10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on August 9, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2022 OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-41197

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) (Zip Code)

(212 ) 515-3200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ||||||||||||||||||||

| ☐ | ||||||||||||||||||||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

As of August 5, 2022, there were 570,990,539 shares of the registrant’s common stock outstanding.

1

| TABLE OF CONTENTS | ||||||||

| Page | ||||||||

| PART I | ||||||||

| ITEM 1. | ||||||||

| ITEM 1A. | ||||||||

| ITEM 2. | ||||||||

| ITEM 3. | ||||||||

| ITEM 4. | ||||||||

| PART II | ||||||||

| ITEM 1. | ||||||||

| ITEM 1A. | ||||||||

| ITEM 2. | ||||||||

| ITEM 3. | ||||||||

| ITEM 4. | ||||||||

| ITEM 5. | ||||||||

| ITEM 6. | ||||||||

2

Forward-Looking Statements

This report may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this report, the words “believe,” “anticipate,” “estimate,” “expect,” “intend,” “target” and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to the impact of COVID-19, the impact of energy market dislocation, market conditions and interest rate fluctuations generally, our ability to manage our growth, our ability to operate in highly competitive environments, the performance of the funds we manage, our ability to raise new funds, the variability of our revenues, earnings and cash flow, our dependence on certain key personnel, the accuracy of management’s assumptions and estimates, our use of leverage to finance our businesses and investments by the funds we manage, Athene’s ability to maintain or improve financial strength ratings, the impact of Athene’s reinsurers failing to meet their assumed obligations, Athene’s ability to manage its business in a highly regulated industry, changes in our regulatory environment and tax status, litigation risks and our ability to recognize the benefits expected to be derived from the merger of Apollo with Athene, among others. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in our quarterly report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on May 10, 2022, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Terms Used in This Report

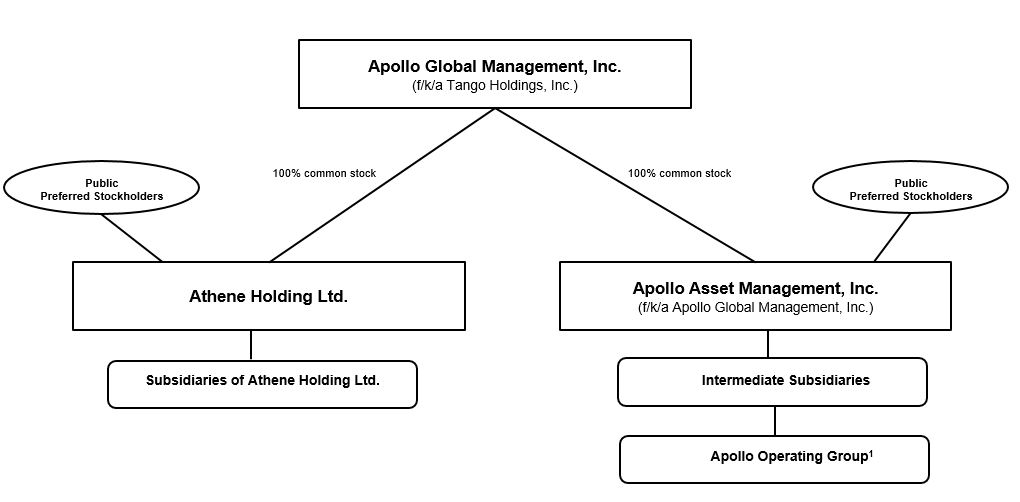

In this report, references to “Apollo,” “we,” “us,” “our,” and the “Company” for periods (i) on or before December 31, 2021 refer to Apollo Asset Management, Inc. (f/k/a Apollo Global Management, Inc.) (“AAM”) and its subsidiaries unless the context requires otherwise and (ii) subsequent to December 31, 2021, refer to Apollo Global Management, Inc. (f/k/a Tango Holdings, Inc.) (“AGM”) and its subsidiaries unless the context requires otherwise. Moreover, references to “Class A shares” refers to the Class A common stock, $0.00001 par value per share, of AAM prior to the Mergers; “Class B share” refers to the Class B common stock, $0.00001 par value per share, of AAM prior to the Mergers; “Class C share” refers to the Class C common stock, $0.00001 par value per share, of AAM prior to the Mergers; “Series A Preferred shares” refers to the 6.375% Series A preferred stock of AAM both prior to and following the Mergers; “Series B Preferred shares” refers to the 6.375% Series B preferred stock of AAM both prior to and following the Mergers; and “Preferred shares” refers to the Series A Preferred shares and the Series B Preferred shares, collectively, both prior to and following the Mergers. In addition, for periods on or before December 31, 2021, references to “AGM common stock” or “common stock” of the Company refer to Class A shares unless the context otherwise requires, and for periods subsequent to December 31, 2021 refer to shares of common stock, par value $0.00001 per share, of AGM.

The use of any defined term in this report to mean more than one entity, person, security or other item collectively is solely for convenience of reference and in no way implies that such entities, persons, securities or other items are one indistinguishable group. For example, notwithstanding the use of the defined terms "Apollo," "we", “us”, "our" and the “Company” in this report to refer to AGM and its subsidiaries, each subsidiary of AGM is a standalone legal entity that is separate and distinct from AGM and any of its other subsidiaries. Any AGM entity (including any Athene entity) referenced herein is responsible for its own financial, contractual and legal obligations.

| Term or Acronym | Definition | ||||

| AADE | Athene Annuity & Life Assurance Company | ||||

| AAIA | Athene Annuity and Life Company | ||||

| AAME | Apollo Asset Management Europe LLP, a subsidiary of Apollo | ||||

| AAME PC | Apollo Asset Management PC LLP, a wholly-owned subsidiary of AAME | ||||

| AARe | Athene Annuity Re Ltd., a Bermuda reinsurance subsidiary | ||||

| ABS | Asset-backed securities | ||||

| Accord+ | Apollo Accord+ Fund, L.P. | ||||

| Accord I | Apollo Accord Fund, L.P. | ||||

3

| Accord II | Apollo Accord Fund II, L.P. | ||||

| Accord III | Apollo Accord Fund III, L.P. | ||||

| Accord III B | Apollo Accord Fund III B, L.P. | ||||

| Accord IV | Apollo Accord Fund IV, L.P. | ||||

| Accord V | Apollo Accord Fund V, L.P. | ||||

| ACRA | Athene Co-Invest Reinsurance Affiliate Holding Ltd., together with its subsidiaries | ||||

| ADIP | Apollo/Athene Dedicated Investment Program, a fund managed by Apollo including third-party capital that invests alongside Athene in certain investments | ||||

| ADS | Apollo Debt Solutions BDC, a non-traded business development company managed by Apollo | ||||

| Advisory | The certain assets advised by ISGI | ||||

| AINV | Apollo Investment Corporation | ||||

| AIOF I | Apollo Infrastructure Opportunities Fund, L.P. | ||||

| AIOF II | Apollo Infrastructure Opportunities Fund II, L.P. | ||||

| ALRe | Athene Life Re Ltd., a Bermuda reinsurance subsidiary | ||||

| Alternative investments | Alternative investments, including investment funds, CLO equity positions and certain other debt instruments considered to be equity-like | ||||

| AmeriHome | AmeriHome Mortgage Company, LLC | ||||

| AMH | Apollo Management Holdings, L.P., a Delaware limited partnership, that is an indirect subsidiary of AGM. | ||||

| ANRP I | Apollo Natural Resources Partners, L.P., together with its parallel funds and alternative investment vehicles | ||||

| ANRP II | Apollo Natural Resources Partners II, L.P., together with its parallel funds and alternative investment vehicles | ||||

| ANRP III | Apollo Natural Resources Partners III, L.P., together with its parallel funds and alternative investment vehicles | ||||

| AOCI | Accumulated other comprehensive income (loss) | ||||

| AOG Unit Payment | On December 31, 2021, holders of units of the Apollo Operating Group (“AOG Units”) (other than Athene and the Company) sold and transferred a portion of such AOG Units to APO Corp., a wholly-owned consolidated subsidiary of the Company, in exchange for an amount equal to $3.66 multiplied by the total number of AOG Units held by such holders immediately prior to such transaction. | ||||

| Apollo funds, our funds and references to the funds we manage | The funds (including the parallel funds and alternative investment vehicles of such funds), partnerships, accounts, including strategic investment accounts or “SIAs,” alternative asset companies and other entities for which subsidiaries of Apollo provide investment management or advisory services | ||||

| Apollo Operating Group | (i) The entities through which we currently operate our asset management business and (ii) one or more entities formed for the purpose of, among other activities, holding certain of our gains or losses on our principal investments in the funds, which we refer to as our “principal investments” | ||||

| Apollo Origination Partners | Apollo Origination Partnership, L.P. | ||||

| APSG I | Apollo Strategic Growth Capital | ||||

| APSG II | Apollo Strategic Growth Capital II | ||||

| ARI | Apollo Commercial Real Estate Finance, Inc. | ||||

| Asia RE Fund I | Apollo Asia Real Estate Fund I, L.P., including co-investment vehicles | ||||

| Asia RE Fund II | Apollo Asia Real Estate Fund II, L.P., including co-investment vehicles | ||||

4

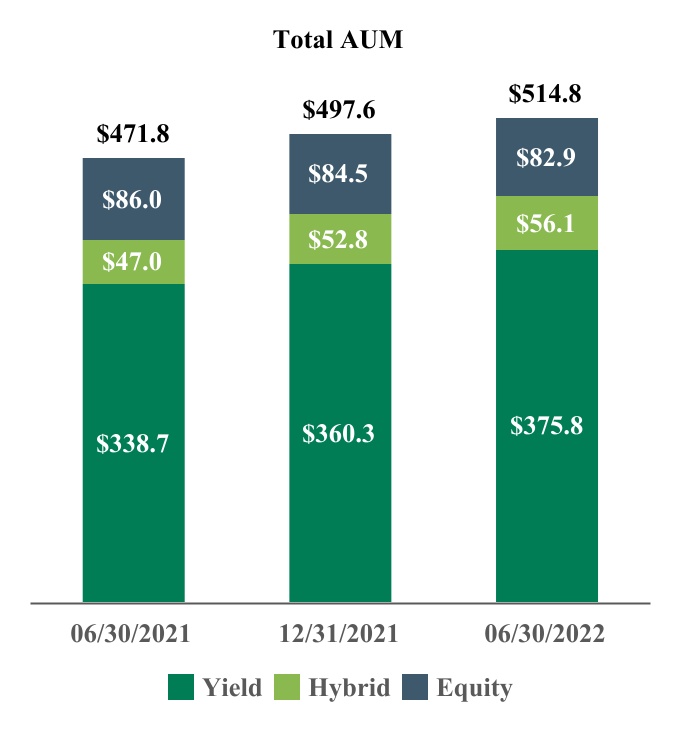

| Assets Under Management, or AUM | The assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of: 1. the NAV, plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than CLOs, CDOs, and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. the fair value of the investments of the equity and certain hybrid funds, partnerships and accounts Apollo manages or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any management agreements of the funds Apollo manages. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in the funds it manages; and (3) the AUM measures that Apollo uses internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM, Gross capital deployed and Dry powder as performance measurements of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. |

||||

| Athene | Athene Holding Ltd. (“Athene Holding” or “AHL” together with its subsidiaries), a leading financial services company specializing in retirement services that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs, and to which Apollo, through its consolidated subsidiary ISG, provides asset management and advisory services. | ||||

| Athora | Athora Holding, Ltd. (“Athora Holding”, together with its subsidiaries), a strategic platform that acquires or reinsures blocks of insurance business in the German and broader European life insurance market (collectively, the “Athora Accounts”). The Company, through ISGI, provides investment advisory services to Athora. Athora Non-Sub-Advised Assets includes the Athora assets which are managed by Apollo but not sub-advised by Apollo nor invested in Apollo funds or investment vehicles. Athora Sub-Advised includes assets which the Company explicitly sub-advises as well as those assets in the Athora Accounts which are invested directly in funds and investment vehicles Apollo manages. | ||||

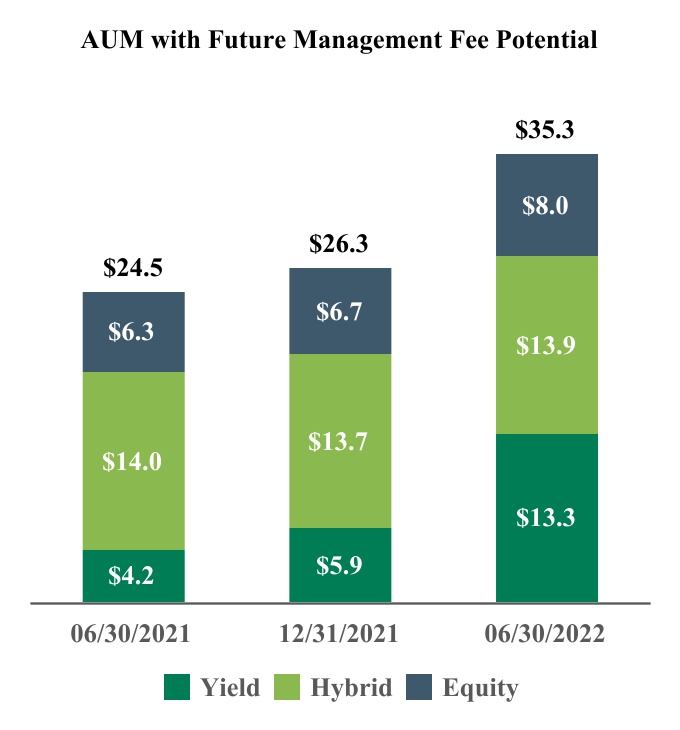

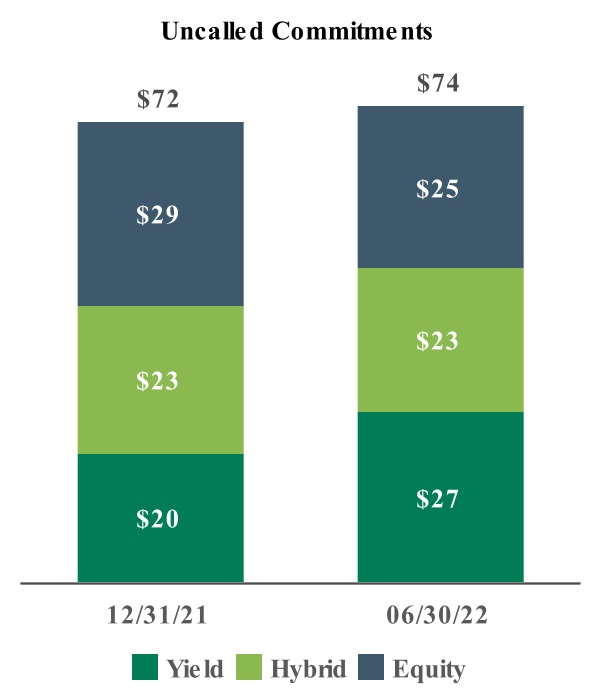

| AUM with Future Management Fee Potential | The committed uninvested capital portion of total AUM not currently earning management fees. The amount depends on the specific terms and conditions of each fund. | ||||

| AUSA | Athene USA Corporation | ||||

| BMA | Bermuda Monetary Authority | ||||

| BSCR | Bermuda Solvency Capital Requirement | ||||

| CDI | California Department of Insurance | ||||

| CDO | Collateralized debt obligation | ||||

| CLO | Collateralized loan obligation | ||||

| CMBS | Commercial mortgage-backed securities | ||||

| CML | Commercial mortgage loans | ||||

| Contributing Partners | Partners and their related parties (other than Messrs. Leon Black, Joshua Harris and Marc Rowan, our co-founders) who indirectly beneficially owned Apollo Operating Group units. | ||||

| Cost of crediting | The interest credited to the policyholders on our fixed annuities, including, with respect to our fixed indexed annuities, option costs, as well as institutional costs related to institutional products, presented on an annualized basis for interim periods | ||||

5

| Cost of funds | Cost of funds includes liability costs related to cost of crediting on both deferred annuities and institutional products, as well as other liability costs. Cost of funds is computed as the total liability costs divided by the average net invested assets for the relevant period and is presented on an annualized basis for interim periods. | ||||

| DAC | Deferred acquisition costs | ||||

| Deferred annuities | Fixed indexed annuities, annual reset annuities, multi-year guaranteed annuities and registered index-linked annuities | ||||

| Dry Powder | The amount of capital available for investment or reinvestment subject to the provisions of the applicable limited partnership agreements or other governing agreements of the funds, partnerships and accounts we manage. Dry powder excludes uncalled commitments which can only be called for fund fees and expenses and commitments from Perpetual Capital Vehicles. | ||||

| DSI | Deferred sales inducement | ||||

| ECR | Enhanced Capital Requirement | ||||

| EPF I | Apollo European Principal Finance Fund I | ||||

| EPF II | Apollo European Principal Finance Fund II | ||||

| EPF III | Apollo European Principal Finance Fund III | ||||

| EPF IV | Apollo European Principal Finance Fund IV | ||||

| Equity Plan | Refers collectively to the Company’s 2019 Omnibus Equity Incentive Plan and the Company’s 2019 Omnibus Equity Incentive Plan for Estate Planning Vehicles. | ||||

| FABN | Funding agreement backed notes | ||||

| FABR | Funding agreement backed repurchase agreement | ||||

| FCI I | Financial Credit Investment Fund I | ||||

| FCI II | Financial Credit Investment Fund II | ||||

| FCI III | Financial Credit Investment Fund III | ||||

| FCI IV | Financial Credit Investment Fund IV | ||||

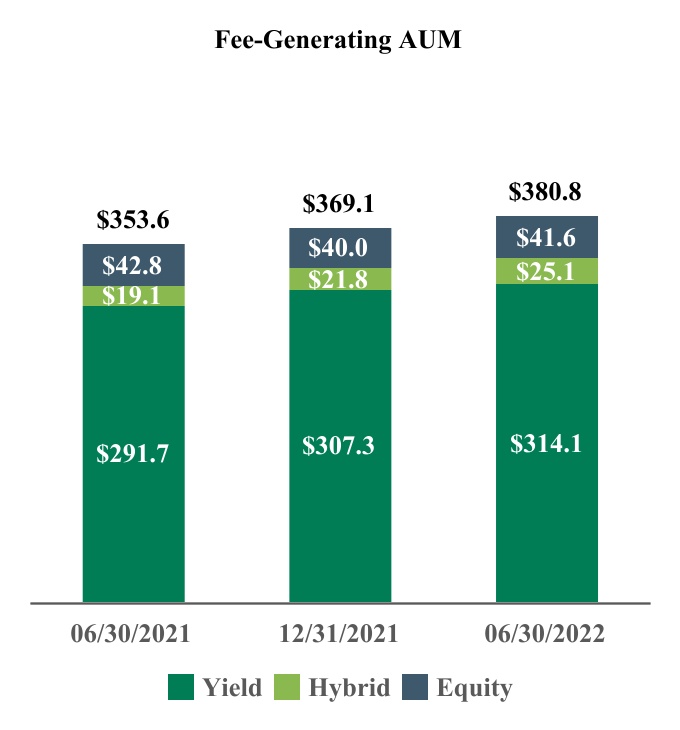

| Fee-Generating AUM | Fee-Generating AUM consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM | ||||

| Fee Related Earnings, or FRE | Component of Adjusted Segment Income that is used to assess the performance of the Asset Management segment. FRE is the sum of (i) management fees, (ii) advisory and transaction fees, (iii) fee-related performance fees from indefinite term vehicles, that are measured and received on a recurring basis and not dependent on realization events of the underlying investments and (iv) other income, net, less (a) fee-related compensation, excluding equity-based compensation, (b) non-compensation expenses incurred in the normal course of business, (c) placement fees and (d) non-controlling interests in the management companies of certain funds the Company manages |

||||

| FIA | Fixed indexed annuity, which is an insurance contract that earns interest at a crediting rate based on a specified index on a tax-deferred basis | ||||

| Fixed annuities | FIAs together with fixed rate annuities | ||||

| Former Managing Partners | Messrs. Leon Black, Joshua Harris and Marc Rowan collectively and, when used in reference to holdings of interests in Apollo or AP Professional Holdings, L.P. includes certain related parties of such individuals | ||||

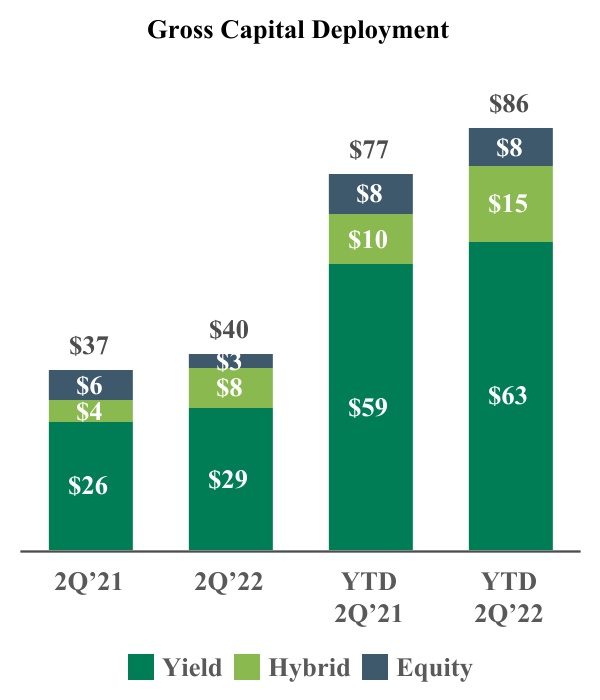

Gross capital deployment |

The gross capital that has been invested in investments by the funds and accounts we manage during the relevant period, but excludes certain investment activities primarily related to hedging and cash management functions at the firm. Gross capital deployment is not reduced or netted down by sales or refinancings, and takes into account leverage used by the funds and accounts we manage in gaining exposure to the various investments that they have made. |

||||

| GLWB | Guaranteed lifetime withdrawal benefit | ||||

| GMDB | Guaranteed minimum death benefit | ||||

| Gross IRR of accord series, financial credit investment, structured credit recovery and the European principal finance funds | The annualized return of a fund based on the actual timing of all cumulative fund cash flows before management fees, performance fees allocated to the general partner and certain other expenses. Calculations may include certain investors that do not pay fees. The terminal value is the net asset value as of the reporting date. Non-U.S. dollar denominated (“USD”) fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. | ||||

6

| Gross IRR of a traditional private equity or hybrid value fund | The cumulative investment-related cash flows (i) for a given investment for the fund or funds which made such investment, and (ii) for a given fund, in the relevant fund itself (and not any one investor in the fund), in each case, on the basis of the actual timing of investment inflows and outflows (for unrealized investments assuming disposition on June 30, 2022 or other date specified) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, performance fees and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. | ||||

| Gross IRR of real estate equity, hybrid real estate or infrastructure funds | The cumulative investment-related cash flows in the fund itself (and not any one investor in the fund), on the basis of the actual timing of cash inflows and outflows (for unrealized investments assuming disposition on June 30, 2022 or other date specified) starting on the date that each investment closes, and the return is annualized and compounded before management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. | ||||

| Gross Return or Gross ROE of a total return yield fund or the hybrid credit hedge fund | The monthly or quarterly time-weighted return that is equal to the percentage change in the value of a fund’s portfolio, adjusted for all contributions and withdrawals (cash flows) before the effects of management fees, incentive fees allocated to the general partner, or other fees and expenses. Returns for these categories are calculated for all funds and accounts in the respective strategies. Returns over multiple periods are calculated by geometrically linking each period’s return over time. Gross return and gross ROE do not represent the return to any fund investor. |

||||

| HoldCo | Apollo Global Management, Inc. (f/k/a Tango Holdings, Inc.) | ||||

| HVF I | Apollo Hybrid Value Fund, L.P., together with its parallel funds and alternative investment vehicles | ||||

| HVF II | Apollo Hybrid Value Fund II, L.P., together with its parallel funds and alternative investment vehicles | ||||

| Inflows | (i) At the individual strategy level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers, and (ii) on an aggregate basis, the sum of inflows across the yield, hybrid and equity investing strategies. | ||||

| IPO | Initial Public Offering | ||||

| ISG | Apollo Insurance Solutions Group LP | ||||

| ISGI | Refers collectively to AAME and AAME PC | ||||

| Jackson | Jackson Financial, Inc., together with its subsidiaries | ||||

| Management Fee Offset | Under the terms of the limited partnership agreements for certain funds, the management fee payable by the funds may be subject to a reduction based on a certain percentage of such advisory and transaction fees, net of applicable broken deal costs . | ||||

| Merger Agreement | The Agreement and Plan of Merger dated as of March 8, 2021 by and among AAM, AGM, AHL, Blue Merger Sub, Ltd., a Bermuda exempted company, and Green Merger Sub, Inc., a Delaware corporation. | ||||

| Merger Date | January 1, 2022 | ||||

| MidCap | MidCap FinCo Designated Activity Company | ||||

| MMS | Minimum margin of solvency | ||||

| Modco | Modified coinsurance | ||||

| NAIC | National Association of Insurance Commissioners | ||||

| NAV | Net Asset Value | ||||

| Net invested assets | The sum of (a) total investments on the consolidated balance sheets with AFS securities at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE assets, liabilities and noncontrolling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an allowance for credit losses. Net invested assets includes our economic ownership of ACRA investments but does not include the investments associated with the noncontrolling interest | ||||

| Net investment earned rate | Income from our net invested assets divided by the average net invested assets for the relevant period, presented on an annualized basis for interim periods | ||||

| Net investment spread | Net investment spread measures our investment performance less the total cost of our liabilities, presented on an annualized basis for interim periods | ||||

| Net IRR of accord series, financial credit investment, structured credit recovery and the European principal finance funds | The annualized return of a fund after management fees, performance fees allocated to the general partner and certain other expenses, calculated on investors that pay such fees. The terminal value is the net asset value as of the reporting date. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. | ||||

7

| Net IRR of a traditional private equity or the hybrid value funds | The gross IRR applicable to the funds, including returns for related parties which may not pay fees or performance fees, net of management fees, certain expenses (including interest incurred or earned by the fund itself) and realized performance fees all offset to the extent of interest income, and measures returns at the fund level on amounts that, if distributed, would be paid to investors of the fund. The timing of cash flows applicable to investments, management fees and certain expenses, may be adjusted for the usage of a fund’s subscription facility. To the extent that a fund exceeds all requirements detailed within the applicable fund agreement, the estimated unrealized value is adjusted such that a percentage of up to 20.0% of the unrealized gain is allocated to the general partner of such fund, thereby reducing the balance attributable to fund investors. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. | ||||

| Net IRR of real estate equity, hybrid real estate and infrastructure funds | The fund (and not any one investor in the fund), on the basis of the actual timing of cash inflows received from and outflows paid to investors of the fund (assuming the ending net asset value as of the reporting date or other date specified is paid to investors), excluding certain non-fee and non-performance fee bearing parties, and the return is annualized and compounded after management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns to investors of the fund as a whole. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. | ||||

| Net reserve liabilities | The sum of (a) interest sensitive contract liabilities, (b) future policy benefits, (c) dividends payable to policyholders, and (d) other policy claims and benefits, offset by reinsurance recoverable, excluding policy loans ceded. Net reserve liabilities also includes the reserves related to assumed Modco agreements in order to appropriately match the costs incurred in the consolidated statements of operations with the liabilities. Net reserve liabilities is net of the ceded liabilities to third-party reinsurers as the costs of the liabilities are passed to such reinsurers and therefore we have no net economic exposure to such liabilities, assuming our reinsurance counterparties perform under our agreements. Net reserve liabilities is net of the reserve liabilities attributable to the ACRA noncontrolling interest. | ||||

| Net Return or Net ROE of a total return yield fund or the hybrid credit hedge fund | The gross return after management fees, performance fees allocated to the general partner, or other fees and expenses. Returns over multiple periods are calculated by geometrically linking each period’s return over time. Net return and net ROE do not represent the return to any fund investor. |

||||

| Non-Fee-Generating AUM | AUM that does not produce management fees or monitoring fees. This measure generally includes the following: (i) fair value above invested capital for those funds that earn management fees based on invested capital; (ii) net asset values related to general partner and co-investment interests; (iii) unused credit facilities; (iv) available commitments on those funds that generate management fees on invested capital; (v) structured portfolio company investments that do not generate monitoring fees; and (vi) the difference between gross asset and net asset value for those funds that earn management fees based on net asset value. |

||||

| NYC UBT | New York City Unincorporated Business Tax | ||||

| NYSDFS | New York State Department of Financial Services | ||||

| Other liability costs | Other liability costs include DAC, DSI and VOBA amortization, change in rider reserves, the cost of liabilities on products other than deferred annuities and institutional products, excise taxes, as well as offsets for premiums, product charges and other revenues | ||||

| "Other operating expenses" within the Principal Investing segment | Expenses incurred in the normal course of business and includes allocations of non-compensation expenses related to managing the business. | ||||

| “Other operating expenses” within the Retirement Services segment | Expenses incurred in the normal course of business inclusive of compensation and non-compensation expenses. | ||||

| Payout annuities | Annuities with a current cash payment component, which consist primarily of single premium immediate annuities, supplemental contracts and structured settlements | ||||

| PCD | Purchased Credit Deteriorated Investments | ||||

| Performance allocations, Performance fees, Performance revenues, Incentive fees and Incentive income | The interests granted to Apollo by a fund managed by Apollo that entitle Apollo to receive allocations, distributions or fees which are based on the performance of such fund or its underlying investments | ||||

8

| Performance Fee-Eligible AUM | AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following: (i) “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements; (ii) “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently below its hurdle rate or preferred return; and (iii) “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner. |

||||

| Perpetual Capital | Assets under management of indefinite duration, that may only be withdrawn under certain conditions or subject to certain limitations, including but not limited to satisfying required hold periods or percentage limits on the amounts that may be redeemed over a particular period. The investment management, advisory or other service agreements with our Perpetual Capital vehicles may be terminated under certain circumstances. |

||||

| Principal Investing Income, or PII | Component of Adjusted Segment Income that is used to assess the performance of the Principal Investing segment. For the Principal Investing segment, PII is the sum of (i) realized performance fees, excluding realizations received in the form of shares, (ii) realized investment income, less (x) realized principal investing compensation expense, excluding expense related to equity-based compensation, and (y) certain corporate compensation and non-compensation expenses | ||||

| Principal investing compensation | Realized performance compensation, distributions related to investment income and dividends, and includes allocations of certain compensation expenses related to managing the business. | ||||

| Policy loan | A loan to a policyholder under the terms of, and which is secured by, a policyholder’s policy | ||||

| Private equity investments | (i) Direct or indirect investments in existing and future private equity funds managed or sponsored by Apollo, (ii) direct or indirect co-investments with existing and future private equity funds managed or sponsored by Apollo, (iii) direct or indirect investments in securities which are not immediately capable of resale in a public market that Apollo identifies but does not pursue through its private equity funds, and (iv) investments of the type described in (i) through (iii) above made by Apollo funds | ||||

| Realized Value | All cash investment proceeds received by the relevant Apollo fund, including interest and dividends, but does not give effect to management fees, expenses, incentive compensation or performance fees to be paid by such Apollo fund. | ||||

| Redding Ridge | Redding Ridge Asset Management, LLC and its subsidiaries, which is a standalone, self-managed asset management business established in connection with risk retention rules that manages CLOs and retains the required risk retention interests. | ||||

| Redding Ridge Holdings | Redding Ridge Holdings LP | ||||

| Remaining Cost | The initial investment of the fund in a portfolio investment, reduced for any return of capital distributed to date on such portfolio investment | ||||

| Rider reserves | Guaranteed lifetime withdrawal benefits and guaranteed minimum death benefits reserves | ||||

| RMBS | Residential mortgage-backed securities | ||||

| RML | Residential mortgage loan | ||||

| RSUs | Restricted share units | ||||

| SCRF I | Structured Credit Recovery Master Fund I | ||||

| SCRF II | Structured Credit Recovery Master Fund II | ||||

| SCRF III | Structured Credit Recovery Master Fund III | ||||

| SCRF IV | Structured Credit Recovery Master Fund IV | ||||

| SIA | Strategic investment account | ||||

| SPACs | Special purpose acquisition companies | ||||

| Spread Related Earnings, or SRE | Component of Adjusted Segment Income that is used to assess the performance of the Retirement Services segment, excluding certain market volatility and certain expenses related to integration, restructuring, equity-based compensation, and other expenses. For the Retirement Services segment, SRE equals the sum of (i) the net investment earnings on Athene’s net invested assets and (ii) management fees earned on the ADIP share of ACRA assets, less (x) cost of funds, (y) operating expenses excluding equity-based compensation and (z) financing costs including interest expense and preferred dividends, if any, paid to Athene preferred stockholders. | ||||

| Surplus assets | Assets in excess of policyholder obligations, determined in accordance with the applicable domiciliary jurisdiction’s statutory accounting principles. | ||||

| Tax receivable agreement | The tax receivable agreement entered into by and among APO Corp., the Former Managing Partners, the Contributing Partners, and other parties thereto | ||||

9

| TDI | Texas Department of Insurance | ||||

| Total Invested Capital | The aggregate cash invested by the relevant Apollo fund and includes capitalized costs relating to investment activities, if any, but does not give effect to cash pending investment or available for reserves and excludes amounts, if any, invested on a financed basis with leverage facilities | ||||

| Total Value | The sum of the total Realized Value and Unrealized Value of investments | ||||

| Traditional private equity funds | Apollo Investment Fund I, L.P. (“Fund I”), AIF II, L.P. (“Fund II”), a mirrored investment account established to mirror Fund I and Fund II for investments in debt securities (“MIA”), Apollo Investment Fund III, L.P. (together with its parallel funds, “Fund III”), Apollo Investment Fund IV, L.P. (together with its parallel fund, “Fund IV”), Apollo Investment Fund V, L.P. (together with its parallel funds and alternative investment vehicles, “Fund V”), Apollo Investment Fund VI, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VI”), Apollo Investment Fund VII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VII”), Apollo Investment Fund VIII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VIII”) and Apollo Investment Fund IX, L.P. (together with its parallel funds and alternative investment vehicles, “Fund IX”). |

||||

| U.S. GAAP | Generally accepted accounting principles in the United States of America | ||||

| U.S. RE Fund I | AGRE U.S. Real Estate Fund, L.P., including co-investment vehicles |

||||

| U.S. RE Fund II | Apollo U.S. Real Estate Fund II, L.P., including co-investment vehicles | ||||

| U.S. RE Fund III | Apollo U.S. Real Estate Fund III, L.P., including co-investment vehicles | ||||

| U.S. Treasury | United States Department of the Treasury | ||||

| Unrealized Value | The fair value consistent with valuations determined in accordance with GAAP, for investments not yet realized and may include payments in kind, accrued interest and dividends receivable, if any, and before the effect of certain taxes. In addition, amounts include committed and funded amounts for certain investments. | ||||

| Venerable | Venerable Holdings, Inc., together with its subsidiaries | ||||

| VIAC | Venerable Insurance and Annuity Company, formerly Voya Insurance and Annuity Company | ||||

| VIE | Variable interest entity | ||||

| Vintage Year | The year in which a fund’s final capital raise occurred, or, for certain funds, the year of a fund’s effective date or the year in which a fund’s investment period commences pursuant to its governing agreements. | ||||

| VIVAT N.V. | Athora Netherlands N.V. (formerly known as: VIVAT N.V.) | ||||

| VOBA | Value of business acquired | ||||

| VOE | Voting interest entity | ||||

| WACC | Weighted average cost of capital | ||||

10

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Index to Condensed Consolidated Financial Statements (unaudited)

11

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

| (In millions, except share data) | As of June 30, 2022 |

As of December 31, 2021 |

|||||||||

| Assets | |||||||||||

| Asset Management | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents | |||||||||||

| Investments | |||||||||||

| Assets of consolidated variable interest entities | |||||||||||

| Cash and cash equivalents | |||||||||||

| Investments | |||||||||||

| Other assets | |||||||||||

| Due from related parties | |||||||||||

| Goodwill | |||||||||||

| Other assets | |||||||||||

| Retirement Services | |||||||||||

| Cash and cash equivalents | — | ||||||||||

| Restricted cash and cash equivalents | — | ||||||||||

| Investments | — | ||||||||||

| Investments in related parties | — | ||||||||||

| Assets of consolidated variable interest entities | |||||||||||

| Cash and cash equivalents | — | ||||||||||

| Investments | — | ||||||||||

| Other assets | — | ||||||||||

| Reinsurance recoverable | — | ||||||||||

| Deferred acquisition costs, deferred sales inducements and value of business acquired | — | ||||||||||

| Goodwill | — | ||||||||||

| Other assets | — | ||||||||||

| — | |||||||||||

| Total Assets | $ |

|

$ |

|

|||||||

| (Continued) | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

12

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

| (In millions, except share data) | As of June 30, 2022 |

As of December 31, 2021 |

|||||||||

| Liabilities and Equity | |||||||||||

| Liabilities | |||||||||||

| Asset Management | |||||||||||

| Accounts payable, accrued expenses, and other liabilities | $ | $ | |||||||||

| Due to related parties | |||||||||||

| Debt | |||||||||||

| Liabilities of consolidated variable interest entities | |||||||||||

| Debt, at fair value | |||||||||||

| Notes payable | |||||||||||

| Other liabilities | |||||||||||

| Retirement Services | |||||||||||

| Interest sensitive contract liabilities | — | ||||||||||

| Future policy benefits | — | ||||||||||

| Debt | — | ||||||||||

| Payables for collateral on derivatives and securities to repurchase | — | ||||||||||

| Other liabilities | — | ||||||||||

| Liabilities of consolidated variable interest entities | — | ||||||||||

| — | |||||||||||

| Total Liabilities |

|

|

|||||||||

Commitments and Contingencies (note 17) |

|||||||||||

| Redeemable non-controlling interests | |||||||||||

| Redeemable non-controlling interests | |||||||||||

| Equity | |||||||||||

Series A Preferred Stock, 0 and 11,000,000 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively |

|||||||||||

Series B Preferred Stock, 0 and 12,000,000 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively |

|||||||||||

Class A Common Stock, $0.00001 par value, 0 and 90,000,000,000 shares authorized, 0 and 248,896,649 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively |

|||||||||||

Class B Common Stock, $0.00001 par value, 0 and 999,999,999 shares authorized, 0 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively |

|||||||||||

Class C Common Stock, $0.00001 par value, 0 and 1 share authorized, 0 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively |

|||||||||||

Common Stock, $0.00001 par value, 90,000,000,000 shares authorized, 571,028,097 shares issued and outstanding as of June 30, 2022 |

|||||||||||

| Additional paid in capital | |||||||||||

| Retained earnings (accumulated deficit) | ( |

||||||||||

| Accumulated other comprehensive income (loss) | ( |

( |

|||||||||

| Total Apollo Global Management, Inc. Stockholders’ Equity | |||||||||||

| Non-controlling interests | |||||||||||

| Total Equity |

|

|

|||||||||

| Total Liabilities, Redeemable non-controlling interests and Equity | $ |

|

$ |

|

|||||||

| (Concluded) | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

13

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| (In millions, except per share data) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Asset Management | |||||||||||||||||||||||

| Management fees | $ | $ | $ | $ | |||||||||||||||||||

| Advisory and transaction fees, net | |||||||||||||||||||||||

| Investment income (loss) | ( |

||||||||||||||||||||||

| Incentive fees | |||||||||||||||||||||||

| Retirement Services | |||||||||||||||||||||||

| Premiums | |||||||||||||||||||||||

| Product charges | |||||||||||||||||||||||

| Net investment income | |||||||||||||||||||||||

| Investment related gains (losses) | ( |

( |

|||||||||||||||||||||

| Revenues of consolidated variable interest entities | |||||||||||||||||||||||

| Other revenues | ( |

( |

|||||||||||||||||||||

| Total Revenues | |||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Asset Management | |||||||||||||||||||||||

| Compensation and benefits | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| General, administrative and other | |||||||||||||||||||||||

| Retirement Services | |||||||||||||||||||||||

| Interest sensitive contract benefits | ( |

( |

|||||||||||||||||||||

| Future policy and other policy benefits | |||||||||||||||||||||||

| Amortization of deferred acquisition costs, deferred sales inducements and value of business acquired | |||||||||||||||||||||||

| Policy and other operating expenses | |||||||||||||||||||||||

| Total Expenses | |||||||||||||||||||||||

Other income (loss) – Asset Management |

|||||||||||||||||||||||

| Net gains from investment activities | |||||||||||||||||||||||

| Net gains from investment activities of consolidated variable interest entities | |||||||||||||||||||||||

| Other income (loss), net | ( |

( |

|||||||||||||||||||||

| Total other income (loss) | |||||||||||||||||||||||

| Income (loss) before income tax (provision) benefit | ( |

( |

|||||||||||||||||||||

| Income tax (provision) benefit | ( |

( |

|||||||||||||||||||||

| Net income (loss) | ( |

( |

|||||||||||||||||||||

| Net (income) loss attributable to non-controlling interests | ( |

( |

|||||||||||||||||||||

| Net income (loss) attributable to Apollo Global Management, Inc. | ( |

( |

|||||||||||||||||||||

| Preferred stock dividends | ( |

( |

|||||||||||||||||||||

| Net income (loss) attributable to Apollo Global Management, Inc. common stockholders | $ | ( |

$ | $ | ( |

$ | |||||||||||||||||

| Earnings (loss) per share | |||||||||||||||||||||||

| Net income (loss) attributable to common stockholders - Basic | $ | ( |

$ | $ | ( |

$ | |||||||||||||||||

| Net income (loss) attributable to common stockholders - Diluted | $ | ( |

$ | $ | ( |

$ | |||||||||||||||||

| Weighted average shares outstanding – Basic | |||||||||||||||||||||||

| Weighted average shares outstanding – Diluted | |||||||||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||||||||||||||

14

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net income (loss) | $ | ( |

$ | $ | ( |

$ | |||||||||||||||||

| Other comprehensive income (loss), before tax | |||||||||||||||||||||||

| Unrealized investment gains (losses) on available-for-sale securities, net of offsets | ( |

( |

( |

||||||||||||||||||||

| Unrealized gains (losses) on hedging instruments | ( |

||||||||||||||||||||||

| Foreign currency translation and other adjustments | ( |

( |

( |

||||||||||||||||||||

| Other comprehensive income (loss), before tax | ( |

( |

( |

||||||||||||||||||||

| Income tax expense (benefit) related to other comprehensive income (loss) | ( |

( |

|||||||||||||||||||||

| Other comprehensive income (loss) | ( |

( |

( |

||||||||||||||||||||

| Comprehensive income (loss) | ( |

( |

|||||||||||||||||||||

| Comprehensive (income) loss attributable to non-controlling interests | ( |

( |

|||||||||||||||||||||

| Comprehensive income (loss) attributable to Apollo Global Management, Inc. | $ | ( |

$ | $ | ( |

$ | |||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||||||||||||||

15

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY (UNAUDITED)

For the three and six months ended June 30, 2021 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Apollo Global Management, Inc. Stockholders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Class A Common Stock | Class B Common Stock | Class C Common Stock | Series A Preferred Stock | Series B Preferred Stock | Additional Paid in Capital |

Retained Earnings | Accumulated Other Comprehensive Loss |

Total Apollo Global Management, Inc. Stockholders’ Equity |

Non-Controlling Interests |

Total Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance at April 1, 2021 |

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||||||||||||

| Deconsolidation of VIEs | — | — | — | — | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accretion of redeemable non-controlling interests | — | — | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital increase related to equity-based compensation | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends/ Distributions | — | — | — | ( |

( |

— | ( |

— | ( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payments related to issuances of common stock for equity-based awards | — | — | — | — | — | ( |

— | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( |

— | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exchange of AOG Units for common stock | — | — | — | — | — | — | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance at June 30, 2021 |

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||||||||||||

Balance at January 1, 2021 |

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||||||||||||

| Deconsolidation of VIEs | — | — | — | — | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accretion of redeemable non-controlling interests | — | — | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dilution impact of issuance of common stock | — | — | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital increase related to equity-based compensation | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends/ distributions | — | — | — | ( |

( |

— | ( |

— | ( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payments related to issuances of common stock for equity-based awards | — | — | — | — | ( |

— | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( |

— | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exchange of AOG Units for common stock | — | — | — | — | — | — | ( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | — | — | — | — | — | — | — | ( |

( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance at June 30, 2021 |

|

|

|

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||||||||||||

| (Continued) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

16

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY (UNAUDITED)

For the three and six months ended June 30, 2022 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Apollo Global Management, Inc. Stockholders | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | Common Stock | Series A Preferred Stock | Series B Preferred Stock | Additional Paid in Capital |

Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Loss |

Total Apollo Global Management, Inc. Stockholders’ Equity |

Non-Controlling

Interests

|

Total Equity |

||||||||||||||||||||||||||||||||||||||||||||

| Balance at April 1, 2022 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||

| Consolidation/ deconsolidation of VIEs | — | — | — | ( |

— | ( |

( |

||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock related to equity transactions | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Accretion of redeemable non-controlling interests | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||

| Capital increase related to equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Dividends/ distributions | — | — | — | ( |

— | ( |

( |

( |

|||||||||||||||||||||||||||||||||||||||||||||

| Payments related to issuances of common stock for equity-based awards | — | — | — | ( |

— | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( |

— | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | ( |

— | ( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | — | — | — | — | — | ( |

( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||

Balance at June 30, 2022 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||

Balance at January 1, 2022 |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||

| Merger with Athene | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of warrants | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of preferred stock to non-controlling interests | — | ( |

( |

— | — | — | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Consolidation/ deconsolidation of VIEs | — | — | — | ( |

— | ( |

( |

||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock related to equity transactions | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Accretion of redeemable non-controlling interests | — | — | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||

| Capital increase related to equity-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Capital contributions | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Dividends/ distributions | — | — | — | ( |

— | — | ( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||

| Payments related to issuances of common stock for equity-based awards | — | — | ( |

— | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( |

— | — | ( |

— | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||||||||||||

| Exchange of AOG Units for common stock | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | ( |

— | ( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | — | — | — | — | — | ( |

( |

( |

( |

||||||||||||||||||||||||||||||||||||||||||||

Balance at June 30, 2022 |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

$ |

|

||||||||||||||||||||||||||||||||||||

| (Concluded) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

17

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Six months ended June 30, | |||||||||||

| (In millions) | 2022 | 2021 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net Income (Loss) | $ | ( |

$ | ||||||||

| Adjustments to Reconcile Net Income (Loss) to Net Cash Provided by (Used in) Operating Activities: | |||||||||||

| Equity-based compensation | |||||||||||

| Net investment income | ( |

( |

|||||||||

| Net recognized (gains) losses on investments and derivatives | ( |

||||||||||

| Depreciation and amortization | |||||||||||

| Net amortization of net investment premiums, discount and other | |||||||||||

| Policy acquisition costs deferred | ( |

||||||||||

| Other non-cash amounts included in net income (loss), net | ( |

||||||||||

| Changes in consolidation | ( |

( |

|||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Purchases of investments by Funds and VIEs | ( |

( |

|||||||||

| Proceeds from sale of investments by Funds and VIEs | |||||||||||

| Interest sensitive contract liabilities | ( |

||||||||||

| Future policy benefits and reinsurance recoverable | |||||||||||

| Other assets and liabilities, net | |||||||||||

| Net Cash Provided by (Used in) Operating Activities | ( |

||||||||||

| Cash Flows from Investing Activities | |||||||||||

| Purchases of investments and contributions to equity method investments | ( |

( |

|||||||||

| Sales, maturities and repayments of investments and distributions from equity method investments | |||||||||||

| Cash acquired through merger | |||||||||||

| Other investing activities, net | ( |

||||||||||

| Net Cash Provided by (Used in) Investing Activities | ( |

||||||||||

| Cash Flows from Financing Activities | |||||||||||

| Issuance of debt | |||||||||||

| Repayment of debt | ( |

( |

|||||||||

| Repurchase of common stock | ( |

( |

|||||||||

| Common stock dividends | ( |

( |

|||||||||

| Preferred stock dividends | ( |

||||||||||

| Other financing activities, net | ( |

||||||||||

| Distributions paid to non-controlling interests | ( |

( |

|||||||||

| Contributions from non-controlling interests | |||||||||||

| Distributions to redeemable non-controlling interests | ( |

||||||||||

| Proceeds from issuance of Class A units of SPAC, net of underwriting and offering costs | |||||||||||

| Deposits on investment-type policies and contracts | |||||||||||

| Withdrawals on investment-type policies and contracts | ( |

||||||||||

| Net change in cash collateral posted for derivative transactions and securities to repurchase | ( |

||||||||||

| Net Cash Provided by (Used in) Financing Activities | ( |

||||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( |

||||||||||

| Net Increase in Cash and Cash Equivalents, Restricted Cash and Cash Held at Consolidated Variable Interest Entities | |||||||||||

| Cash and Cash Equivalents, Restricted Cash and Cash Held at Consolidated Variable Interest Entities, Beginning of Period | |||||||||||

| Cash and Cash Equivalents, Restricted Cash and Cash Held at Consolidated Variable Interest Entities, End of Period | $ | $ | |||||||||

| (Continued) | |||||||||||

18

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Six months ended June 30, | |||||||||||

| (In millions) | 2022 | 2021 | |||||||||

| Supplemental Disclosure of Cash Flow Information | |||||||||||

| Cash paid for taxes | |||||||||||

| Cash paid for interest | |||||||||||

| Non-cash transactions | |||||||||||

| Non-Cash Operating Activities | |||||||||||

| Asset Management and Other | |||||||||||

| Capital increases related to equity-based compensation | |||||||||||

| Non-Cash Investing Activities | |||||||||||

| Asset Management and Other | |||||||||||

| Acquisition of goodwill and intangibles | |||||||||||

| Distributions from principal investments | |||||||||||

| Retirement Services | |||||||||||

| Investments received from settlements on reinsurance agreements | |||||||||||

| Investments received from pension group annuity premiums | |||||||||||

| Assets contributed to consolidated VIEs | |||||||||||

| Non-Cash Financing Activities | |||||||||||

| Retirement Services | |||||||||||

| Deposits on investment-type policies and contracts through reinsurance agreements | |||||||||||

| Withdrawals on investment-type policies and contracts through reinsurance agreements | |||||||||||

| Reconciliation of Cash and Cash Equivalents, Restricted Cash and Cash Equivalents Held at Consolidated Variable Interest Entities to the Condensed Consolidated Statements of Financial Condition: | |||||||||||

| Cash and cash equivalents | |||||||||||

| Restricted cash and cash equivalents | |||||||||||

| Cash held at consolidated variable interest entities | |||||||||||

| Total Cash and Cash Equivalents, Restricted Cash and Cash Equivalents Held at Consolidated Variable Interest Entities | $ | $ | |||||||||

| (Concluded) | |||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements. | |||||||||||

19

APOLLO GLOBAL MANAGEMENT, INC.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Organization

Apollo Global Management, Inc. together with its consolidated subsidiaries (collectively, “Apollo” or the “Company”) is a global alternative asset manager that offers asset management and retirement services solutions. Through its asset management business, Apollo seeks to provide clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three investing strategies: yield, hybrid and equity. Through its asset management business, Apollo raises, invests and manages funds, accounts and other vehicles, on behalf of pension, endowment and sovereign wealth funds, as well as other institutional and individual investors. Apollo’s retirement services business, which is operated by Athene, seeks to provide policyholders with financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Athene specializes in issuing, reinsuring and acquiring retirement savings products in the United States and internationally.

Merger with Athene

On January 1, 2022, Apollo and Athene completed the previously announced merger transactions pursuant to the Merger Agreement (the “Mergers”). As a result of the Mergers, AAM and AHL became consolidated subsidiaries of AGM.

Athene’s results are included in the condensed consolidated financial statements commencing from the Merger Date. References herein to “Apollo” and the “Company” refer to AGM and its subsidiaries, including Athene, unless the context requires otherwise such as in sections where it refers to the asset management business only. See note 3 for additional information.

Corporate Recapitalization

In connection with the closing of the Mergers, the Company completed a corporate recapitalization (the “Corporate Recapitalization”) which resulted in the recapitalization of the Company from an umbrella partnership C corporation (“Up-C”) structure to a corporation with a single class of common stock with one vote per share.

Griffin Capital Acquisitions

On May 3, 2022, the Company completed the acquisition of the U.S. asset management business of Griffin Capital in exchange for closing consideration of $213 million and contingent consideration of $64 million, substantially all of which was, or will be, settled in shares of AGM common stock, per the transaction agreement signed December 2, 2021. This follows the March 2022 close of Griffin Capital’s U.S. wealth distribution business. As a result of the final close, the Griffin Institutional Access Real Estate Fund and the Griffin Institutional Access Credit Fund are advised by Apollo and have been renamed the Apollo Diversified Real Estate Fund and Apollo Diversified Credit Fund, respectively.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). These condensed consolidated financial statements should be read in conjunction with the annual financial statements included in Apollo Asset Management, Inc.’s annual report on Form 10-K for the year ended 2021. Certain disclosures included in the annual financial statements have been condensed or omitted as they are not required for interim financial statements under U.S. GAAP and the rules of the SEC. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year.

20

APOLLO GLOBAL MANAGEMENT, INC.

Notes to Condensed Consolidated Financial Statements (Unaudited)

Furthermore, in conjunction with the Mergers, Apollo was deemed to be the accounting acquirer and Athene the accounting acquiree, which, for financial reporting purposes, results in Apollo’s historical financial information prior to the Mergers becoming that of the Company. Athene’s results before the Mergers have not been included in the condensed consolidated financial statements of the Company. The unaudited consolidated financial statements include the assets, liabilities, operating results and cash flows of Athene from the date of acquisition. For information on Athene prior to the Mergers, please refer to the annual financial statements included in AHL’s annual report on Form 10-K for the year ended December 31, 2021.

Following the Mergers, the Company’s principal subsidiaries AAM and AHL, together with their subsidiaries, operate an asset management business and a retirement services business, respectively, which possess distinct characteristics. As a result, the Company’s financial statement presentation is organized into two tiers: asset management and retirement services. The Company believes that separate presentation provides a more informative view of the Company’s consolidated financial condition and results of operations than an aggregated presentation.

The following summary of significant accounting policies first includes those most significant to the overall Company and then specific accounting policies for each of the asset management and retirement services businesses, respectively.

Significant Accounting Policies— Overall

Consolidation

When an entity is consolidated, the accounts of the consolidated entity, including its assets, liabilities, revenues, expenses and cash flows, are presented on a gross basis. Consolidation does not have an effect on the amounts of net income reported. The Company consolidates entities where it has a controlling financial interest unless there is a specific scope exception that prevents consolidation. The types of entities with which the Company is involved generally include, but are not limited to:

•subsidiaries, including management companies and general partners of funds that the Company manages

•entities that have attributes of an investment company (e.g., funds)

•SPACs

•CLOs

•AAM and its subsidiaries

•AHL and its subsidiaries

Investment Companies

Funds managed by the Company are generally accounted for as investment companies and they are not required to consolidate their investments in operating companies. Judgement is required to evaluate whether entities have the characteristics of an investment company and are thus eligible to be accounted for as an investment company. Funds that meet the investment company criteria reflect their investments at fair value as required by specialized accounting guidance. The Company has retained this specialized accounting for investment companies in consolidation.

Variable Interest Entities

All entities are first considered under the VIE model. VIEs are entities that 1) do not have sufficient equity at risk to finance activities without additional subordinated financial support or 2) have equity investors that do not have the ability to make significant decisions related to the entity’s operations, absorb expected losses, or receive expected residual returns.

The Company consolidates a VIE if it is the primary beneficiary of the entity. The Company is deemed the primary beneficiary when it has a controlling financial interest in the VIE, which is defined as possessing both (i) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance (“primary beneficiary power”) and (ii) the obligation to absorb losses or the right to receive benefits from the VIE that could potentially be significant (“significant variable interest”). The Company performs the VIE and primary beneficiary assessment at inception of its involvement with a VIE and on an ongoing basis if facts and circumstances change.

21

APOLLO GLOBAL MANAGEMENT, INC.

Notes to Condensed Consolidated Financial Statements (Unaudited)