (Dollar A), L.P., together with its parallel funds and alternative investment vehicles | ||||

| Equity Plan | Refers collectively to the Company’s 2019 Omnibus Equity Incentive Plan and the Company’s 2019 Omnibus Equity Incentive Plan for Estate Planning Vehicles. | ||||

| FABN | Funding agreement backed notes | ||||

| FASB | Financial Accounting Standards Board |

||||

| FCI Funds | Financial Credit Investment I, L.P., Financial Credit Investment II, L.P., together with its feeder funds, Financial Credit Investment Fund III L.P., and Financial Credit Investment IV, L.P., together with its feeder funds | ||||

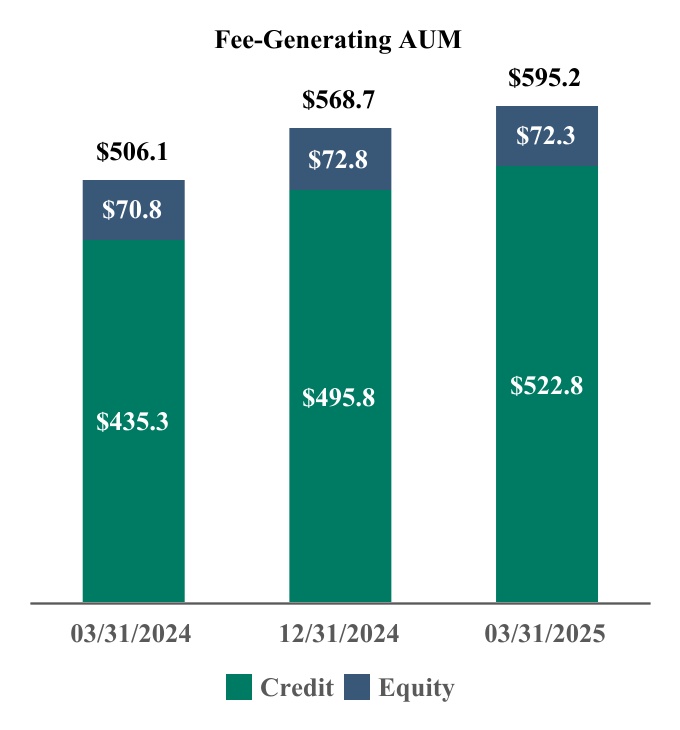

| Fee-Generating AUM | Fee-Generating AUM consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM. | ||||

6

| Fee Related Earnings, or FRE | Component of Segment Income that is used to assess the performance of the Asset Management segment. FRE is the sum of (i) management fees, (ii) capital solutions and other related fees, (iii) fee-related performance fees from indefinite term vehicles, that are measured and received on a recurring basis and not dependent on realization events of the underlying investments, excluding performance fees from Athene and performance fees from origination platforms dependent on capital appreciation, and (iv) other income, net, less (a) fee-related compensation, excluding equity-based compensation, (b) non-compensation expenses incurred in the normal course of business, (c) placement fees and (d) non-controlling interests in the management companies of certain funds the Company manages. |

||||

| FIA | Fixed indexed annuity, which is an insurance contract that earns interest at a crediting rate based on a specified index on a tax-deferred basis | ||||

| Fixed annuities | FIAs together with fixed rate annuities | ||||

| Former Managing Partners | Messrs. Leon Black, Joshua Harris and Marc Rowan collectively and, when used in reference to holdings of interests in Apollo or AP Professional Holdings, L.P. includes certain related parties of such individuals | ||||

| Freedom Parent Holdings | Freedom Parent Holdings, L.P. |

||||

| GDP | Gross Domestic Product | ||||

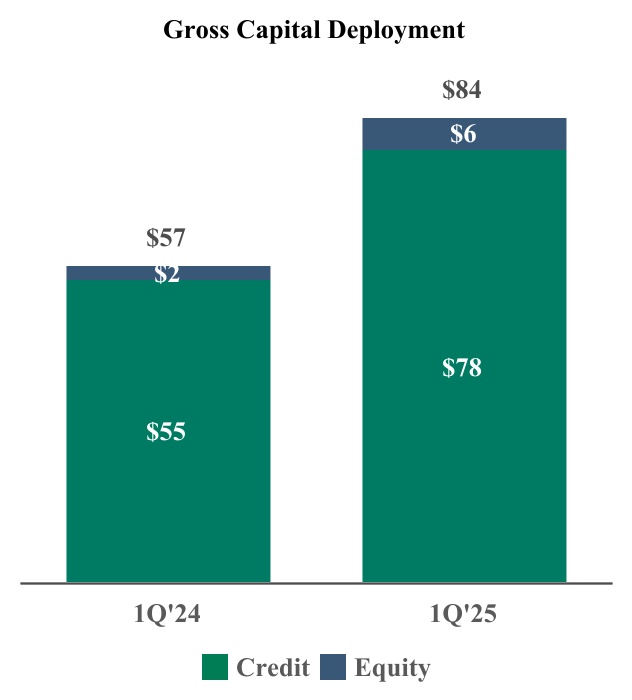

Gross capital deployment |

The gross capital that has been invested by the funds and accounts we manage during the relevant period, but excludes certain investment activities primarily related to hedging and cash management functions at the firm. Gross capital deployment is not reduced or netted down by sales or refinancings, and takes into account leverage used by the funds and accounts we manage in gaining exposure to the various investments that they have made. |

||||

| GLWB | Guaranteed lifetime withdrawal benefit | ||||

| GMDB | Guaranteed minimum death benefit | ||||

| Gross IRR of accord series, ADIP funds and the European principal finance funds | The annualized return of a fund based on the actual timing of all cumulative fund cash flows before management fees, performance fees allocated to the general partner and certain other expenses. Calculations may include certain investors that do not pay fees. The terminal value is the net asset value as of the reporting date. Non-U.S. dollar denominated (“USD”) fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. | ||||

| Gross IRR of a traditional private equity or hybrid value fund | The cumulative investment-related cash flows (i) for a given investment for the fund or funds which made such investment, and (ii) for a given fund, in the relevant fund itself (and not any one investor in the fund), in each case, on the basis of the actual timing of investment inflows and outflows (for unrealized investments assuming disposition on March 31, 2025 or other date specified) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, performance fees and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. | ||||

| Gross IRR of infrastructure funds | The cumulative investment-related cash flows in the fund itself (and not any one investor in the fund), on the basis of the actual timing of cash inflows and outflows (for unrealized investments assuming disposition on March 31, 2025 or other date specified) starting on the date that each investment closes, and the return is annualized and compounded before management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. | ||||

| HoldCo | Apollo Global Management, Inc. (f/k/a Tango Holdings, Inc.) | ||||

| HVF I | Apollo Hybrid Value Fund, L.P., together with its parallel funds and alternative investment vehicles | ||||

| HVF II | Apollo Hybrid Value Fund II, L.P., together with its parallel funds and alternative investment vehicles | ||||

| Inflows | (i) At the individual strategy level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers, and (ii) on an aggregate basis, the sum of inflows across the credit and equity investing strategies. | ||||

| IPO | Initial Public Offering | ||||

| ISG | Apollo Insurance Solutions Group LP | ||||

| ISGI | Refers collectively to Apollo Asset Management Europe LLP, a subsidiary of AAM (“AAME”) and Apollo Asset Management PC LLP, a wholly-owned subsidiary of AAME (“AAME PC”) |

||||

| Management Fee Offset | Under the terms of the limited partnership agreements for certain funds, the management fee payable by the funds may be subject to a reduction based on a certain percentage of such advisory and transaction fees, net of applicable broken deal costs. | ||||

| Market risk benefits | Guaranteed lifetime withdrawal benefits and guaranteed minimum death benefits | ||||

| Mergers | Completion of the previously announced merger transactions pursuant to the Merger Agreement | ||||

7

| Merger Agreement | The Agreement and Plan of Merger dated as of March 8, 2021 by and among AAM, AGM, AHL, Blue Merger Sub, Ltd., a Bermuda exempted company, and Green Merger Sub, Inc., a Delaware corporation. | ||||

| Merger Date | January 1, 2022 | ||||

| MFIC | MidCap Financial Investment Corporation (f/k/a Apollo Investment Corporation or “AINV”) | ||||

| MidCap Financial | MidCap FinCo LLC, together with its subsidiaries | ||||

| Modco | Modified coinsurance | ||||

| NAIC | National Association of Insurance Commissioners | ||||

| NAV | Net Asset Value | ||||

| Net invested assets | Represent the investments that directly back Athene's net reserve liabilities as well as surplus assets. Net invested assets include Athene’s (a) total investments on the condensed consolidated statements of financial condition, with available-for-sale securities, trading securities and mortgage loans at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE and VOE assets, liabilities and non-controlling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an adjustment for the allowance for credit losses. Net invested assets exclude the derivative collateral offsetting the related cash positions. Athene includes the investments supporting assumed funds withheld and modco agreements and excludes the investments related to ceded reinsurance transactions in order to match the assets with the income received. Net invested assets include Athene’s economic ownership of ACRA investments but do not include the investments associated with the non-controlling interests. | ||||

| Net investment earned rate | Computed as income from Athene’s net invested assets, excluding the proportionate share of the ACRA net investment income associated with the non-controlling interests, divided by the average net invested assets for the relevant period, presented on an annualized basis for interim periods. | ||||

| Net investment spread | Net investment spread measures Athene’s investment performance plus its strategic capital management fees less its total cost of funds, presented on an annualized basis for interim periods. | ||||

| Net IRR of accord series, ADIP funds and the European principal finance funds | The annualized return of a fund after management fees, performance fees allocated to the general partner and certain other expenses, calculated on investors that pay such fees. The terminal value is the net asset value as of the reporting date. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. | ||||

| Net IRR of a traditional private equity or the hybrid value funds | The gross IRR applicable to a fund, including returns for related parties which may not pay fees or performance fees, net of management fees, certain expenses (including interest incurred or earned by the fund itself) and realized performance fees all offset to the extent of interest income, and measures returns at the fund level on amounts that, if distributed, would be paid to investors of the fund. The timing of cash flows applicable to investments, management fees and certain expenses, may be adjusted for the usage of a fund’s subscription facility. To the extent that a fund exceeds all requirements detailed within the applicable fund agreement, the estimated unrealized value is adjusted such that a percentage of up to 20.0% of the unrealized gain is allocated to the general partner of such fund, thereby reducing the balance attributable to fund investors. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. | ||||

| Net IRR of infrastructure funds | The cumulative cash flows in a fund (and not any one investor in the fund), on the basis of the actual timing of cash inflows received from and outflows paid to investors of the fund (assuming the ending net asset value as of the reporting date or other date specified is paid to investors), excluding certain non-fee and non-performance fee bearing parties, and the return is annualized and compounded after management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns to investors of the fund as a whole. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. | ||||

| Net reserve liabilities | Represent Athene's policyholder liability obligations net of reinsurance and used to analyze the costs of its liabilities. Net reserve liabilities include Athene’s (a) interest sensitive contract liabilities, (b) future policy benefits, (c) net market risk benefits, (d) long-term repurchase obligations, (e) dividends payable to policyholders and (f) other policy claims and benefits, offset by reinsurance recoverable, excluding policy loans ceded. Net reserve liabilities include Athene’s economic ownership of ACRA reserve liabilities but do not include the reserve liabilities associated with the non-controlling interests. Net reserve liabilities are net of the ceded liabilities to third-party reinsurers as the costs of the liabilities are passed to such reinsurers and, therefore, Athene has no net economic exposure to such liabilities, assuming its reinsurance counterparties perform under the agreements. Net reserve liabilities include the underlying liabilities assumed through modco reinsurance agreements in order to match the liabilities with the expenses incurred. | ||||

8

| Non-Fee-Generating AUM | AUM that does not produce management fees or monitoring fees. This measure generally includes the following: (i) fair value above invested capital for those funds that earn management fees based on invested capital; (ii) net asset values related to general partner and co-investment interests; (iii) unused credit facilities; (iv) available commitments on those funds that generate management fees on invested capital; (v) structured portfolio company investments that do not generate monitoring fees; and (vi) the difference between gross asset and net asset value for those funds that earn management fees based on net asset value. |

||||

| NYC UBT | New York City Unincorporated Business Tax | ||||

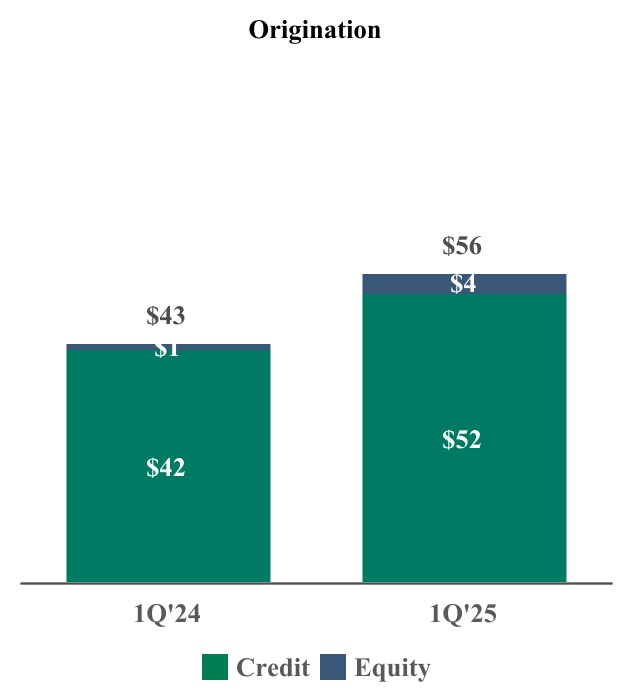

Origination |

Represents (i) capital that has been invested in new equity, debt or debt-like investments by Apollo's equity and credit strategies (whether purchased by funds and accounts managed by Apollo, or syndicated to third parties) where Apollo or one of Apollo's origination platforms has sourced, negotiated, or significantly affected the commercial terms of the investment; (ii) new capital pools formed by debt issuances, including CLOs; and (iii) net purchases of certain assets by the funds and accounts we manage that we consider to be private, illiquid, and hard to access assets and which the funds and accounts otherwise may not be able to meaningfully access. Origination generally excludes any issuance of debt or debt-like investments by the portfolio companies of the funds we manage. | ||||

| Other operating expenses within the Principal Investing segment | Expenses incurred in the normal course of business and includes allocations of non-compensation expenses related to managing the business. | ||||

| Other operating expenses within the Retirement Services segment | Expenses incurred in the normal course of business inclusive of compensation and non-compensation expenses, excluding the proportionate share of the ACRA operating expenses associated with the non-controlling interests. | ||||

| Payout annuities | Annuities with a current cash payment component, which consist primarily of single premium immediate annuities, supplemental contracts and structured settlements. | ||||

| PCD | Purchased Credit Deteriorated Investments | ||||

| Performance allocations, Performance fees, Performance revenues, Incentive fees and Incentive income | The interests granted to Apollo by a fund managed by Apollo that entitle Apollo to receive allocations, distributions or fees which are based on the performance of such fund or its underlying investments. | ||||

| Performance Fee-Eligible AUM | AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following: (i) “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements; (ii) “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently below its hurdle rate or preferred return; and (iii) “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner. |

||||

| Perpetual capital | Assets under management of certain vehicles with an indefinite duration, which assets may only be withdrawn under certain conditions or subject to certain limitations, including satisfying required hold periods or percentage limits on the amounts that may be redeemed over a particular period. The investment management, advisory or other service agreements with our perpetual capital vehicles may be terminated under certain circumstances. |

||||

| Principal Investing Income, or PII | Component of Segment Income that is used to assess the performance of the Principal Investing segment. For the Principal Investing segment, PII is the sum of (i) realized performance fees, including certain realizations received in the form of equity, (ii) realized investment income, less (x) realized principal investing compensation expense, excluding expense related to equity-based compensation, and (y) certain corporate compensation and non-compensation expenses. | ||||

| Principal investing compensation | Realized performance compensation, distributions related to investment income and dividends, and includes allocations of certain compensation expenses related to managing the business. | ||||

| Policy loan | A loan to a policyholder under the terms of, and which is secured by, a policyholder’s policy. | ||||

| Realized Value | All cash investment proceeds received by the relevant Apollo fund, including interest and dividends, but does not give effect to management fees, expenses, incentive compensation or performance fees to be paid by such Apollo fund. | ||||

| Redding Ridge | Redding Ridge Asset Management, LLC and its subsidiaries, which is a standalone, self-managed asset management business established in connection with risk retention rules that manages CLOs and retains the required risk retention interests. | ||||

| Redding Ridge Holdings | Redding Ridge Holdings LP | ||||

9

| Remaining Cost | The initial investment of a fund in a portfolio investment, reduced for any return of capital distributed to date on such portfolio investment | ||||

| RMBS | Residential mortgage-backed securities | ||||

| RML | Residential mortgage loan | ||||

| RSUs | Restricted share units | ||||

| SIA | Strategic investment account | ||||

| Spread Related Earnings, or SRE | Component of Segment Income that is used to assess the performance of the Retirement Services segment, excluding certain market volatility, which consists of investment gains (losses), net of offsets and non-operating change in insurance liabilities and related derivatives, and certain expenses related to integration, restructuring, equity-based compensation, and other expenses. For the Retirement Services segment, SRE equals the sum of (i) the net investment earnings on Athene’s net invested assets and (ii) management fees received on business managed for others, less (x) cost of funds, (y) operating expenses excluding equity-based compensation and (z) financing costs, including interest expense and preferred dividends, if any, paid to Athene preferred stockholders. |

||||

| Surplus assets | Assets in excess of Athene’s policyholder obligations, determined in accordance with the applicable domiciliary jurisdiction’s statutory accounting principles. | ||||

| Tax receivable agreement | The tax receivable agreement entered into by and among APO Corp., the Former Managing Partners, the Contributing Partners, and other parties thereto | ||||

| Total Invested Capital | The aggregate cash invested by the relevant Apollo fund and includes capitalized costs relating to investment activities, if any, but does not give effect to cash pending investment or available for reserves and excludes amounts, if any, invested on a financed basis with leverage facilities | ||||

| Total Value | The sum of the total Realized Value and Unrealized Value of investments | ||||

| Traditional private equity funds | Apollo Investment Fund I, L.P. (“Fund I”), AIF II, L.P. (“Fund II”), a mirrored investment account established to mirror Fund I and Fund II for investments in debt securities (“MIA”), Apollo Investment Fund III, L.P. (together with its parallel funds, “Fund III”), Apollo Investment Fund IV, L.P. (together with its parallel fund, “Fund IV”), Apollo Investment Fund V, L.P. (together with its parallel funds and alternative investment vehicles, “Fund V”), Apollo Investment Fund VI, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VI”), Apollo Investment Fund VII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VII”), Apollo Investment Fund VIII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VIII”), Apollo Investment Fund IX, L.P. (together with its parallel funds and alternative investment vehicles, “Fund IX”) and Apollo Investment Fund X, L.P. (together with its parallel funds and alternative investment vehicles, “Fund X”). |

||||

| U.S. GAAP | Generally accepted accounting principles in the United States of America | ||||

| U.S. RBC | The CAL RBC ratio for AAIA, Athene's parent U.S. insurance company | ||||

| U.S. Treasury | United States Department of the Treasury | ||||

| Unrealized Value | The fair value consistent with valuations determined in accordance with GAAP, for investments not yet realized and may include payments in kind, accrued interest and dividends receivable, if any, and before the effect of certain taxes. In addition, amounts include committed and funded amounts for certain investments. | ||||

| Venerable | Venerable Holdings, Inc., together with its subsidiaries | ||||

| VIAC | Venerable Insurance and Annuity Company | ||||

| VIE | Variable interest entity | ||||

| Vintage Year | The year in which a fund’s final capital raise occurred, or, for certain funds, the year of a fund’s effective date or the year in which a fund’s investment period commences pursuant to its governing agreements. | ||||

| VOBA | Value of business acquired | ||||

| VOE | Voting interest entity | ||||

| WACC | Weighted average cost of capital | ||||

10

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Index to Condensed Consolidated Financial Statements (unaudited)

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

| (In millions, except share data) | As of March 31, 2025 |

As of December 31, 2024 |

|||||||||

| Assets | |||||||||||

| Asset Management | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

| Investments | |||||||||||

| Assets of consolidated variable interest entities | |||||||||||

| Cash and cash equivalents | |||||||||||

| Investments | |||||||||||

| Other assets | |||||||||||

| Due from related parties | |||||||||||

| Goodwill | |||||||||||

| Other assets | |||||||||||

| Retirement Services | |||||||||||

| Cash and cash equivalents | |||||||||||

| Restricted cash and cash equivalents | |||||||||||

| Investments | |||||||||||

| Investments in related parties | |||||||||||

| Assets of consolidated variable interest entities | |||||||||||

| Cash and cash equivalents | |||||||||||

| Investments | |||||||||||

| Other assets | |||||||||||

| Reinsurance recoverable | |||||||||||

| Deferred acquisition costs, deferred sales inducements and value of business acquired | |||||||||||

| Goodwill | |||||||||||

| Other assets | |||||||||||

| Total Assets | $ |

|

$ |

|

|||||||

| (Continued) | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

12

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

| (In millions, except share data) | As of March 31, 2025 |

As of December 31, 2024 |

|||||||||

| Liabilities, Redeemable non-controlling interests and Equity | |||||||||||

| Liabilities | |||||||||||

| Asset Management | |||||||||||

| Accounts payable, accrued expenses, and other liabilities | $ | $ | |||||||||

| Due to related parties | |||||||||||

| Debt | |||||||||||

| Liabilities of consolidated variable interest entities | |||||||||||

| Other liabilities | |||||||||||

| Retirement Services | |||||||||||

| Interest sensitive contract liabilities | |||||||||||

| Future policy benefits | |||||||||||

| Market risk benefits | |||||||||||

| Debt | |||||||||||

| Payables for collateral on derivatives and securities to repurchase | |||||||||||

| Other liabilities | |||||||||||

| Liabilities of consolidated variable interest entities | |||||||||||

| Other liabilities | |||||||||||

| Total Liabilities |

|

|

|||||||||

Commitments and Contingencies (note 16) |

|||||||||||

| Redeemable non-controlling interests | |||||||||||

| Redeemable non-controlling interests | |||||||||||

| Equity | |||||||||||

Mandatory Convertible Preferred Stock, |

|||||||||||

Common Stock, $ |

|||||||||||

| Additional paid in capital | |||||||||||

| Retained earnings (accumulated deficit) | |||||||||||

| Accumulated other comprehensive income (loss) | ( |

( |

|||||||||

| Total Apollo Global Management, Inc. Stockholders’ Equity | |||||||||||

| Non-controlling interests | |||||||||||

| Total Equity |

|

|

|||||||||

| Total Liabilities, Redeemable non-controlling interests and Equity | $ |

|

$ |

|

|||||||

| (Concluded) | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

13

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three months ended March 31, | |||||||||||

| (In millions, except per share data) | 2025 | 2024 | |||||||||

| Revenues | |||||||||||

| Asset Management | |||||||||||

| Management fees | $ | $ | |||||||||

| Advisory and transaction fees, net | |||||||||||

| Investment income (loss) | |||||||||||

| Incentive fees | |||||||||||

| Retirement Services | |||||||||||

| Premiums | |||||||||||

| Product charges | |||||||||||

| Net investment income | |||||||||||

| Investment related gains (losses) | ( |

||||||||||

| Revenues of consolidated variable interest entities | |||||||||||

| Other revenues | |||||||||||

| Total Revenues | |||||||||||

| Expenses | |||||||||||

| Asset Management | |||||||||||

| Compensation and benefits | |||||||||||

| Interest expense | |||||||||||

| General, administrative and other | |||||||||||

| Retirement Services | |||||||||||

| Interest sensitive contract benefits | |||||||||||

| Future policy and other policy benefits | |||||||||||

| Market risk benefits remeasurement (gains) losses | ( |

||||||||||

| Amortization of deferred acquisition costs, deferred sales inducements and value of business acquired | |||||||||||

| Policy and other operating expenses | |||||||||||

| Total Expenses | |||||||||||

Other income (loss) – Asset Management |

|||||||||||

| Net gains (losses) from investment activities | ( |

||||||||||

| Net gains (losses) from investment activities of consolidated variable interest entities | |||||||||||

| Other income (loss), net | ( |

( |

|||||||||

| Total Other income (loss) | ( |

||||||||||

| Income (loss) before income tax (provision) benefit | |||||||||||

| Income tax (provision) benefit | ( |

( |

|||||||||

| Net income (loss) | |||||||||||

| Net (income) loss attributable to non-controlling interests | ( |

( |

|||||||||

| Net income (loss) attributable to Apollo Global Management, Inc. | |||||||||||

| Preferred stock dividends | ( |

( |

|||||||||

| Net income (loss) attributable to Apollo Global Management, Inc. common stockholders | $ | $ | |||||||||

| Earnings (loss) per share | |||||||||||

| Net income (loss) attributable to common stockholders - Basic | $ | $ | |||||||||

| Net income (loss) attributable to common stockholders - Diluted | $ | $ | |||||||||

| Weighted average shares outstanding – Basic | |||||||||||

| Weighted average shares outstanding – Diluted | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. |

|||||||||||

14

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| Three months ended March 31, | |||||||||||

| (In millions) | 2025 | 2024 | |||||||||

| Net income (loss) | $ | $ | |||||||||

| Other comprehensive income (loss), before tax | |||||||||||

| Unrealized investment gains (losses) on available-for-sale securities | ( |

||||||||||

| Unrealized gains (losses) on hedging instruments | ( |

||||||||||

| Remeasurement gains (losses) on future policy benefits related to discount rate | ( |

||||||||||

| Remeasurement gains (losses) on market risk benefits related to credit risk | ( |

||||||||||

| Foreign currency translation and other adjustments | ( |

||||||||||

| Other comprehensive income (loss), before tax | ( |

||||||||||

| Income tax expense (benefit) related to other comprehensive income (loss) | ( |

||||||||||

| Other comprehensive income (loss) | ( |

||||||||||

| Comprehensive income (loss) | |||||||||||

| Comprehensive (income) loss attributable to non-controlling interests | ( |

( |

|||||||||

| Comprehensive income (loss) attributable to Apollo Global Management, Inc. | $ | $ | |||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

15

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY (UNAUDITED)

For the three months ended March 31, 2024 |

|||||||||||||||||||||||||||||||||||||||||||||||

| Apollo Global Management, Inc. Stockholders | |||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except share data) | Common Stock | Series A Mandatory Convertible Preferred Stock |

Additional Paid in Capital |

Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Income (Loss) |

Total Apollo Global Management, Inc. Stockholders’ Equity (Deficit) |

Non-Controlling Interests |

Total Equity | |||||||||||||||||||||||||||||||||||||||

Balance at January 1, 2024 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||

| Other changes in equity of non-controlling interests | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Accretion of redeemable non-controlling interests | — | — | ( |

— | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Capital increase related to equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Dividends/distributions | — | ( |

— | ( |

— | ( |

( |

( |

|||||||||||||||||||||||||||||||||||||||

| Payments related to issuances of common stock for equity-based awards | — | ( |

— | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( |

— | ( |

— | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Stock option exercises | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | ( |

( |

( |

( |

|||||||||||||||||||||||||||||||||||||||

Balance at March 31, 2024 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||

For the three months ended March 31, 2025 |

|||||||||||||||||||||||||||||||||||||||||||||||

| Apollo Global Management, Inc. Stockholders | |||||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except share data) | Common Stock | Series A Mandatory Convertible Preferred Stock |

Additional Paid in Capital |

Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Income (Loss) |

Total Apollo Global Management, Inc. Stockholders’ Equity (Deficit) |

Non-Controlling

Interests

|

Total Equity |

|||||||||||||||||||||||||||||||||||||||

Balance at January 1, 2025 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||

| Consolidation/deconsolidation of VIEs | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Issuance of warrants | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other changes in equity of non-controlling interests | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Issuance of common stock related to equity transactions | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Accretion of redeemable non-controlling interests | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock to donor-advised fund | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Capital increase related to equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Dividends/distributions | — | ( |

— | ( |

— | ( |

( |

( |

|||||||||||||||||||||||||||||||||||||||

| Payments related to issuances of common stock for equity-based awards | — | ( |

— | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( |

— | ( |

— | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

Balance at March 31, 2025 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||||||||||||||||||||||||||||||||||||||

16

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Three months ended March 31, | |||||||||||

| (In millions) | 2025 | 2024 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net income (loss) | $ | $ | |||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||

| Equity-based compensation | |||||||||||

| Net investment income | ( |

( |

|||||||||

| Net recognized (gains) losses on investments and derivatives | ( |

||||||||||

| Depreciation and amortization | |||||||||||

| Net amortization (accretion) of net investment premiums, discount and other | ( |

( |

|||||||||

| Policy acquisition costs deferred | ( |

( |

|||||||||

| Other non-cash amounts included in net income (loss), net | |||||||||||

| Changes in consolidation | ( |

||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Purchases of investments by funds and VIEs | ( |

( |

|||||||||

| Proceeds from sale of investments by funds and VIEs | |||||||||||

| Interest sensitive contract liabilities | |||||||||||

| Future policy benefits, market risk benefits and reinsurance recoverable | ( |

( |

|||||||||

| Other assets and liabilities, net | ( |

( |

|||||||||

| Net cash provided by operating activities | $ | $ | |||||||||

| Cash Flows from Investing Activities | |||||||||||

| Purchases of investments and contributions to equity method investments | $ | ( |

$ | ( |

|||||||

| Purchases of available-for-sale securities | ( |

( |

|||||||||

| Purchases of mortgage loans | ( |

( |

|||||||||

| Purchases of investment funds | ( |

( |

|||||||||

| Purchases of U.S. Treasury securities | ( |

||||||||||

| Purchases of derivatives instruments and other investments | ( |

( |

|||||||||

| Sales, maturities and repayments of investments and distributions from equity method investments | |||||||||||

| Other investing activities, net | |||||||||||

| Net cash used in investing activities | $ | ( |

$ | ( |

|||||||

| Cash Flows from Financing Activities | |||||||||||

| Issuance of debt | $ | $ | |||||||||

| Repayment of debt | ( |

( |

|||||||||

| Repurchase of common stock | ( |

( |

|||||||||

| Common stock dividends | ( |

( |

|||||||||

| Preferred stock dividends | ( |

( |

|||||||||

| Distributions paid to non-controlling interests | ( |

( |

|||||||||

| Contributions from non-controlling interests | |||||||||||

| Deposits on investment-type policies and contracts | |||||||||||

| Withdrawals on investment-type policies and contracts | ( |

( |

|||||||||

| Net change in cash collateral posted for derivative transactions and securities to repurchase | ( |

||||||||||

| Other financing activities, net | ( |

( |

|||||||||

| Net cash provided by financing activities | $ | $ | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( |

||||||||||

| Net increase (decrease) in cash and cash equivalents, restricted cash and cash held at consolidated variable interest entities | ( |

||||||||||

| Cash and cash equivalents, restricted cash and cash equivalents, and cash and cash equivalents held at consolidated variable interest entities, beginning of period | |||||||||||

| Cash and cash equivalents, restricted cash and cash equivalents, and cash and cash equivalents held at consolidated variable interest entities, end of period | $ | $ | |||||||||

| (Continued) | |||||||||||

17

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Three months ended March 31, | |||||||||||

| (In millions) | 2025 | 2024 | |||||||||

| Supplemental Disclosure of Cash Flow Information | |||||||||||

| Cash paid for taxes | $ | $ | |||||||||

| Cash paid for interest | |||||||||||

| Non-cash transactions | |||||||||||

| Non-cash investing activities | |||||||||||

| Retirement Services | |||||||||||

| Investments received from settlements on reinsurance agreements | |||||||||||

| Non-cash financing activities | |||||||||||

| Asset Management and Other | |||||||||||

| Capital increases related to equity-based compensation | |||||||||||

| Issuance of warrants | |||||||||||

| Issuance of restricted shares | |||||||||||

| Issuance of common stock to donor-advise fund | |||||||||||

| Retirement Services | |||||||||||

| Deposits on investment-type policies and contracts through reinsurance agreements, net assumed (ceded) | ( |

( |

|||||||||

| Withdrawals on investment-type policies and contracts through reinsurance agreements, net assumed (ceded) | |||||||||||

| Distributions to non-controlling interests | |||||||||||

| Supplemental Disclosure of Cash Flow Information of Consolidated VIEs | |||||||||||

| Cash Flows from Operating Activities | |||||||||||

Purchases of investments - Asset Management

|

( |

( |

|||||||||

Proceeds from sale of investments - Asset Management

|

|||||||||||

| Cash Flows from Investing Activities | |||||||||||

Purchases of investments - Retirement Services

|

( |

( |

|||||||||

Proceeds from sale of investments - Retirement Services

|

|||||||||||

| Cash Flows from Financing Activities | |||||||||||

| Issuance of debt | |||||||||||

| Principal repayment of debt | ( |

( |

|||||||||

| Distributions paid to non-controlling interests | ( |

( |

|||||||||

| Contributions from non-controlling interests | |||||||||||

| Other financing activities, net | ( |

||||||||||

| Changes in Consolidation | |||||||||||

| Investments, at fair value | ( |

||||||||||

| Other assets | ( |

||||||||||

| Notes payable | ( |

||||||||||

| Other liabilities | |||||||||||

| Non-controlling interest | |||||||||||

| Equity | |||||||||||

Reconciliation of cash and cash equivalents, restricted cash and cash equivalents, and cash and cash equivalents held at consolidated variable interest entities to the condensed consolidated Statements of Financial Condition: |

|||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

| Cash and cash equivalents held at consolidated variable interest entities | |||||||||||

| Total cash and cash equivalents, restricted cash and cash equivalents, and cash and cash equivalents held at consolidated variable interest entities | $ | $ | |||||||||

| (Concluded) | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

18

APOLLO GLOBAL MANAGEMENT, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. Organization

Apollo Global Management, Inc. together with its consolidated subsidiaries (collectively, “Apollo” or the “Company”) is a high-growth, global alternative asset manager and a retirement services provider. Its asset management business focuses on two investing strategies: credit and equity. Through its asset management business, Apollo raises, invests and manages funds, accounts and other vehicles, on behalf of some of the world’s most prominent pension, endowment and sovereign wealth funds and insurance companies, as well as other institutional and individual investors. Apollo’s retirement services business is conducted by Athene, a leading financial services company that specializes in issuing, reinsuring and acquiring retirement savings products for the increasing number of individuals and institutions seeking to fund retirement needs.

Bridge Acquisition

On February 23, 2025, the Company entered into a definitive agreement for Apollo to acquire Bridge Investment Group Holdings Inc. (“Bridge”) in an all-stock transaction. The transaction is expected to close in the second half of 2025, subject to customary closing conditions and the receipt of regulatory approvals.

2. Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

The accompanying unaudited condensed consolidated financial statements are prepared in accordance with U.S. GAAP for interim financial information and the SEC’s rules and regulations for Form 10-Q and Article 10 of Regulation S-X. Certain disclosures included in the annual audited financial statements have been condensed or omitted as they are not required for interim financial statements under U.S. GAAP and the rules of the SEC. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These condensed consolidated financial statements should be read in conjunction with the annual audited financial statements included in the 2024 Annual Report.

The results of the Company and its subsidiaries are presented on a consolidated basis. Any ownership interest other than the Company’s interest in its subsidiaries is reflected as a non-controlling interest. Intercompany accounts and transactions have been eliminated. Management believes it has made all necessary adjustments (consisting only of normal recurring items) so that the condensed consolidated financial statements are presented fairly and that any estimates made are reasonable and prudent. Certain reclassifications have been made to previously reported amounts to conform to the current period’s presentation.

Deferred Revenue

Recently Issued Accounting Pronouncements

Income Taxes—Improvements to Income Tax Disclosures (ASU 2023-09)

In December 2023, the FASB made amendments to update disclosures on income taxes including rate reconciliation, income taxes paid, and certain amendments on disaggregation by federal, state, and foreign taxes, as relevant.

19

APOLLO GLOBAL MANAGEMENT, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

The guidance is mandatorily effective for the Company for annual periods beginning in 2025. The Company is currently evaluating the impact of the new standard on its consolidated financial statements.

Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (ASU 2024-03)

In November 2024, the FASB issued guidance that requires disaggregation of certain expense captions into specified categories in disclosures within the footnotes to the financial statements. The ASU requires tabular presentation of each relevant expense caption on the face of the income statement including employee compensation, depreciation, intangible asset amortization, and certain other expenses, when applicable.

The guidance is mandatorily effective for the Company in its 2027 annual report and in interim periods in 2028; early adoption is permitted. The Company is currently evaluating the impact of the new pronouncement on its consolidated financial statements.

Recently Adopted Accounting Pronouncements

Business Combinations – Joint Venture Formations (ASU 2023-05)

In August 2023, the FASB issued amendments to address how a joint venture initially recognizes and measures contributions received at its formation date. The amendments require a joint venture to apply a new basis of accounting upon formation and to initially recognize its assets and liabilities at fair value.

The Company adopted the guidance on January 1, 2025, and there was no impact on the condensed consolidated financial statements upon adoption.

Intangibles—Goodwill and Other—Crypto Assets: Accounting for and Disclosure of Crypto Assets (ASU 2023-08)

In December 2023, the FASB issued amendments on the accounting for and disclosure of crypto assets. The guidance requires assets that meet certain conditions be accounted for at fair value with changes in fair value recognized in net income. The ASU also requires disclosures about significant holdings, contractual sale restrictions, and changes during the reporting period.

The Company adopted the guidance on January 1, 2025, and there was no impact on the condensed consolidated financial statements upon adoption.

Compensation – Stock Compensation (ASU 2024-01)

In March 2024, the FASB issued guidance in ASU 2024-01 that clarifies how an entity determines whether it is required to account for profits interest awards (and similar awards) in accordance with ASC 718 or other guidance. The ASU provides specific examples on when a profits interest award should be accounted for as a share-based payment arrangement under ASC 718 or in a manner similar to a cash bonus or profit-sharing arrangement under ASC 710 or other ASC topics.

The Company adopted the guidance on January 1, 2025, and there was no impact on the condensed consolidated financial statements upon adoption.

Segment Reporting – Improvements to Reporting Segment Disclosures (ASU 2023-07)

In November 2023, the FASB issued guidance to incrementally add disclosures for public entities’ reporting segments including significant segment expenses and other segment items.

The Company adopted the guidance for the annual reporting period ended December 31, 2024, and in interim periods beginning January 1, 2025. Refer to Note 17, Segments, for the expanded disclosures.

20

APOLLO GLOBAL MANAGEMENT, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

3. Investments

The following table outlines the Company’s investments:

| (In millions) | March 31, 2025 | December 31, 2024 | |||||||||

| Asset Management | |||||||||||

| Investments, at fair value | $ | $ | |||||||||

| Equity method investments | |||||||||||

| Performance allocations | |||||||||||

| U.S. Treasury securities, at fair value | |||||||||||

| Other investments | |||||||||||

Total Investments – Asset Management |

|||||||||||

Retirement Services |

|||||||||||

| AFS securities, at fair value | $ | $ | |||||||||

| Trading securities, at fair value | |||||||||||

| Equity securities, at fair value | |||||||||||

| Mortgage loans, at fair value | |||||||||||

| Investment funds | |||||||||||

| Policy loans | |||||||||||

| Funds withheld at interest | |||||||||||

| Short-term investments | |||||||||||

| Other investments | |||||||||||

Total Investments, including related parties – Retirement Services |

|||||||||||

| Total Investments | $ | $ | |||||||||

Asset Management

Net Gains (Losses) from Investment Activities

The following outlines realized and net change in unrealized gains (losses) reported in net gains (losses) from investment activities:

| Three months ended March 31, | |||||||||||

| (In millions) | 2025 | 2024 | |||||||||

| Realized gains (losses) on sales of investments, net | $ | ( |

$ | ||||||||

| Net change in unrealized gains (losses) due to changes in fair value | ( |

||||||||||

| Net gains (losses) from investment activities | $ | ( |

$ | ||||||||

Performance Allocations

Performance allocations receivable is recorded within investments in the condensed consolidated statements of financial condition. The table below provides a roll forward of the performance allocations balance:

| (In millions) | Total | ||||

Performance allocations, January 1, 2025 |

$ | ||||

| Change in fair value of funds | |||||

| Fund distributions to the Company | ( |

||||

Performance allocations, March 31, 2025 |

$ | ||||

The change in fair value of funds excludes the general partner obligation to return previously distributed performance allocations, which is recorded in due to related parties in the condensed consolidated statements of financial condition.

21

APOLLO GLOBAL MANAGEMENT, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

The timing of the payment of performance allocations due to the general partner or investment manager varies depending on the terms of the applicable fund agreements. Generally, performance allocations with respect to the equity funds and certain credit funds we manage are payable and are distributed to the fund’s general partner upon realization of an investment if the fund’s cumulative returns are in excess of the preferred return.

Retirement Services

AFS Securities

The following table represents the amortized cost, allowance for credit losses, gross unrealized gains and losses and fair value of Athene’s AFS investments by asset type:

| March 31, 2025 | |||||||||||||||||||||||||||||

| (In millions) | Amortized Cost | Allowance for Credit Losses | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||||||

| AFS securities | |||||||||||||||||||||||||||||

| U.S. government and agencies | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||

| U.S. state, municipal and political subdivisions | ( |

||||||||||||||||||||||||||||

| Foreign governments | ( |

||||||||||||||||||||||||||||

| Corporate | ( |

( |

|||||||||||||||||||||||||||

| CLO | ( |

||||||||||||||||||||||||||||

| ABS | ( |

( |

|||||||||||||||||||||||||||

| CMBS | ( |

( |

|||||||||||||||||||||||||||

| RMBS | ( |

( |

|||||||||||||||||||||||||||

| Total AFS securities | ( |

( |

|||||||||||||||||||||||||||

| AFS securities – related parties | |||||||||||||||||||||||||||||

| Corporate | ( |

||||||||||||||||||||||||||||

| CLO | ( |

||||||||||||||||||||||||||||

| ABS | ( |

( |

|||||||||||||||||||||||||||